It's certainly not news anymore that we're entering the "next wave" of cleantech investment. The focus is now on who will ride that wave as it begins to build -- and who will be standing when it crests.

The Global Cleantech 100 report is a good way to judge where investors are thinking about deploying their money.

Each year, the Cleantech Group puts dozens of investors and energy experts together on a panel who then evaluate thousands of early-stage companies based on their level of innovation, their market potential and their ability to penetrate the market. In the end, the panel chooses 100 startups out of the list that they judge as having the most potential.

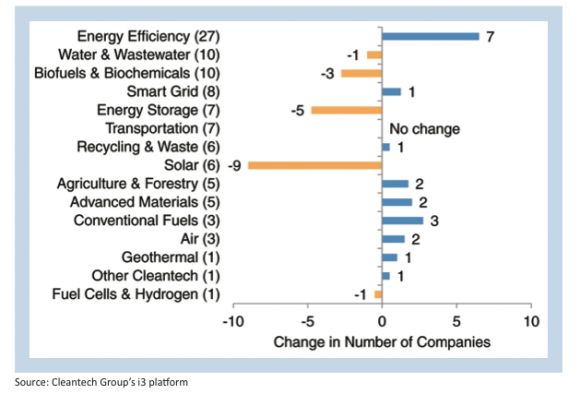

As it has in previous years, efficiency topped the rankings. This year, however, more than one-quarter of the companies on the list (shown at the bottom of this page) were in the efficiency technologies or services space -- an increase of seven companies since 2012.

"We've seen a huge push up in energy efficiency," said Cleantech Group CEO Sheeraz Haji in an interview. "Solar has by far been the sector hurt the most. That's really illustrative of the broader shift away from capital-intensive upstream solar and toward cleanweb, capital-efficient, software-type deals."

In 2009, there were twenty solar companies -- most upstream -- on the list. This year, there are only six, almost all in the downstream market. Here's a comparison to last year's report:

Not all the efficiency companies are strictly in software and data analytics. There are a few in LED manufacturing, one in waste-heat recovery and some in building materials. But few of them require the heaps of money needed for building out new manufacturing facilities to service an entirely new market.

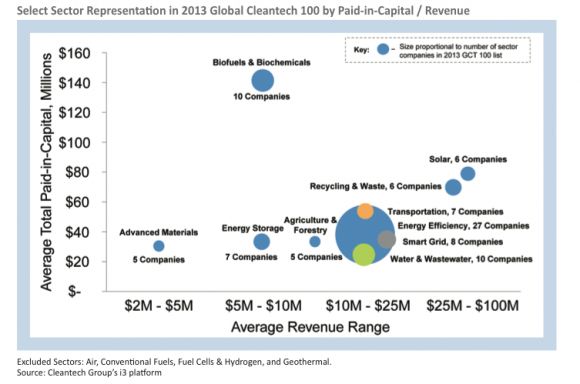

We can see below that investor sentiment is mostly focused on low-capital opportunities -- even if that means lower potential revenues. That puts efficiency squarely in the sweet spot, as shown in the next chart.

Investors speaking at the Global Cleantech 100 Summit shared this sentiment.

"When you look at the turnover, it's a big shift in the sectoral interest of investors. That really speaks to the vagaries of what's in favor right now," said Rob Day, a partner with Black Coral Capital who frequently writes for GTM about investment trends.

"Vagaries" connotes an arbitrary or inexplicable change in strategy, rather than something planned. The venture capital community is indeed known for having a herd-like mentality, but Day himself has helped Black Coral invest in companies like Noesis Energy and Digital Lumens, two intelligent efficiency companies that are arguably "capital-light."

Speaking to the crowd of investors, Day explained why his firm made a decision to invest in the intelligent LED company Digital Lumens.

"No one wanted to just pay for lighting controls. So they made better LED fixtures with controllability. They took a solutions-based approach and contracted the manufacturing, and they've been able to get good growth with a lot less capital for hardware innovations. There are a lot of companies with stories like that."

