Think of an industry dominated by huge, established firms reliant on distribution models that have been in place for more than a century. One where customers pay a premium for the reliability ensured by known brands despite little difference in delivered product. One where financing huge upfront costs depends on both that premium and those dated distribution models.

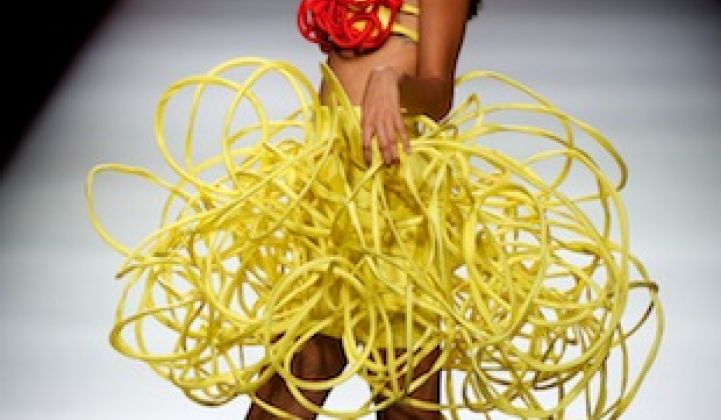

That could describe the utility industry in the U.S. -- but it could also describe the U.S. and European fashion industry. As models and designers brace for the onslaught of media attention and glamour that is New York’s fashion week, the two sectors -- on the surface as different as businesses could be -- have a lot to teach each other.

More truthfully, the utility business can learn from the mixed fortunes of the fashion business over the past decade. Fashion has already undergone disruption to its brands and distribution models. Fashion went first in dealing with the new complexity of business today, juggling globalization’s impact on distribution, such as interchangeable components and reputation risk from outsourcing, along with customer migration and increased awareness from online media.

The fashion industry does not have the regulatory protections that the utility industry enjoys, but it also has fewer constraints. If a new delivery of jackets doesn’t make it to the shop floor in time, the only person at risk is someone’s beleaguered assistant. If power doesn’t get to homes and offices and schools, the consequences are substantially more dire.

The central importance of power delivery makes the question of its business model more fundamental than fashion’s, but it doesn’t guarantee that the power business will look the same in twenty years as it does today. Increasingly, technology, aging infrastructure and regulatory shifts almost guarantee that the utility sector’s future won’t look like its past.

So what does fashion have to teach the power sector?

Responses to new operating challenges have been inconsistent and varied, but there are a few trends that have underpinned successful transitions.

1) As big brands are challenged, collaborations with upstarts are key.

Why does J.Crew carry Barbour coats, and why does LVMH pay large sums to acquire new designers with buzz but almost no business? Thanks in part to the work of that uber-fashion figure Anna Wintour, the fashion sector is awash with successful collaborations, including the designer of Michelle Obama’s inauguration gown, Jason Wu, working on the “new white shirt” for the Gap.

The utility business all too often takes a government-style approach of building its own. Smart grid implementation has long been a tale of regional power giants commissioning systems that are unable to adopt to changing technology or to communicate outside the utility’s own technology infrastructure. There is an urgent need for power companies to embrace rather than resist collaboration with the energy startups that have begun to emerge across the country (including fashion capital New York City).

Technology startups building smart meters or distributed wind are all desperate for capital and access to scale, while utilities spend more time tinkering with marginal design shifts to their existing systems than it would take for a startup to entirely rework its network.

Collaborations carry risk, but they are also key to negotiating a future that is coming whether utilities like it or not.

2) Unusual and counterintuitive solutions for handling inventory can help navigate disrupted markets.

The power market in the U.S. is broken. New plants and transmission grid infrastructure struggle to get financed and built, while blackouts are becoming more common and customer interest in distributed power solutions is soaring.

When Versace had trouble financing its hugely expensive storefronts around the world and the production of its premium products, it led the way in disrupting itself by an “accessible” (read cheaply priced) line sold through the very stores that make immense profits by reworking its designs for a global audience. Working with scale discount retailers like Target, or with flash-sale sites like Net a Porter, has become a way for fashion to handle one of its biggest challenges -- inventory -- as traditional distribution models dependent on a large branded retail presence and on the (now slowly dying) department store chains has failed.

Utilities have begun to make some moves to engage with a new customer reality, turning to social media and other technology-focused solutions to improve delivery and reliability of power with greater efficiency. When meters at distributed generation centers are able to price out which generation source to turn to and at what time, what utilities have done so far will only be the beginning of a wave of disruption to their model of holding excess inventory in the form of idle power plants. Keeping coal or gas plants mothballed until the hottest few days of the summer makes as much sense in the coming energy future as keeping piles of clothes around for the Christmas shopping season does in the age of Amazon.

3) Extreme price competition makes brand management even more vital.

For designer fashion businesses, brand is everything. Why else would someone pay thousands of dollars for a handbag, especially when there is one on sale next door that looks nearly identical for a tenth of the price?

Customers pay more for service, prestige and reliability. It is doubtful that the special form of insanity that possesses brand maniacs to buy sets of Gucci luggage will ever possess buyers of power supply, but in an environment where power companies are forced to compete to make sales, brand perception will matter. In deregulated markets, being the established "name" in power production is already a major asset in sales, and it is instructive to look at how active power firms in those markets have become in managing their public identities. NRG Energy, a leader in both California and Texas, has a brand in a way the Central Illinois Light Co. does not.

Active brand management is a strange idea for most utility executives, whose focus has traditionally been on engineering challenges, relationships with regulators and long-term financing issues. But when customers have options, the emotional element of purchasing decisions becomes an important factor for business models, and something power firms need to engage with.

***

Peter Gardett is founding editor of Breaking Energy. All opinions here are his own.

Editor's note: This article is reposted in its original form from Breaking Energy.