While it may seem niche, the world of solar software is becoming larger and more diverse by the minute.

According to Paul Grana, co-founder of software firm Folsom Labs, the general trend in the solar software space is toward fragmentation.

"There are literally thousands of apps just for sales teams alone — not even HR or marketing, let alone the integration of technology," he said in an interview last week at GTM's Solar Software Summit in San Diego.

While managing a wide range of software solutions can add complexity, it's also an opportunity. "Fragmentation means that a team is working on a narrower problem, and is therefore able to solve it more effectively because they can understand it better, and you get better products," Grana said.

"The buyer who is running a business using these apps is going to...have five options to choose from and can pick the best-in-class [product] for their needs," he added. "Within any narrow niche, there's a big difference."

The trend toward diversification aligns with the findings of a forthcoming Folsom Labs and GTM Research survey, in which 600 solar developers, engineers and consultants identify pain points they're looking for software to solve. Companies aren't looking for technology solutions to that can do a dozen things at once, according to Grana. Rather, they're looking for multiple tailored solutions that can solve specific challenges.

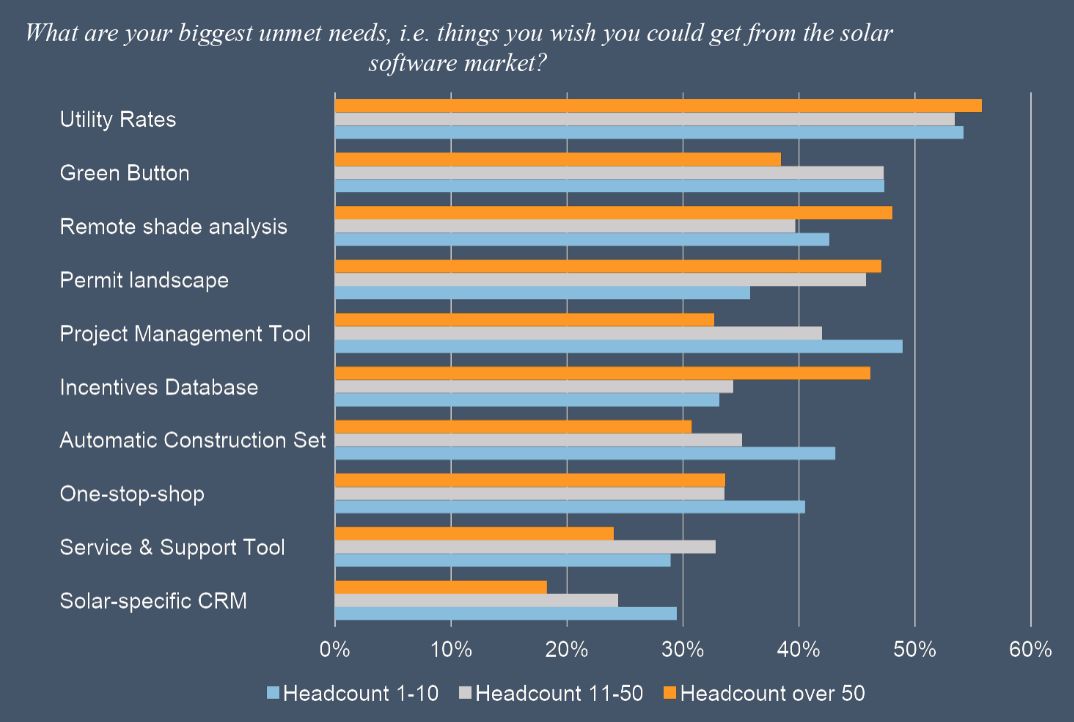

Based on the survey, understanding utility rates is a top priority for the solar industry. The majority of respondents (60 percent) said Excel spreadsheets are how they keep track of utility rates. Energy Toolbase was the next most popular software platform among survey takers (18 percent), followed by UtilityAPI (10 percent).

Grana noted that there are other software solutions out there to help solar companies manage utility rates. What's likely driving the demand for a technology fix in this space is that utility rates are becoming more complicated, particularly for distributed solar.

For instance, California's Net Metering 2.0 transition has made selling rooftop solar significantly more complex. Telling customers what their rates, and thus their solar savings are, "has gone from something a salesperson can do on a calculator at the kitchen table, to something you need to plug in to a model to figure it out," Grana said.

For larger companies, remote shade analysis, the permitting landscape and incentive databases are unmet needs that respondents want software to fix. For smaller companies, project management tools, remote shade analysis and support for Green Button, a standardized way to access energy usage data, emerged as priorities.

