Mid-Atlantic grid operator PJM has released a much-anticipated "fuel security" report (PDF) that indicates it can maintain grid reliability with the coal and nuclear power plant retirements expected over the next five years, even while losing natural-gas pipelines during multi-week winter cold snaps. It's a finding that could undermine Trump administration efforts to bail out those industries.

The report found that a combination of “extreme” but plausible wintertime conditions, like those experienced during the 2014 polar vortex, could cause forced outages by early next decade — but only if power plant retirements accelerate beyond today’s projections. That's a finding CEO Andy Ott said is leading PJM to consider “actions we will need to take relating to valuing fuel security.”

Thursday’s report is the first unveiling of results from a study PJM launched in May, with a final report due in December. It was compiled as part of PJM’s response to the Federal Energy Regulatory Commission (FERC) proceeding on grid resilience launched last year.

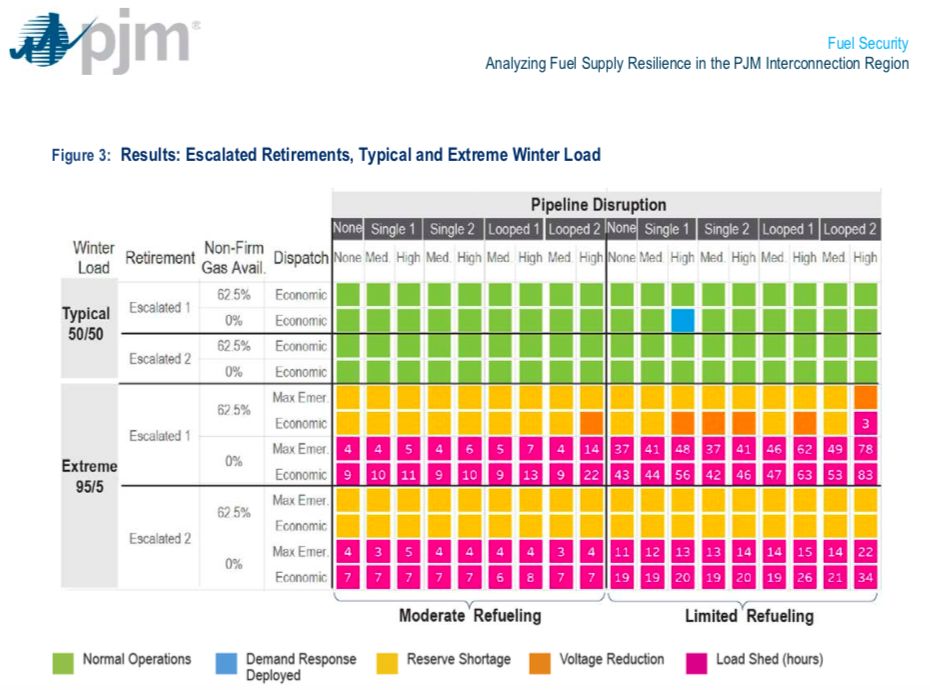

PJM’s study looked five years into the future, and used more than 300 scenarios combining different variables pertaining to weather, load, power plant retirement and fuel supply disruption, Ott said at a Thursday press conference. And under almost all foreseeable circumstances, the study found “the system can withstand a considerable period of stress while remaining reliable and fuel secure in most circumstances,” he said.

Specifically, PJM found that it could maintain reliability over a 14-day period of cold winter weather — the season which puts the most stress on fuel supply infrastructure such as natural-gas pipelines or fuel oil delivery trucks — under expected loads and retirements. “Even in an extreme scenario, such as an extended period of severe weather combined with high customer demand and a fuel supply disruption, the PJM system would still remain reliable,” the report states.

"The system will remain reliable and secure, but we will see some reserve shortages,” explained Mike Bryson, PJM’s vice president of operations.

These findings align with previous PJM analysis that shows no threat of grid disruptions from the coal and nuclear power plants set to be closed down in its territory, including those of bankrupt utility FirstEnergy Solutions. FirstEnergy and one of its major coal suppliers, Murray Energy, have been at the heart of lobbying the Trump administration to declare these power plants critical to grid reliability because they store fuel on-site, and force utilities and customers to buy their uncompetitively priced energy output at a potential cost of billions of dollars per year.

