If the intensity, excitement and turnout of GTM's Energy Storage Summit are any indication, the energy storage market really got going this year. GTM Research Senior VP Shayle Kann kicked off the sold-out event with an eye to the future.

Kann said it was "amazing" that the grid had gotten this far "without a significant volume of energy storage" but that it was "emblematic of the reason why energy storage is so exciting and so important for the future of electricity in the U.S., and indeed, globally."

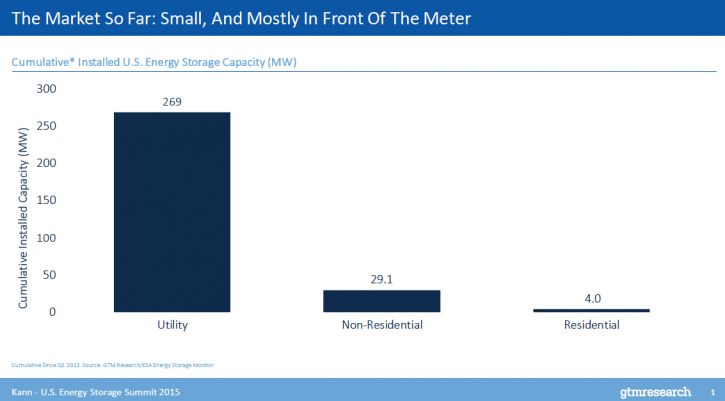

Kann said, "Let's be honest with ourselves about the market as it exists today. It's very small. Since the beginning of 2013, the past three years or so, we've deployed about 270 megawatts of energy storage in front of the meter, another 30 megawatts or so of energy storage at the non-residential or commercial level, and just about 4 megawatts of energy storage at the residential level. (This is just grid-connected.) That's just not very much."

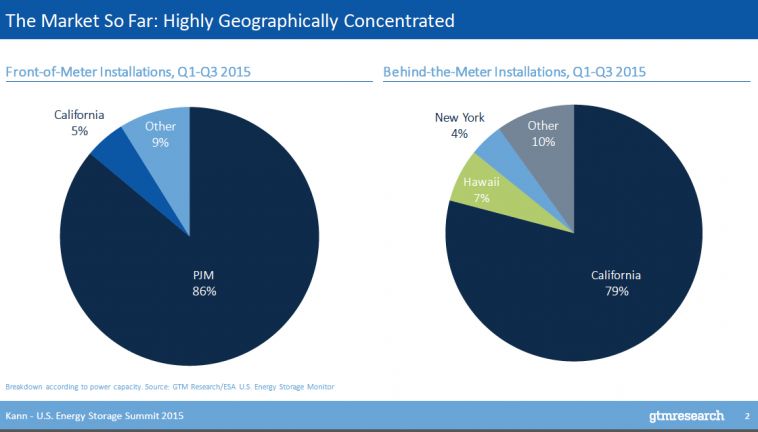

"Not only have we only deployed [only] a little bit of it, but what has been deployed already basically occurs in two places. In front of the meter, we deployed almost everything that we've done, especially in energy capacity terms, in PJM specifically for frequency regulation. The vast majority of behind-the-meter storage that is being deployed right now and has been deployed over the past year or two has occurred in California, thanks largely to attractive rate structures, attractive economics, and the Self-Generation Incentive Program."

"Let's start in front of the meter, because in front of the meter is where the vast majority of the megawatts are getting built out right now. I mentioned before the geographic consolidation of the market to date. Basically, all of the energy storage in front of the meter that we are deploying right now is occurring in the PJM frequency regulation [jurisdiction], but that's not where the market is headed necessarily, and you can use the project pipeline as a way to explain this."

"We can start by just looking at what's been deployed. Of what has been deployed thus far in megawatt terms, the vast majority is in PJM... [with] a little bit less in places like California and Hawaii."

"If you look at the pipeline of all projects that are in development right now, it's obviously a very different story. We have over 4 gigawatts of energy storage projects in development in California alone."

"Even if you imagine that there's, say, a 75 percent fallout rate of this pipeline, you still have a gigawatt of energy storage front-of-the-meter projects that are supposed to get built out in California over the next few years. You do have a pipeline that is getting built out in PJM as well, and actually in Texas and New Jersey, outside of the rest of PJM. The trend...is from a market that is entirely dominated by PJM to a market that probably going to be dominated by California."

