From the North Sea to New Jersey, offshore wind tenders have been successfully awarding gigawatts' worth of contracts to bankable, sizable and increasingly economical projects.

This year has been dominated by falling prices, with offshore wind joining its onshore cousin and solar PV in beating some conventional power prices.

Now it looks like 2020 could see a host of new markets opening for the technology.

Europe has set the pace so far with 18.5 gigawatts deployed at the turn of the year. But just two countries, the U.K. and Germany, were responsible for 85 percent of this.

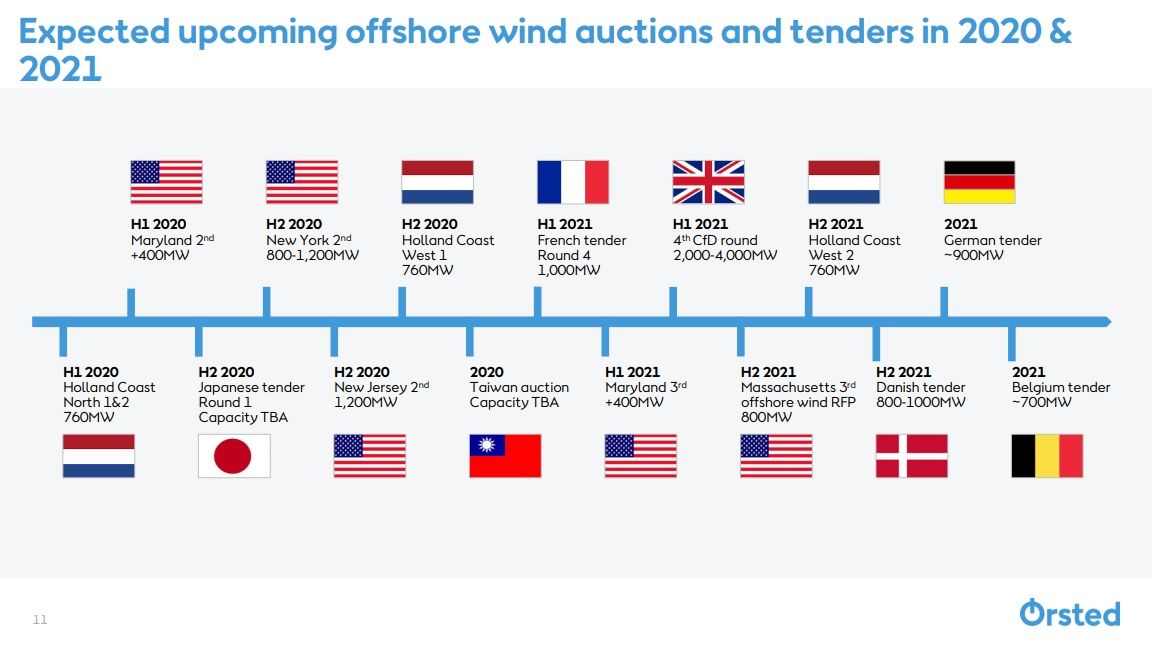

In its recent quarterly results, Danish energy company and offshore wind developer Ørsted provided a powerful visual demonstration of why this is likely to change.

In the next two years the Netherlands will tender 2,280 megawatts. Neighbors Germany and Belgium will add another 900 and 700 megawatts, respectively. France will also chip in with 1,000 megawatts. Denmark will make between 800 and 1,000 megawatts available, and the next round of the U.K. contracts for difference auction will make up to 4,000 megawatts available.

Beyond Europe Ørsted is also tracking tenders in Taiwan and Japan, as well as 4,000 megawatts in the U.S. across four states.

And these are just the competitive tenders already on the calendar; there is potential beyond this.

The renewables-focused utility RWE acquired four projects in Poland last month. The portfolio has a total capacity of 1,500 megawatts and construction could be underway as early as 2023. RWE plans to build, own and operate all four.

A few days before the RWE announcement, Ørsted revealed it was in talks with Polish utility PGE to purchase a 50 percent stake in two projects with a maximum capacity of 2.5 gigawatts. The completion dates on those are a little later, 2026 and 2030.

In its own quarterly results, Swedish energy firm Vattenfall said its domestic offshore wind market is making some progress. There had been debate around who should pay for the grid connection, the developer (as is done in the U.K.) or the network operator. CEO Magnus Hall said it had been agreed that the state would pay, but there is currently no legislation to support this.

Beyond Europe

Leaving the U.S. aside, there is huge potential outside Europe.

The World Bank announced in March that it would set up a program to support developing countries in building the necessary framework for bankable offshore wind projects. If it's half as successful as the Scaling Solar program run by its private-sector offshoot, the IFC, it could prove extremely useful. Scaling Solar created a library of standardized contracts for industry and government, speeding up the development process and offering investors familiar and comfortable conditions. It's now being used in six countries, and the IFC claims its Zambian rollout has yielded the lowest solar tariffs on the African continent.

A report issued by the bank last month, harnessing its global offshore wind atlas, demonstrated the scale of the opportunity for offshore wind in developing economies.

It estimates just over a terawatt (not a typo) of potential for fixed offshore wind turbines within 200 kilometers of the coast in just eight countries used for its case study. Brazil is the runaway leader with 480 gigawatts, while Vietnam has 261 gigawatts of potential and India 112 gigawatts. The remaining five, Morocco, the Philippines, South Africa, Sri Lanka and Turkey, have a combined potential of 164 gigawatts.

To harness this, the report recommends each country take a long-term position on port infrastructure, grid planning and supply-chain development, as well as the usual policy asks. If the technical and regulatory conditions are right, the reduced risk will improve the chances of attracting the necessary investment.

Several developed economies in Asia are also making progress. Last month Macquarie’s Green Investment Group closed financing on the 376-megawatt Formosa 2 project in Taiwan.

RWE has just announced the opening of its first office in Asia as it looks to tap into the Japanese offshore wind market.

Wood Mackenzie expects Japan to install 4 gigawatts of offshore wind by 2028.

Floating turbines

With the world’s largest floating project, Equinor’s 88-megawatt Hywind Tampen, having recently reached financial close, the technology is edging toward full-scale rollouts.

Tampen will be connected to two offshore oil and gas drilling operations rather than to shore, but is a great stepping stone development for a project large enough to cover the cost of a shoreline grid connection.

Wood Mackenzie has charted the potential for 1,000 megawatts or more by 2027 in Taiwan, mainland China, Japan, South Korea, the U.S. and the usual suspects in Europe.

The World Bank, operating beyond that 2027 time scale, has produced some even more eye-opening figures for the potential of floating offshore wind in its eight case studies.

Brazil is again the big winner with a potential of 748 gigawatts of floating offshore wind within 200 kilometers of the shore, but South Africa is not far behind with 589 gigawatts.

With the government in Pretoria looking to overhaul the state utility Eskom, including through competition and a buildout of renewables, South Africa could be a major offshore wind market that is currently getting very little attention.

The quality of execution will determine how much of this potential in Europe and beyond is translated into bankable projects. The lessons learned in established offshore wind markets and successful programs from other renewable technologies globally could catalyze that conversion rate.