Tesla (TSLA) shares surged 14 percent in after-hours trading on better-than-expected revenue and gross margin.

The EV pioneer's Q2 revenue of $405 million beat estimates by $22 million, and its Q2 EPS of $0.20 beat estimates by $0.37. Tesla sold 5,150 Model S vehicles in North America during Q2. The EV builder's surge in gross margin to 22 percent came as a surprise to the analyst contingent, as revenue for Q1 was $562 million at a 17 percent gross margin. (Here's the audio transcript and here is the investor letter. Here's a Tesla high-speed test drive review.)

Takeaways

- The company posted a net loss of $30.5 million

- There are over 13,000 Model S Sedans on the road in North America (all sales, so far, are in North America)

- Tesla opened 7 new retails stores in Q2 and will soon be opening a store in China.

- Shipments to Europe started this week

- Sales of zero-emission vehicle (ZEV) credits still contribute to revenue -- but promised Q4 margin of 25 percent does not include credits

- Tesla maintained its 2013 guidance of selling 21,000 electric vehicles this year. That has meant growing production to 500 cars per week

Last quarter Tesla produced 400 or more Model S vehicles per week for a total of 5,000 units in the quarter. “At this point, making 400 cars a week actually feels like a walk in the park, whereas it was a nightmare in Q4,” Tesla CEO Elon Musk told Bloomberg in July.

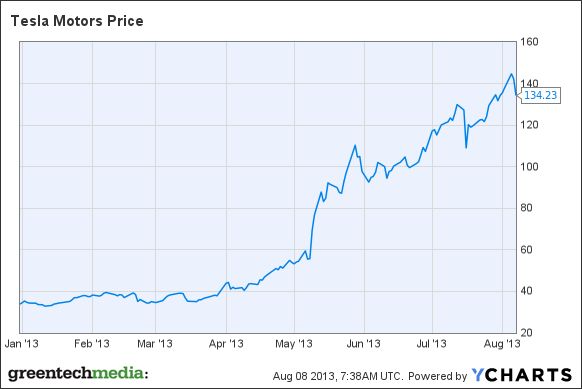

Tesla stock is up roughly 300 percent this year.