How can you improve performance and price in crystalline silicon solar panels?

You can make the solar cells thinner and go to a kerf-less approach. We've covered startups such as AstroWatt and Ampulse that are working on getting solar cells to 25 to 50 µm in thickness without a sawing operation. Thin silicon has the potential to reduce silicon usage and improve performance and price, but there are immense handling and processing challenges.

You can look to eliminate the polysilicon step entirely and go straight from silane gas to cell as 1366 Technologies and Crystal Solar are attempting. This is a smart concept, but has yet to be commercialized. (Note that 1366 has received a DOE loan guarantee.)

Suntech and other vendors have developed a hybrid mono-poly solution, squelching the myth that China doesn't innovate.

And lastly, and with somewhat less risk, you can work on taking existing wafers and making incremental changes to optimize their performance. This can take the form of texturing steps or silicon inks as in Innovalight's approach or what just-unstealthed Silevo is looking to do.

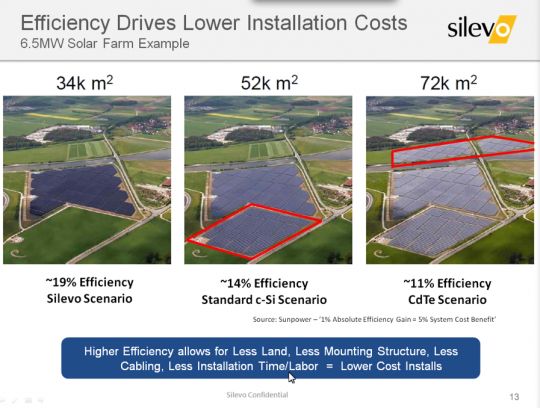

Silevo is looking to raise panel efficiency to the limits of what silicon can achieve while keeping prices low.

I spoke with Chris Beitel, the VP of Business Development at Silevo (formerly known as Sierra Solar Power). Undaunted by the current pain in the solar industry, Beitel said, "The challenge with the industry is reliance on subsidies -- and boom markets which become bust markets." He added, "We need to be at $2/W system costs installed," adding that the industry must eventually "get down to $0.06 to $0.07 per kilowatt-hour."

And these prices have to be achieved while allowing each player in the value chain to make some money, said Beitel.

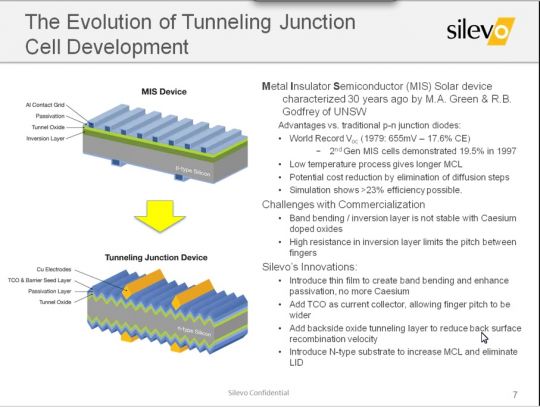

Silevo's technology looks to achieve high efficiencies, "appropriate costs," and improved energy harvest through improved temperature coefficient via their "hybrid cell" technology that encompasses:

- Tunneling junction cell technology provide for better junction quality

- N-type substrates

- Thin-film passivation layers that allow higher voltages

- Copper-based metal electrodes that eliminate the high cost of silver.

The firm claims to be producing cells on full-size substrates with efficiencies in the 20 percent to 21 percent range, with "headroom to 24 percent." Silevo also claims it can achieve these figures commercially at relatively small volumes of 30 megawatts. Beitel says he doesn't have to build one gigawatt to achieve these results.

Silevo claims cell temperature coefficients of -0.22 percent per degree Celsius, which could enable thin film-like solar energy harvest by crystalline silicon.

Beitel claims to be shipping trial samples and looks to get to 200 megawatts of capacity in 2013. The startup aspires to be a module manufacturer; Beitel believes that "module manufacturing is the path forward" for sales in the emerging U.S. and China markets. He said that the firm would consider selling cells in order to "accelerate the bankability data set."

I would question why being a module manufacturer is a great idea when Silevo has no value to add in that production step.

In any case, "It comes down to product differentiation," said Beitel. He said that Chinese solar is not on the trajectory it once was and that costs at the gigawatt-scale factories from firms such as Yingli have plateaued.

Silevo has closed $33 million in financing from investors New Margin, GSR, and DT Capital.

The firm is in pilot production in Fremont, CA, with high-volume commercial production set to begin in the first half of 2012 in Hangzhou, China

It's a difficult time to be an established solar panel manufacturer and an even more challenging time to be a solar startup. Margins are compressing as ASPs continue to fall while the market is oversupplied, and the global policy framework has little long-term visibility. Silevo has a lot to prove technologically and commercially.