Combining residential rooftop solar with behind-the-meter batteries isn’t just a matter of wiring the two technologies together and hoping for the best. Winning combinations will need to be simple to install and operate, but sophisticated in terms of the range of money-making and utility-serving functions they can provide.

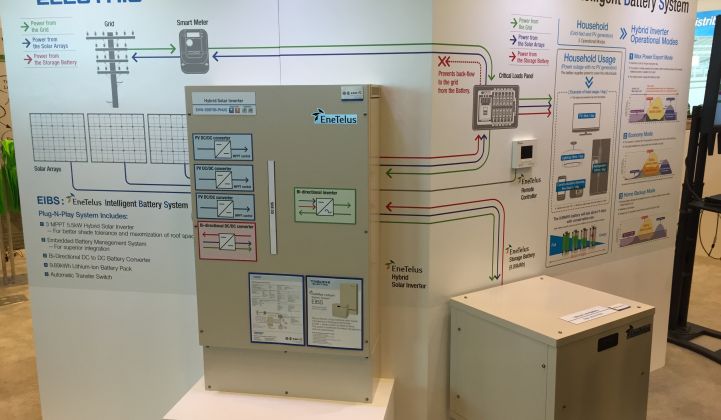

Over the past few years, Japanese solar-inverter maker Tabuchi Electric has been building a solar inverter-energy storage system that it believes hits these marks. Now installed in about 1,000 Japanese homes, the EneTelus Intelligent Battery System (EIBS) comes with a control system that can pick between charging its 10-kilowatt-hour Panasonic lithium-ion battery pack with cheap overnight grid power or daytime solar power. It can store that power for emergency backup, use it to power homes and maximize solar output under Japan’s lucrative feed-in tariff regime, or store solar power for use when the sun isn’t shining.

Tabuchi, along with Japanese solar-storage players like Kyocera and Sharp, has also incorporated some features unique to the Japanese market, which has seen increasing utility restrictions placed on grid-connected PV systems over the past year or so. These include being able to curtail how much solar power is feeding back onto the grid at any moment in time, as well as to differentiate between solar and battery output to avoid selling grid-stored power at feed-in tariff rates.

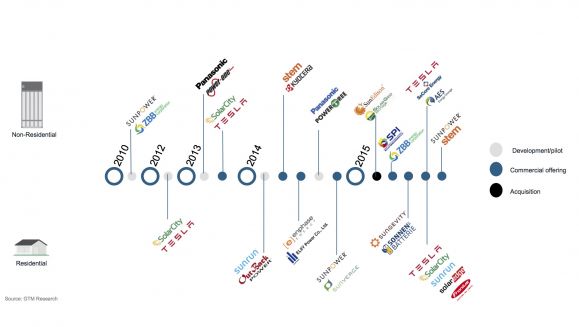

These are all features that could serve well in North America, which is where Tabuchi is headed next. At this week’s Intersolar show in San Francisco, the company announced its EIBS unit is now available for U.S. and Canadian contractors and installers, ready to compete with the long list of solar-storage partnerships -- Tesla and SolarCity, Sungevity and Sonnenbatterie, SunPower and Sunverge, Sunrun and Outback Power, Enphase and Eliiy, and many others -- now in the market.

The EIBS system comes with a 10-year warranty, important for meeting guidelines of California’s Self-Generation Incentive Program (SGIP), which has helped make that state the U.S. leader in behind-the-meter storage. While Tabuchi isn’t disclosing prices, Daniel Hill, Tabuchi America’s sales and marketing director, said in a Tuesday interview at Intersolar that they will “definitely be competitive” with those already in the market.

Tabuchi’s system also combines a 5.5-kilowatt solar inverter with a bidirectional DC-to-DC battery power converter, which allows for separation of the solar and battery systems. That’s a critical capability for Japanese markets, according to Harumi McClure, general manager of Tabuchi Electric of America.

“Sometimes the price is so good, utilities say if people use storage, they might use electricity from the grid during the nighttime, and sell it during the day,” she said. “We have IP that can technically prove that this power is not from the battery.”

