As the World Cup kicks off in Brazil, the power outlook is shaky at best. The host country’s main stadium, Maracanã in Rio de Janeiro, may be outfitted with a 390-kilowatt solar installation, but the primary source of the country’s power generation has been waning for months.

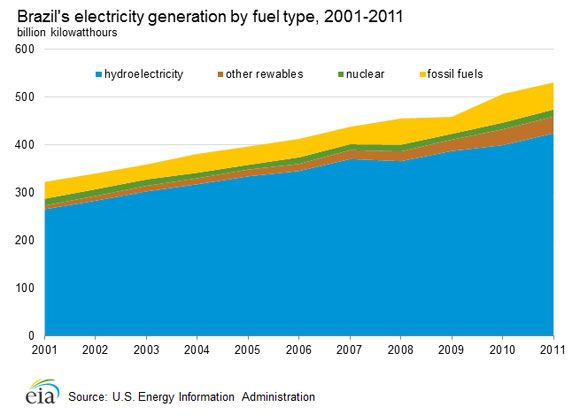

The most severe drought Brazil has seen in decades has handicapped the hydropower that provides more than 70 percent of Brazil’s electricity capacity. Water reservoirs in the southeast and central-west regions of the country are at less than 38 percent capacity, according to Platts, and continue to drop.

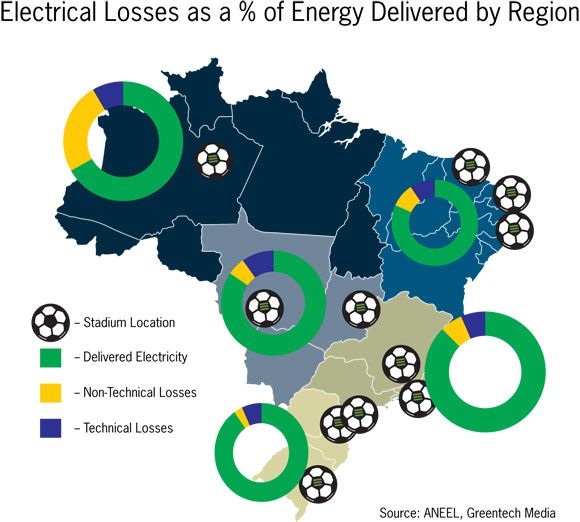

The problem for Brazil is not just producing electricity, but delivering it with minimal losses. There are more than 60 distribution companies serving approximately 65 million customers, according to GTM Research. Many of those face losses, both due to technical issues and theft, in the double-digit percentages. Energy theft is particularly pervasive in the northern regions. The U.S., by comparison, has about 7 percent losses, almost all technical.

Grid modernization and upgrades are happening, just not in time for the World Cup, and perhaps not before the Olympics. AES Eletropaulo, one of the larger distribution utilities in Brazil, has plans for 3,000 reclosers to help contain outages, as well as an upgraded distribution management system and outage management system. It is also piloting smart meters and pre-payment options to try to cut down on theft.

CPFL Energia, another major utility, has a distribution automation project with Silver Spring Networks to redirect energy flows in the case of outages; it is also installing smart meters in parts of Sao Paulo to reduce fraud. Although some utilities are installing smart meters in targeted areas to help minimize theft, it is not the countrywide mandatory deployment that meter manufacturers were hoping for in 2012.

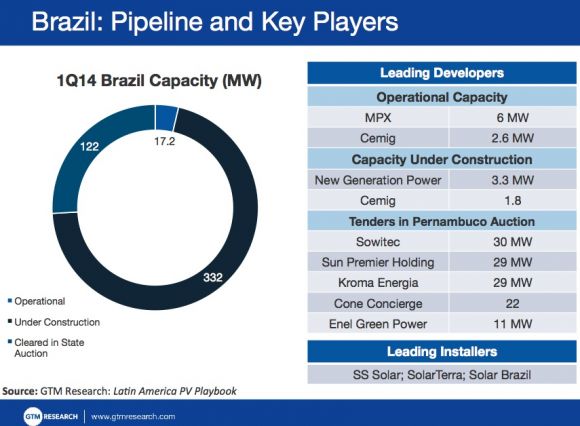

To meet the increased need for electricity during the World Cup, Brazil has turned to generating more power rather than reducing losses. Utilities are importing more natural gas and ramping up coal-fired power plants, which make up only a small portion of installed capacity. Large-scale non-hydro renewables are making some inroads, but not fast enough to make a marked difference in time for this event. GTM Research increased its demand expectations for solar in the next two years, and the analysts expect more than 70 megawatts of solar PV to be installed in 2014.

Source: Latin America PV Playbook

Wind projects are also increasing in Brazil, with about 550 megawatts of energy from wind farms getting winning bids at Brazil’s energy auction earlier this month, according to Bloomberg News. Although more renewables are coming on-line, there is not necessarily a guarantee of transmission lines to connect the projects. Also, more capacity does not fix the inefficiencies that stem from high losses on the distribution grid. Distributed generation makes up only about 10 megawatts now, according to a report by Cogeneration & On-Site Power Production, but that could rise to 2,000 megawatts within five years.

Even if there are electricity shortfalls during the World Cup, utilities would likely have rolling blackouts in the areas not hosting the matches, rather than risk affecting an event that the entire world is watching. Stadiums are also mandated to have uninterruptible power supplies, something that would have been helpful during the 2013 Super Bowl in New Orleans.

There are not expected to be any major changes to the energy policy landscape in Brazil until after elections this fall, and even then, it is unclear whether heavy investment in grid upgrades will come before the Olympics in 2016.