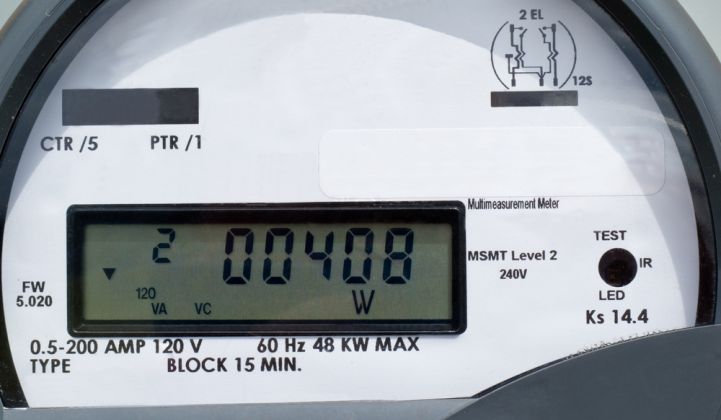

As one of the first states to roll out smart meters en masse -- and the only one to build a central, statewide data repository to share that data with customers and competitive energy companies -- you'd think that Texas would be way ahead in the energy-data sharing game. But it isn't.

That's largely because of a clunky platform built on last decade's technology, and cumbersome rules that have dissuaded a vast majority of the 7.3 million households and businesses with a smart meter from taking part. Last week, Texas utilities, big energy customers and representatives of would-be third-party users of that data reached a settlement agreement that will unclog these bottlenecks between smart meter data and its uses -- if it’s approved by the Public Utility Commission of Texas in April.

The settlement would make big changes to Smart Meter Texas (SMT), the platform set up in 2007 by state grid operator ERCOT to collect data from meters owned by distribution utilities CenterPoint, Oncor, AEP and Texas-New Mexico Power and share it with the competitive service providers (CSPs) that vie for customers in the state’s deregulated energy market.

Customers, as the legal owners of their own data, are also entitled to access, which was built into SMT in principle. As with most of the utilities that promised smart meter data to customers, SMT was slow to deliver. CSP access was only made available in November 2014, roughly seven years after the platform launched.

Since then, the limitations of the existing system have resulted in low uptake of its services, according to the South-central Partnership for Energy Efficiency as a Resource, or SPEER. In an October 2016 report, the nonprofit research group wrote that there were only 1,735 active data-sharing agreements in SMT as of that summer, “in a universe of over 7 million meters.”

While there are 73,000 residential and business customers registered on the SMT website to access their data, many of those are associated with a state-mandated program for low-income participants, or for on-site solar installations, SPEER noted.

Mission:Data, an industry trade group and stakeholder in the Public Utility Commission of Texas proceedings, has been tracking the deficiencies in how Texas -- and to be fair, most other states -- handle data-sharing. It's also tracking how the new settlement will change that.

The first change is a technology update. “Currently, SMT 1.0 provides an outdated, clunky simple object access protocol [application programming interface] and a [file transfer protocol] site to download encrypted CSV files,” Mission:Data wrote in a statement, adding that these require “significant support costs on the part of CSPs.”

As SPEER noted, that’s likely a cause of low adoption on the part of companies vying for Texas energy customers. While 98 had registered on SMT as of mid-2016, only 17 of them had successfully integrated with its File Transfer Protocol (FTP), and only 10 had integrated with the application programming interface (API) that would support high volumes of customers and meter data.

The settlement solves this by mandating the use of the latest API from the Green Button standard for customer energy data. Green Button was launched by the Obama administration in 2011 and taken up, in rather piecemeal fashion, by utilities in California, Texas, New York and several other big advanced metering infrastructure states. Mission:Data has been pushing state regulators to demand that utilities adopt the latest, more uniform technologies defined by the standard. According to the Texas settlement, "The API data format and API specification used by SMT will be compliant with the Green Button standard as of 2017.”

The second change is the outdated methods for customers to sign up on the SMT platform. SMT requires customers to go through 10 steps to allow their CSPs use of their data, many of them non-starters for people used to a world of one-click service for everything from ordering a cab to handling their banking.

Take the requirement for customers to fill in their own utility account numbers, rather than auto-filling them. According to EnergyHub, the home energy technology provider owned by Alarm.com, only 9 percent of invited customers agreed to participate in a DR program it offered in the Texas market when forced to look up this piece of data at the utility’s fingertips, compared to 55 percent who signed up when they didn’t have to go through that step.

Today, the Texas system also calls for customers to create an SMT account, and then trade emails and authorizations between SMT, the customers, and the chosen third party, which has led to a lot of confusion among would-be adopters. SPEER noted that between January and July 2016, 38 percent of all new residential registrations came with help-desk tickets.

The settlement would replace that with a system that allows the CSPs to create portals where customers can sign in, and then authorize the transaction with SMT on their own terms, with a final email to the customer to assure security. Importantly, this keeps the customer on the CSP’s website through the entire process, instead of forcing them to switch websites or even abandon the process altogether.

California, the other state that led the country in AMI adoption last decade, has also experienced growing pains when it comes to data-sharing. The situation improved thanks to a July 2016 decision from the California Public Utilities Commission, which no longer required utilities to fill out cumbersome customer information service request forms with “wet-ink” signatures to allow third parties to access that data.