According to the latest U.S. Solar Market Insight report, released this week, solar PV system installation prices dropped between 9 percent and 12 percent in 2014, depending on market segment.

Residential

The U.S. residential solar market experienced its best year ever, seeing more than a gigawatt of PV installed in 2014. The rapid growth of the market has certainly contributed to declining system prices.

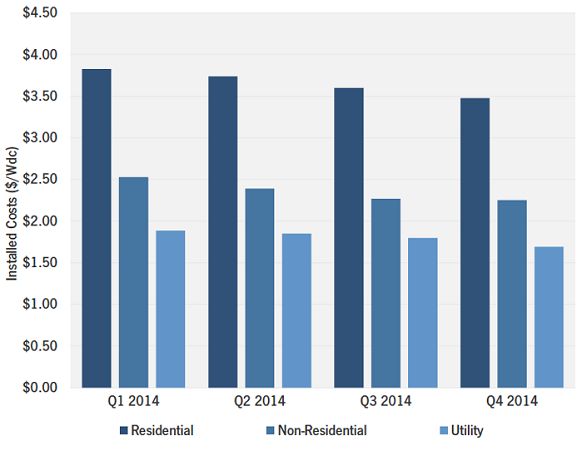

Given the smaller system size, home installations are more costly than commercial or utility installations. However, by the end of 2014, residential rooftop PV system installed prices averaged $3.48 per watt, down from $3.83 cents per watt in the first three months of 2014. This represents the largest absolute decline across any of the market segments.

According to the report, soft costs like customer acquisition, labor, and permitting make up 60 percent of system prices, and there is ample opportunity for improvement and efficiencies which will continue to lower system costs.

Commercial

The commercial solar market experienced a dip in 2014, with installations down 6 percent year-over-year. However, system prices continued to fall, despite the lack of installation growth.

Driven by significant reductions in balance-of-system costs, the cost for a medium-scale commercial system averaged $2.25 per watt by the end of 2014. This is down from $2.53 per watt in the first quarter of 2014.

Utility

With its large-scale installations, the utility segment accounted for 63 percent of all PV capacity brought on-line in 2014. Because of the enormous scale of its projects, the segment sees system prices that are nearly $2 per watt cheaper than the residential segment.

Turnkey installation prices for fixed-tilt PV systems fell from an average of $1.77 per watt in the first quarter of 2014 to $1.55 per watt in the fourth quarter. The report notes significant variance in system pricing in the utility-scale segment, ranging from as high as $2.10 per watt or as low as $1.40 per watt.

FIGURE: U.S. National Average System Prices by Market Segment

Source: GTM Research / SEIA U.S. Solar Market Insight

"Total installation costs for utility and large commercial systems," writes GTM Research Director MJ Shiao, "are now below 2011 module costs, underscoring the magnitude of the impact of falling module prices and incremental balance-of-system reductions."

GTM Research expects U.S. PV installations to grow 31 percent in 2015, reaching 8.1 gigawatts.

***

Download the free 20-page executive summary of the U.S. Solar Market Insight report here.