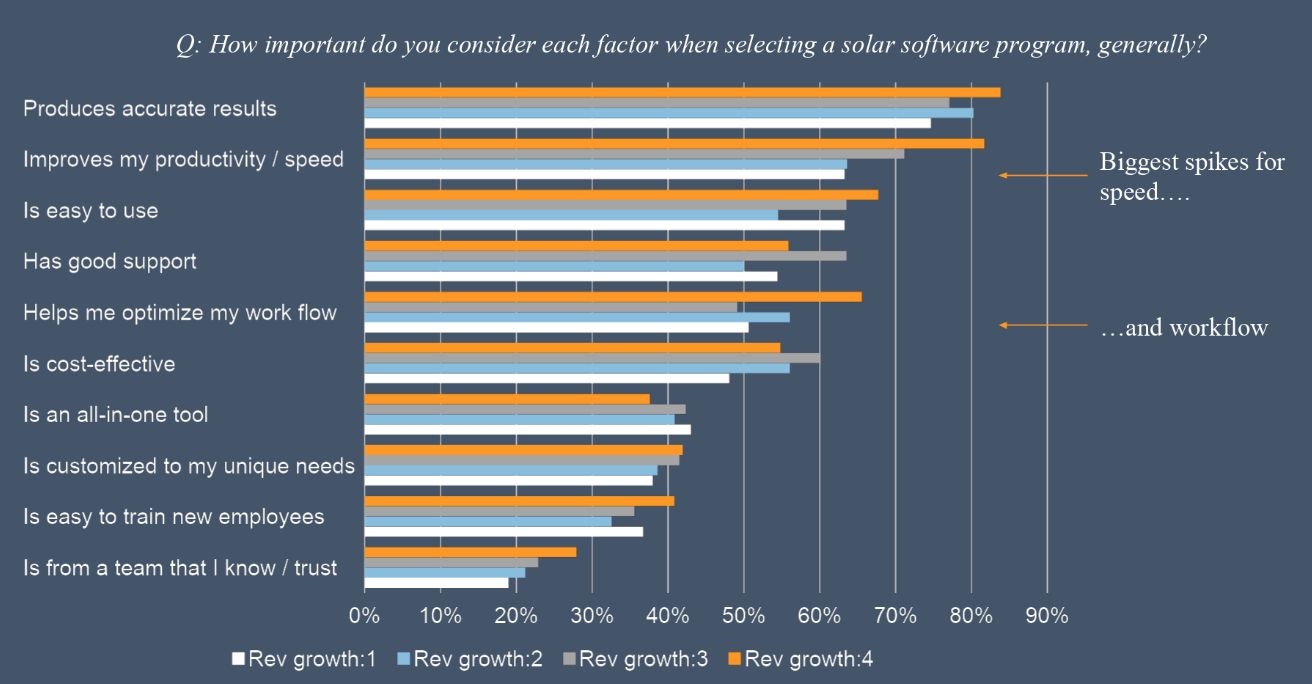

In addition to market diversification and a preference for tailored solutions, survey results showed that solar developers are prioritizing growth, more so than expanding margins or cutting costs.

"Certainly, they are related," said Grana. "Price informs the payback period, and the payback period informs the willingness of someone to go solar, particularly for distributed generation. But still, I would say given the survey results, it's much more about companies finding new customers, serving those customers more effectively, and becoming more efficient in doing it."

This is particularly true for solar companies with high levels of revenue growth.

To Grana, this makes perfect sense. High-growth companies have already figured out the core of their business; they have a number of happy customers and now they want to find more of them at a faster rate. Or, at least, they don't want to grow at a slower rate. In general, that's true of all solar companies, although slower-growth firms are more sensitive to software prices and ease of use.

Another finding that came out of the survey is that faster-growing solar companies are more likely to use drones and high-resolution imagery technology. They're also more likely to offer energy storage.

According to Grana, this ties back to the efficiency and productivity piece. Companies can get most of the data they need to build a solar project from satellite imagery, but once that company reaches a certain level of maturity, it looks for places to invest that will allow the company to move faster. Investing in high-quality drone data is one way to do that.

Energy storage is another way for companies to boost growth, because it offers companies a way to differentiate.

If all solar companies appear to be offering the same product, then the competition comes down entirely to price. The more differences there are in how a company goes to market, the easier it is to shift the conversation from price to customer needs and value.

"When you can do that, it's your own customer to lose, and you don't have to just lower the price to win the deal," said Grana.

While the solar software landscape is becoming more varied and complex, picking the right set of software tools supports greater productivity and differentiation. Ultimately, said Grana, "That's going to be how we all survive."