The global photovoltaic (PV) manufacturing sector continues to be besieged by problems of overcapacity and mounting financial losses. However, a new report from GTM Research indicates that equipment vendors, material suppliers, component manufacturers and startups are pushing the needle on advanced technology concepts like never before, in a bid to further increase efficiencies and lower the cost curve of crystalline silicon (c-Si) PV technology.

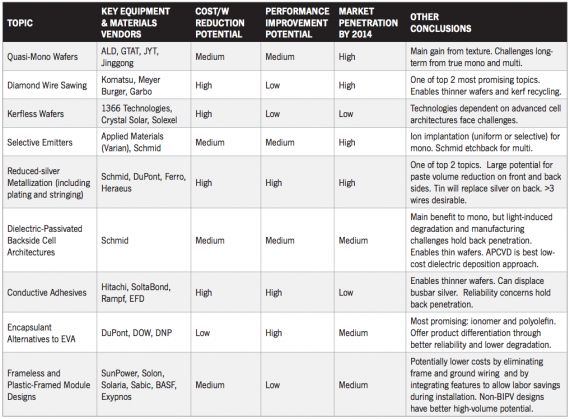

Titled Innovations in Crystalline Silicon PV 2013: Markets, Strategies and Leaders in Nine Technology Areas, this 262-page report closely examines the benefits, challenges, key vendors, and market penetration prospects of nine advanced technology platforms being commercialized in the 2012 to 2014 timeframe. The nine technologies covered in the report are:

- Quasi-mono wafers

- Diamond wire sawing

- Kerfless wafers

- Selective emitters

- Reduced-silver metallization

- Dielectric-passivated backside cell architectures

- Conductive adhesives

- Encapsulant alternatives to EVA

- Frameless and plastic-framed module designs

“Silicon PV is entering an era of unprecedented technological progress,” said Andrew Gabor, Consulting Analyst at GTM Research and author of the report. “While most c-Si cost reductions until now have stemmed from economies of scale and reductions in the cost of key consumables, the next few years will have to see technology innovation playing a dominant role in driving down costs. Platforms such as diamond wire sawing, selective emitters and reduced-silver metallization will enable higher cell and module efficiencies, more efficient material utilization and higher throughput processes that will keep the cost of silicon PV declining for years to come.”

FIGURE: Key Findings From Innovations in Crystalline Silicon PV 2013

Source: Innovations in Crystalline Silicon PV 2013

“The rate of technological innovation for c-Si is overwhelming and the potential impacts on PV module cost, performance and reliability are difficult to understand or predict," continued Gabor. “This report aims to help readers navigate these topics. We have made concrete recommendations based on both technology and cost/performance merits and do not shy away from controversial conclusions.”

GTM Research analyzes more than 150 vendors in this report and identifies the following companies and their technologies as potential market leaders:

- Applied Materials (NASDAQ:AMAT): Ion implantation diffusion for mono c-Si

- Dai Nippon Printing (Tokyo:7912): Polyolefin encapsulant

- DuPont (NYSE:DD): Ionomer encapsulant

- Hitachi Chemicals (Tokyo:4217): Conductive adhesives for cell interconnection

- Komatsu (OTC:KMTUY): Diamond wire sawing

- Meyer Burger (SIX:MBTN): Diamond wire sawing

-

Schmid Group: Mask/etchback selective emitter for multi c-Si and TinPad™ rear metallization