FERC unanimously rejected an Energy Department proposal to make out-of-market payments for such “fuel-secure” power plants early this year, leading the Trump administration to prepare an unreleased, but leaked, plan to use laws meant to secure critical infrastructure in times of national emergency to force the purchase of their power. The administration has reportedly shelved those plans, although opponents fear they may re-emerge.

PJM has spoken out strongly against “government intervention” of this type, saying it prefers to find ways to create market values for the reliability and resilience “attributes” that different grid resources can provide, whether they’re power plants with fuel on-site or off, as well as renewable energy, energy storage or demand-side resources.

However, PJM’s fuel security study did find a risk of significant grid disruptions, including extended power outages for certain parts of its system, if it assumed that even more power plants will close over the next five years than the roughly 12,000 megawatts of retirements already announced.

“We do see a risk where we could get into situations where we couldn’t meet demand under all circumstances,” Ott said. That raises the question that PJM intends to work on with its stakeholders and FERC in the months to come, he said. “How do we assure that if these risks come to fruition, we are ready for it?”

Specifically, PJM looked at two scenarios in which power plant retirements brought it all the way down to its reserve margin reliability requirement of 15.8 percent, well below the 21.5-percent reserve margin it garnered in its capacity auction this summer. One scenario increased retirements to the margin, and the other doubled retirements — a highly unlikely scenario — and then replaced up to the margin with more economically viable resources like natural gas or renewables.

Under these heavy-retirement scenarios, the gas pipeline and fuel oil delivery disruptions that PJM would have been able to handle during extended cold snaps could instead lead to localized instances of PJM needing to call on voltage reduction and other emergency load reduction, “or in some case, load loss or power outages,” Bryson said.

PJM’s report highlighted that these scenarios represented a highly unlikely confluence of events. Still, “key elements such as availability of non-firm gas service, oil deliverability, pipeline design, reserve level, method of dispatch and availability of demand response become increasingly important as the system comes under more stress,” it noted.

Ott said that PJM has begun working with stakeholders on suggestions for how to manage these highly unlikely, “yet plausible,” future outcomes. For example, a consensus may emerge to develop rules to value commitments from the roughly 16,000 megawatts of “non-firm” natural-gas capacity in PJM territory, he said. And because oil-fired generators and heating systems replenished by tanker trucks become critical during cold snaps that last more than a week, PJM is examining how to value that as a resilience “attribute,” he said.

PJM expects to bring these issues into its ongoing work to meet FERC’s resilience proceeding, which was launched as part of the same decision that rejected DOE’s coal and nuclear bailout plan. “I think that this study will inform the FERC resilience discussion,” Ott said.

PJM has come under criticism from clean energy and environmental groups for linking its resilience work to its proposal to change its capacity markets in ways that could increase payments to coal and nuclear plants at the expense of natural gas, renewable energy and demand-side resources.

Todd Foley, senior VP of policy for the American Council on Renewable Energy, noted in a Thursday statement that PJM’s fuel security study didn’t explicitly address “how renewable energy technologies provide a range of resiliency and reliability attributes to the grid, including flexibility, dispatchability, and other essential reliability services.”

Also on Thursday, S&P Global Market Intelligence reported on an as-yet-unreleased study by the North American Electric Reliability Corp. that modeled the grid resilience effects of extremely high coal and nuclear plant closures, and found they could lead to power outages. But NERC spokesperson Kimberly Mielcarek told S&P that the assessment should not be viewed as a prediction of future events. The "accelerated scenario is a stress test intended to identify risks to reliability and is not a predictive forecast," she said.

--

Join GTM at the upcoming Power & Renewables Summit! We'll cover how decarbonization, sector electrification and shifting regulatory developments will transform power markets over the next 10-to-20 years. We've confirmed senior executives with FERC, Exelon, ERCOT, PJM, APS, Microsoft, Dell, CPS Energy, NRG, CohnReznick, Los Angeles Department of Water & Power and many more. Learn more here.