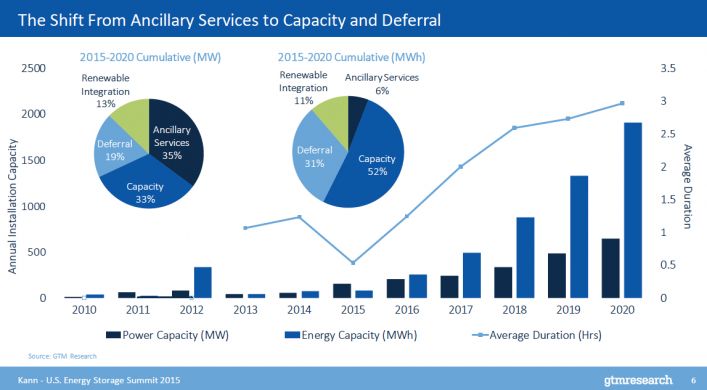

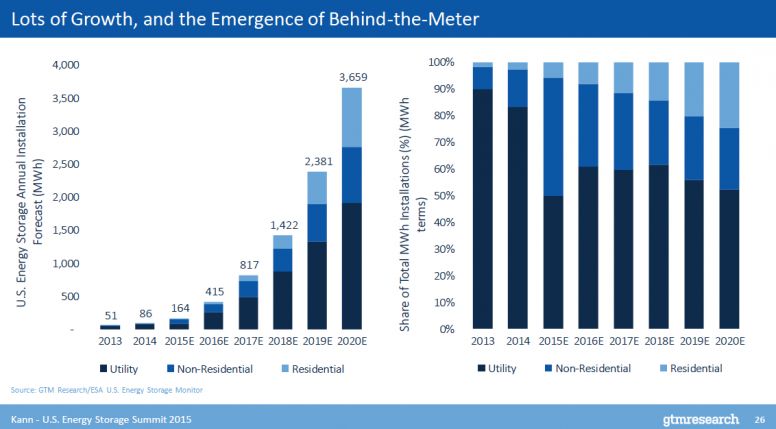

"This is our forecast for deployments, yearly both in power-capacity terms, in megawatt terms, and in energy-capacity terms, and in megawatt-hour terms.

"The big transition that we're going to be seeing here, first of all, [is] growth. No matter how you look at it, there's a lot more that will get built out over the next couple of years than has been built out in basically all of the history of energy storage in the U.S. We're already heading into a market that is larger, but what's changing about that market is that it's shifting from a frequency regulation market, PJM, which means fast-acting [and] low-duration, to a market that is largely dominated by California, wherein the value proposition is more around capacity value, or 'resource adequacy' as California often calls it -- deferral.

"That means that in megawatt-hour terms, the market will be growing faster than it will in megawatt terms. It means the average duration, at least in our forecast, will go from a low this year of about a half an hour up to something like three hours by 2020.

"If you look at the forecast from 2015 to 2020 cumulatively in megawatt terms, you can still see ancillary services such as frequency regulation will be something like one-third of the primary use case for most of the storage that gets built, followed by capacity and deferral. If you look at it in megawatt-hour terms, it'll be a different story. You'll see more than half of it getting built up for capacity or for resource-adequacy purposes and a little under one-third for deferral -- actually relatively little.

"You just have a much larger total adjustable market when you're playing for the purpose of capacity or deferral than you do for ancillary services. Frequency regulation has...a total adjustable market of 1 percent peak load in any given location. Once you add storage to it, that number goes down. If PJM is something like .7 percent of peak load, there's a market there, to be sure. There are hundreds of megawatts that will be built out, but over the long term, where we see the big primary use case is in capacity, it's in deferral," Kann said.

He continued, "Generally speaking, the value energy storage can provide to integrated renewal doesn't have to be located with the renewable resource."

"The nonresidential energy storage market or the commercial energy storage market in the U.S. is in an interesting spot right now. There's a lot of activity and a lot of development. There are companies popping up, there are companies proving they can finance these things, but it's basically all happening in California. There's a little bit going on in a few other states, but the vast majority of it is in California for demand-charge management purposes.

"One of the questions that we have as we're trying to figure out how this market is going to develop over the next few years is what it would take for other states to see attractive enough economics. Then you can have a commercial energy storage market, even just for demand-charge management, that extends beyond just...California, New Jersey and Massachusetts, the few states that exist today.

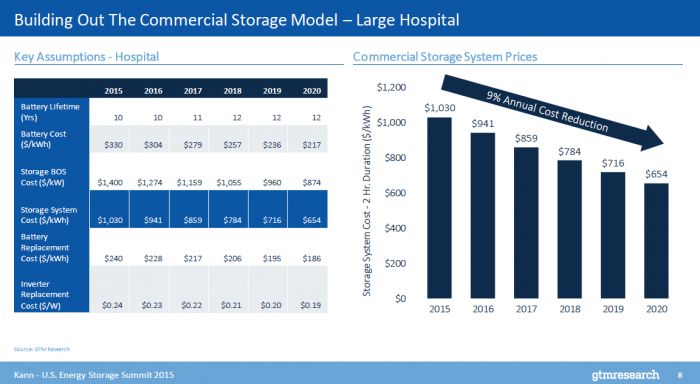

"We've been spending the past couple months trying to figure out how to model this out, and what we ended up doing was modeling out a customer that has a similar type of load, a large hospital, across all 50 states. In each of the 50 states, we're including the largest utility territory and the actual tariff that customer would be under and trying to figure out what it would take for that market to see attractive enough economics so that you can finance a commercial energy storage project for demand-charge management.

