The three large California utilities PG&E, SCE, and SDG&E have had to file detailed reports on their smart grid plans. Greentech Media's smart grid reporter, Katie Tweed, had the pleasure of reading through the hundreds of pages and she summarized her findings here.

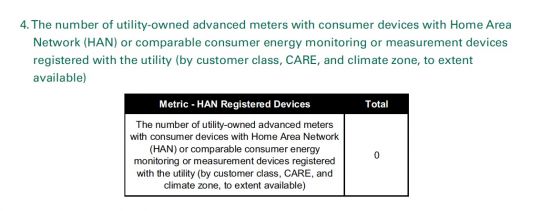

Here's one statistic from the Southern California Edison report that jumped out at our smart grid analyst team:

As Tweed wrote, "To sum it up, the figure here is zero all around, with the exception of a few very small trials conducted by SCE and PG&E. (The utilities are waiting for the adoption of the Smart Energy Profile 2.0 HAN national standard, which might not be finalized until 2014 at the earliest. SCE, however, says it will have a pilot with several thousand devices later this year. The other utilities did not attempt to explain future rollouts or setbacks, but it is likely that large-scale HAN hardware is still years in the future in California."

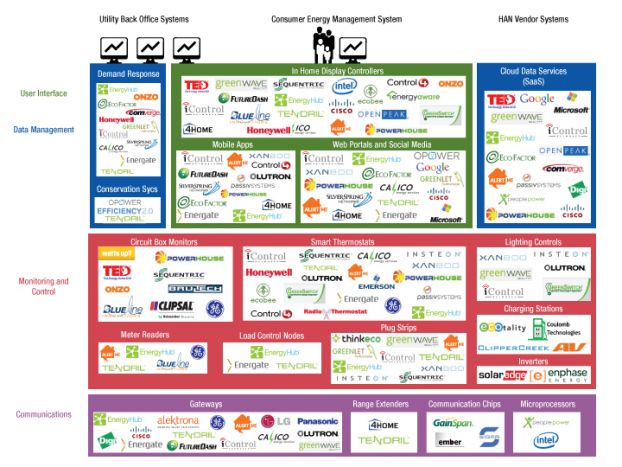

The HAN market is still forming and utilities remain flinchy about investments in the home and behind the meter. The growth in this market may not come from the utilities themselves but from companies working in tandem with the utilities. It certainly won't come from Google or Microsoft, which have both abandoned their home energy offerings in the last few weeks. (See the diagram below for the long list of companies clamoring to enter this market.)

In the words of GTM Research Smart Grid Analyst Chet Geschickter, "Of course, what utilities really want is demand management. They are not out to mimic consumer electronics companies," adding, "Multiple formats will prevail: services only, technology plus services, self-installing devices, the energy management subsystems of smart appliances, websites and more."

All told, Greentech Media Smart Grid Research forecasts a $750 million U.S. HAN market by 2015. See diagram below for the HAN taxonomy from the most recent GTM Research HAN report.