Earlier this month, we covered Sunverge’s $36 million Series C round, with a big emphasis on how lead investor AGL Energy Limited planned to put the startup’s behind-the-meter battery storage systems and underlying software to use in Australia’s fast-growing solar-storage market.

This week, Sunverge revealed another of its new investors -- Japanese trading house Mitsui, which invested $10 million in the San Francisco, Calif.-based startup’s latest round. This investment comes with another market opportunity in Japan, where Mitsui is considering using Sunverge’s software to create a new "next-generation electricity power business.”

Terms of the agreement are still sparse at this point. But Sunverge CEO Ken Munson said in a Tuesday interview that the two are working on a half-dozen or so “material projects, all under NDA, with large entities,” though he declined to provide any specifics.

Those projects could involve residential behind-the-meter battery systems, which Sunverge has already installed in the United States. But it could also include commercial customers looking to aggregate multiple battery-inverter systems and their integrated communications and control systems into a “virtual power plant,” he said.

Japan is already one of the fastest-growing markets for rooftop solar and energy storage installations, he noted. But big changes coming to its energy markets could open even bigger opportunities for these kinds of services, he said.

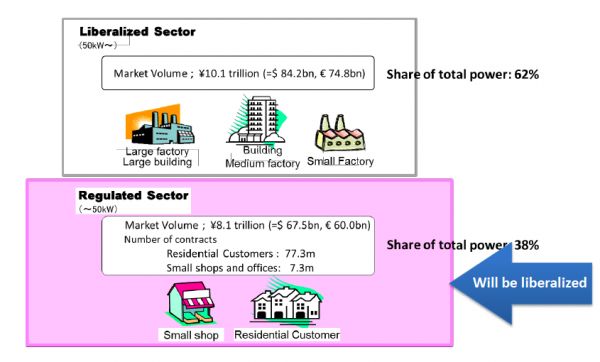

In moving from a landscape dominated by about 10 regional utilities to multiple competing energy retailers, Japan’s market reforms envisions what Munson described as “the formation of IPPs -- [independent] power producers [that] will be able to offer power and services in the marketplace.”

The first big step in this market reform, set for mid-2016, will open up retail competition for the country’s residential and small business utility customers, a first for the country, as a July 2015 presentation (PDF) from Japan’s Ministry of Economy, Trade and Industry (METI) lays out.

According to this October report from Bloomberg, this new retail energy opportunity has drawn more than 750 applicants, fewer than 100 of them already serving retail accounts in the large commercial and industrial customer classes now able to shop outside their regional utility for energy.

As this transition looms, Munson said, “everyone from Nissan to Toyota to Sumitomo to NEC, all of the big conglomerates, and the big trading houses…they’re coming together with very interesting partnerships.” In that context, “I think Mitsui sees the opportunity behind the meter, both residential and commercial, in taking advantage of this virtual power plant capability.”

Here’s how a Mitsui press release describes the company’s interest in Sunverge’s technology:

Mitsui, by effectively using Sunverge’s aggregation and orchestration software to overcome difficulties with the electricity grid, will contribute to further promotion of the use of renewable energy. Moreover, Mitsui aspires to realize a virtual power plant business model through integrated control over diverse DERs by utilizing the unique characteristics of Sunverge software, which allows connection between progressively diversified DERs, including energy storage systems, and solar power generation devices, as well as battery cars.

Mitsui has also invested in Stem, the California startup that’s putting batteries in commercial buildings for behind-the-meter demand charge management, as well as for utility capacity and grid management needs.

It’s just one of the many energy storage partnerships underway in Japan, including Itochu’s work with Green Charge Networks, or Sharp’s SmartStorage systems, or Panasonic’s work with inverter maker Tabuchi Electric, to name a few we’ve covered in the last several months. A recent report from ISH predicted that Japan could make up 20 percent of the global energy storage market in 2016, falling behind only the United States in terms of market growth.

Japan is also making a big push to integrate distributed energy resources for local grid resiliency -- a transformation given urgency by the country’s energy struggles in the wake of its 2011 earthquake, tsunami and Fukushima nuclear power plant disaster. Several large-scale “smart city” projects are combining distributed energy, energy storage, plug-in vehicles, smart appliances and home energy management systems, and corresponding grid communications and controls to manage them in microgrid or virtual power plant settings.

Munson cited Sunverge’s experience with projects in California, as well as its pilot project work with New York utility Consolidated Edison, as proving points for managing complex combinations of resources like these. He also highlighted that managing a fleet of these assets as grid resources is a more complicated matter than using batteries to limit demand charges at single locations, as most behind-the-meter battery systems do today.

“Aggregating resources and solving for capacity -- I refer to that as the ticket to the dance. That’s just table stakes,” he said. “Orchestration around a broad array of grid services, within the real-time constraints of the distribution grid, is our specialty.”