"The system size is actually different depending on the state, because we size it to 25 percent of that peak load, and we have different load profiles for each customer in each state, but it works out to something between 300 and 400 kilowatts. It's always a two-hour duration system. The cost that we're assuming is a 9 percent annual cost reduction starting if you have installed it in 2015, around $1,000 total a kilowatt-hour, down to about $600 a kilowatt-hour in 2020," he said.

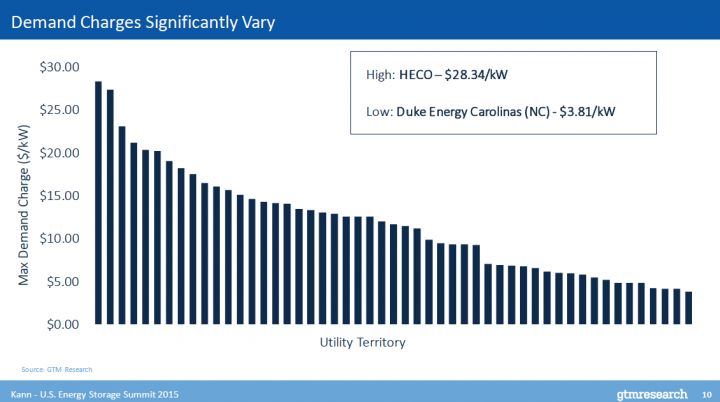

Kann spoke about the challenges of commercial energy storage: "The primary value stream...that commercial energy storage provides today varies significantly. This is just looking at that load profile and what rate [a customer] would be under for all 50 states and the largest utility in each state. Demand charges vary from as high as nearly $30 a kilowatt in HECO territory in Hawaii down to less than $4 a kilowatt in Duke in North Carolina and everything in between, which is to say that for commercial energy storage, you have a dual challenge here. You both have to find a customer that has the right kind of demand charge or the right tariff structure and has the right type of load. This is a challenge that isn't going to go anywhere if you're basing your economics off of the customer's rate and the customer's load."

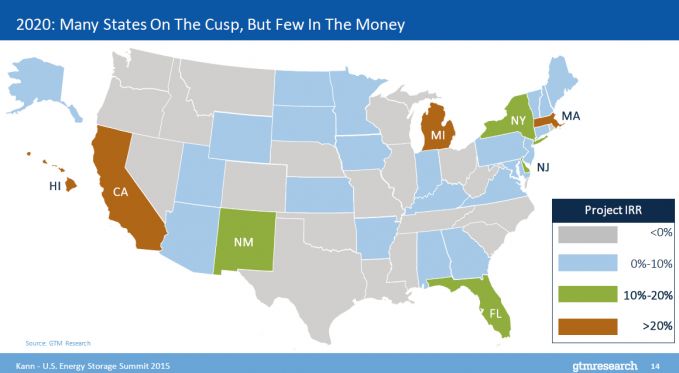

"Today, you have four or five states that look attractive. This aligns with the state of the market today. These are the staes where...there's activity going on with commercial energy storage. It's Hawaii, California, New York, Massachusetts. The one surprise here is Michigan, which may have to do with the load that we assume and the rate that [Detroit utility] DTE has in that case. It doesn't mean Michigan is a big market right now, but it does mean if you're in the audience and you're looking at commercial energy storage, take a look at Michigan.

"You have three or four states that are really attractive today, and that's just the market that we live in. Then [there are] a few states that are...approaching the cusp but just aren't economic yet," Kann said.

"Let's skip forward a couple of years given all the assumptions that I mentioned initially and see what happens in 2017," he continued.

"It's actually not that much different. You have a couple new states that have picked up. New Jersey becomes a little bit more attractive, and you have some other states that are on the cusp. It doesn't change things in any substantial way, which is to say if this is really how the market looks...you don't see that much geographic expansion over the next couple of years, and even if you build it out to 2020, things get a little bit better. You have states like New Mexico PNM and Florida FPL that might pick up in some cases.

