In recent years, the global solar market has looked a lot like a monarchy, with Europe reigning as king of installations.

But Europe is quickly losing its crown as the industry's playing field levels, bringing a more diversified set of markets around the world.

Between 2006 and 2011, Europe represented more than 70 percent of global solar installations. In the period 2008-2010, the region made up roughly 85 percent of installations. But subsidy reform and high rates of solar penetration are slowing deployment there, while other regions start picking up the pace.

"That kind of dominance is a thing of the past," said Adam James, GTM Research's global demand analyst. "Demand is becoming more diffused globally."

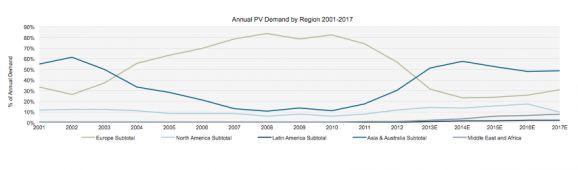

To show how global solar markets are expanding, James shared this chart illustrating how Europe's solar crown is getting knocked off by, well, every other major region cumulatively -- Asia, North America, and to a lesser extent, the up-and-coming Middle East and North Africa (MENA) and Latin American markets:

Source: GTM Research

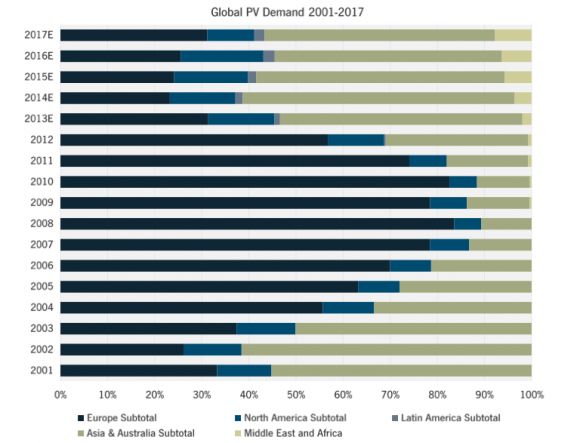

Here's another way to look at the ongoing diversification. Click on the graph to enlarge:

Source: GTM Research

With the Chinese and Japanese markets surging, the Asia-Pacific region has grown its installation share from just over 10 percent in 2010 to around half of the global market in 2013. Europe represented only around one-third of demand for 2013 -- and will likely decline to one-quarter of demand by the end of this year.

North America continues its steady pace of installations, but likely won't unseat Europe on its own.

Saudi Arabia and Turkey will lead the charge in the MENA market, which could account for 3 gigawatts of yearly installations after 2015.

And although solar incentives are a leading indicator of where installations will boom next, some of the diversification is starting to come from unsubsidized Latin American markets such as Chile and Mexico. Those countries will offer a comparatively small market, but enough of a pipeline to attract the biggest developers.

"In other places, like Latin America, companies with a global presence are trying their hand at purely unsubsidized markets with strong fundamentals," said James.

AES Gener, First Solar, SunEdison and a variety of other large developers are partnering with local companies to figure out the dynamics in these burgeoning countries, giving them a range of new opportunities beyond the old world of solar markets.

"Europe isn't just passing the crown to Asia-Pacific," explained James. "Now markets are far more distributed. You see this new reality reflected by many companies that are regionally diversifying their downstream business and exploring multiple markets -- not just chasing the ball like 5-year-old soccer players."

For more on this topic, see GTM Research's Latin America PV Playbook and Middle East and North Africa (MENA) Solar Market Outlook, 2013-2017.