Almost all U.S. states use net-metering regimes to compensate customers for their solar power, which lessens the utility financial concerns that arise with feed-in tariffs on this front. Even so, California utilities sought for more than a year to restrict grid interconnection of solar-battery systems on the grounds that they could feed grid-stored battery power to the grid for net-metering credits. State regulators eventually forced utilities to resume connecting solar-battery systems to the grid, with some metering and measurement requirements to ensure they’re not gaming the system.

Canada’s Ontario province does have a feed-in tariff, however -- one that has driven a huge growth in distributed solar. Energy storage could be quite useful in smoothing out the potentially destabilizing peaks in solar output that are arising as a result. But Ontario’s utilities and grid operator Ontario IESO have been concerned about the potential for battery-backed solar systems to recycle grid power at FIT rates.

Last year, Tabuchi launched a pilot project with Oshawa, Ontario’s municipal utility to test how it could help solve this problem, McClure said. “We’re trying to prove how our system is equipped to stabilize the grid, so we can share the data with the rule-makers to improve their system.” Results from the project are to be released later this week, she said.

Hawaii is another solar market that could use these kinds of capabilities, she noted. Tabuchi is in discussions with Hawaiian Electric Co about how its ability to divert solar power to batteries that would otherwise be fed back onto the grid could help the islands’ big investor-owned utility manage the increasing disruptions it’s facing from rooftop PV, she said.

HECO has already implemented requirements for residential inverters to comply with transient overvoltage concerns, a relatively simple firmware upgrade for most inverters, according to GTM Research analyst MJ Shiao. Now it’s “looking toward more advanced functionality to ensure that its uniquely high penetration of DG solar doesn't adversely affect grid reliability.”

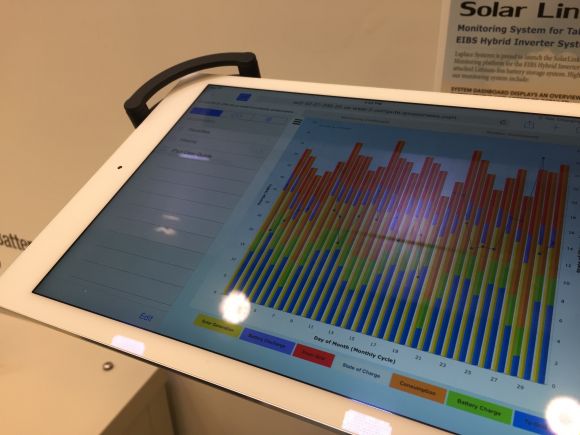

Tabuchi’s booth at Intersolar featured a live feed from a house in Hawaii that’s been set up with an EIBS system and a monitoring platform from partner Laplace Systems, a long-time renewable energy software player in Japan. “We do have monitoring with what we’re offering, so you can tell when you’re charging and discharging your battery, when you’re getting solar input, when you’re pulling from the grid or discharging to the grid,” Hill said. The system also provides some in-home energy usage measurement capability, something that’s increasingly being built into residential solar and battery offerings.

Also on display at Tabuchi’s booth at Intersolar was a placard noting that the EIBS system is being “enabled” by Growing Energy Labs Inc. (Geli), the San Francisco-based startup with software that’s managing grid-connected battery and solar-storage systems for partners including Coda Energy, Aquion Energy, Bright Power and Gexpro.

“We use Geli for residential and also commercial” systems, McClure said, to enable the communications and control links between its inverter and battery controls and the utilities it plans to integrate with in the future. That’s going to be useful in managing how solar-battery systems predict when they’ll be required to store solar power to alleviate grid backfeed or other utility-friendly tasks, while still maximizing the economic return from the system, she noted.

There are still many questions about how solar-linked batteries can profitably serve the array of grid-facing tasks they’re theoretically capable of performing. States like Hawaii, California and New York are starting to set up programs and markets that could open revenue streams on this front.

“That’s a little bit of the holy grail, talking about the controls side,” Hill said. As the world’s fifth-largest solar inverter maker, Tabuchi would appear to have a handle on the bankability issues for solar installers looking for a solar-storage system that will last long enough for these opportunities to emerge. On the future functionality side, “our Japanese heritage, needing to control what we put onto the grid -- the capabilities are there," he said.