The push for market space in the wide world of home energy management is squarely in the side of analytics. Onzo, a U.K.-based maker of energy dashboards and devices, has become the latest company to ditch its hardware to focus on analytics.

Scottish & Southern Energy announced on Wednesday that it purchased Onzo’s hardware and digital delivery division for an undisclosed amount. SSE is not a surprising buyer, since it already held the rights to distribute Onzo’s hardware in the U.K. and Ireland and held a significant investment in the startup.

Unlike in the U.S., where almost no one is talking about home energy dashboards anymore, Nick Hunn, CTO of Onzo, noted that the U.K. is mandating in-home displays when smart meters are deployed in the coming years.

But like the U.S., it’s unclear how much of the data collecting functionality of the meters will be turned on as soon as they are installed. The problem for utilities is that, if they are collecting interval data, then they have to secure it, store it, and ideally, do something with it. For many utilities, that is biting off more than they can chew. Other companies, like EnergyHub and Tendril, have also de-emphasized their hardware plays (but not totally ditched them) as they invest in analytics.

Either way, smart meters will be installed across the U.K. The government has required that all households have dual (electricity and gas) smart meters by 2020 -- a figure that will mean about 47 million devices will be put in place in the coming decade.

Large British utilities, like SSE and BritishGas, have been building partnerships and investing in home energy management companies for years as they prepared for the future (BritishGas has invested in AlertMe). American companies like Trilliant and Opower have also jumped across the pond for a piece of the action.

The most appealing part of the action is that the U.K. is a deregulated market where energy retailers compete for customers. Increasingly, having energy services and energy management options are becoming the norm. By shedding its hardware division, Onzo will be able to double its analytics staff.

“When Onzo was first founded, its goal was to become the leading provider of insight to the utility industry,” Joel Hagan, CEO of Onzo, said in a statement. “In the early years we struggled to obtain data, which is why we diversified to develop our own range of sensors and displays. With the progress in smart metering, which is starting to produce a real flow of user energy data, this is the ideal time to refocus on that original goal.”

Although smart meters are coming, the speed of markets between utilities installing smart meters and retailers expanding energy services is vastly different. “What we discovered was there was a lot of smoke and mirrors and not a lot of real data coming out of smart meters yet,” said Hunn.

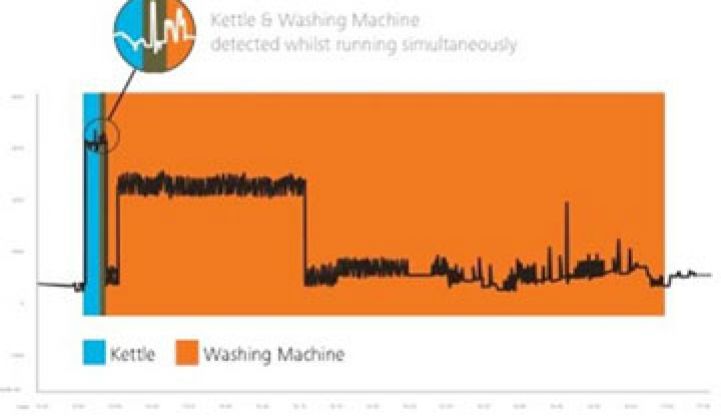

Onzo’s analytics can take a single stream of information off of meters (that don’t have to be smart) and get information about appliance use by disaggregating the different electronic signatures of various appliances. Onzo is not the only company picking up on the unique fingerprints of individual appliances: everyone from AlertMe to Intel is working on similar technologies. Hunn said that the data is fully encrypted and secured.

It needs to be secure, because by understanding the use of individual appliances, the technology can learn a lot about living patterns. That information can be used so that utilities can better target households that could shift usage to different time-of-use plans, rather than those that are on set schedules that aren’t as flexible.

Customers of Onzo are already delivering bills that break down energy use by different tasks, such as laundry, cooking and heating. “We haven’t found a single customer that doesn’t want more data,” Hunn said.

By becoming hardware-agnostic, Onzo is now not a competitor to other companies it might want to partner with, such as thermostat makers. Onzo is also imagining a world beyond the U.K. borders, and beyond energy all together.

Other deregulated European countries and Australia are attractive markets for advanced analytics that allow retailers to build novel applications and services to get -- and keep -- customers. Additionally, granular information about people’s daily lives could be of use completely outside of the energy sphere.

Hunn noted that families with elderly relatives in assisted living could opt to get alerts if regular patterns started to change, which could imply that the relative is not well, forgetting things or not taking medications. Again, security issues would be paramount, and any program would have to have customers opt in. But people might like data about their living patterns for a variety of reasons, said Hunn. “We see the derived data going way outside of the utility business.”