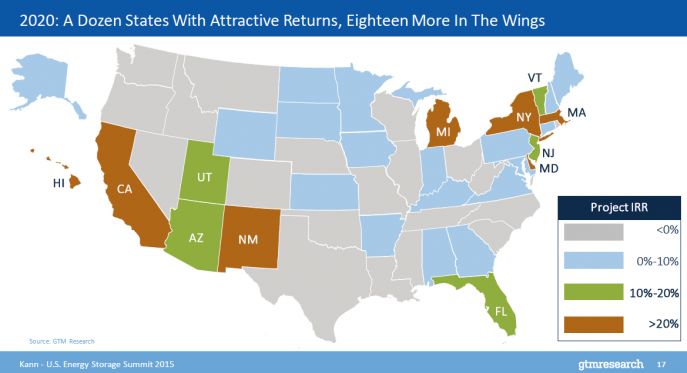

"What that's telling me is that in order for commercial energy storage to have a really drastic growth rate over the next few years, system prices need to fall pretty fast. A lot of people expect them to fall pretty fast; it's a necessity not a benefit," Kann said.

The following map depicts a scenario with a less-conservative price trajectory on system costs.

"Now let's finish by talking about residential. As I mentioned...residential is by far the smallest market. Four megawatts deployed that [have been] connected through Q3 of this year. It's just not a very big market yet, especially relative to the hype," Kann said.

"The market as it exists today is not primarily an economic market for residential storage; it is about backup power.

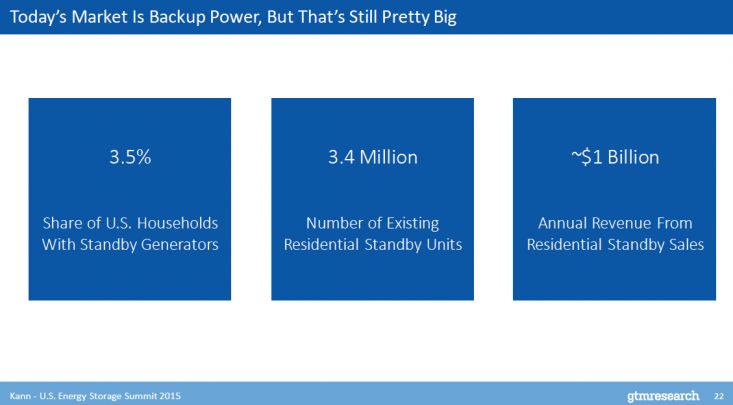

"The reality is the backup power market is not small. Something like 3.5 percent of households in the U.S. already have standby generators. That's a backup power market that energy storage can eat into that equates to something like 3.4 million individual units. What's particularly interesting about that billion-dollar annual market is that one company, Generac, has something like 70 percent market share within that market. You have a billion-dollar market that is dominated by one company that uses standby generators, which customers don't love necessarily, that are dirty, and that residential storage can't eat into a lot. That is a real market to build into.

"The tricky part about it for residential storage is incentives just aren't there for the most part. You don't have big differentials and time-of-use rates that you can arbitrage against. You generally don't have residential demand charges, you don't have the ability to aggregate in most places yet. It's just hard to find an economic value proposition for residential storage, but we're starting to see a few examples of places where the economics are starting to pan out because new opportunities are arising for value streams.

"Backup power should be considered a value stream," Kann noted. He cited the recent plan announced by Vermont utility Green Mountain Power, "where they're planning to be selling [Tesla] Powerwalls to residential customers. They'll either sell it to the customer, lease it to the customer, or give it to the customer and have the customer pay a monthly charge, and which one the customer chooses will dictate what level of power Green Mountain Power has to charge and discharge during peak times."

"The energy storage market is going to grow really fast. There's a reason why our first-ever energy conference at GTM is oversold -- because there are a lot of people trying to figure out how to make this market work. And in fact, [they] are starting to deploy things now, getting projects done, getting things financed," Kann added.

"The other thing that we will start to see is the emergence of behind-the-meter as a significant portion of this market. Ultimately, we think we'll see behind-the-meter energy storage play just as big a role as front-of-the-meter will.

"If you take a step back, the electricity sector in the U.S. is undergoing pretty dramatic transformations all at once and at different paces. You have decarbonization through which...we're planning to reduce greenhouse gases. [...] We have decentralization through which distributed energy resources are popping up in various forms and making the system more distributed than it ever has been in the past. Finally, vehicle electrification. The advent of electric vehicles and the growth therein and potential that they provide to offer grid services and to assume a load, [...] which is something utilities haven't seen, is presenting a whole array of opportunities.

"These three transitions that are all happening at once -- decarbonization, decentralization, and vehicle electrification -- they're all very important. If you look across them, the one thing I think that is cross-cutting and can act as a catalyst for all three of those is energy storage," Kann concluded.

***

Here's the archived live stream from the event.