The other shift is toward a customer-focused strategy that creates a more compelling case for a product. For example, saving money on energy costs through efficiency measures is an easy proposition on its face. But there are a lot of reasons customers don't buy products or services -- they're worried about risk, they don't like the way a product looks or feels, or they just aren't hearing the right messages that get them to act.

"We're beginning to see a whole new class of company that attracts customers in a different way," said Stephan Dolezalek, managing director of VantagePoint Capital Partners. "Look at Nest -- that's a company that intensely understands what a consumer wants. Companies on the list understand these things in a different way than we did ten years ago."

The exact same trend is playing out in solar. Four out of the six companies that made this year's Global 100 list are providing solutions for downstream deployment: Clean Power Finance, Solar Mosaic, Sungevity and Sunrun.

But there's still skepticism about whether innovation in services will be enough to transform massive quantities of energy infrastructure.

"Many investors are saying that heavy infrastructure was yesterday's model, so they go and do the 'capital-light' stuff. I'm not sure many of the CEOs in this room think that was the right thing to do," said Dolezalek.

There were a lot of nodding heads in the room.

Sheeraz Haji of the Cleantech Group agreed with that sentiment in an interview about the report's rankings.

"I think there's a real risk that we may be overdoing it. The world of cleantech still fundamentally revolves around hard things. I think we have to be careful not to overcorrect," said Haji.

The good thing about this year's list is that the efficiency companies identified are actually making stuff, deploying hardware and delivering services -- not just developing fancy dashboards.

Here's the full list of efficiency companies in the Global Cleantech 100 list:

-- 4Energy: Developer of cooling devices for thermally sensitive equipment such as radios, routers, batteries, and data centers

-- Alphabet Energy: Developer of low-cost thermoelectric technology for waste heat recovery

-- Anesco: Provider of energy-efficiency and carbon-reduction solutions for homeowners, local authorities, and businesses

-- Azzuro Semiconductors: Developer of technology for low-cost, high-brightness LEDs, high-power electronics applications and GaN semiconductors

-- Cooltech Applications: Developer of a magnetocaloric technology, including solutions for refrigerators, conditioners, and food processing equipment for industrial application.

-- Digital Lumens: Developer of intelligent LED-based lighting systems for industrial facilities that provide fully integrated controls and reporting capabilities

-- Enlighted: Provider of lighting control systems for energy management applications

-- glo: Developer of nanowire light-emitting diodes (nLED)

-- Gridium: Provider of energy-efficiency services that uses a company’s online utility bill to identify energy savings and maintenance needs

-- Heliex Power: Developer of a novel rotary screw expander which recovers low-grade energy from steam and uses it to generate electricity

-- Lucibel: Designer and manufacturer of low-maintenance, recyclable LED luminary products and systems suitable for homeowners, retailers, and the building sector

-- Nest: Designer of a networked “learning” thermostat for home use

-- Nexant: Provider of intelligent grid software, including electric power grid and alternative energy technologies and services

-- Next Step Living: Provider of home energy diagnostics and energy efficiency services

-- NovaLED: Developer of high-efficiency organic light-emitting diodes and organic solar cells for architectural design, medical applications, home lighting and electronic devices

-- Nualight: Producer of LED lighting for food displays and chilled cabinets in food retail

-- Nujira: Provider of high-efficiency radio frequency and power amplifiers for the wireless communications industry

-- Opower: Developer of a software-as-a-service platform that utilizes customer engagement and billing analytics for utilities

-- OSIsoft: Provider of real-time data infrastructure solutions for management of resource consumption and process performance

-- Phoebus Energy: Developer of hybrid water heating systems that use solar thermal energy and electricity to maximize efficiency for large facilities

-- Phononic Devices: Developer of advanced thermoelectric devices that efficiently manage and monetize heat

-- Project Frog: Designer and manufacturer of resource-efficient and zero-net-energy modular buildings

-- Sefaira: Provider of web-based energy-efficiency software to help the building industry

-- SorTech: Manufacturer of energy-saving, environment-friendly adsorption refrigeration units that cover small and medium-level cooling demands

-- Tendril: Provider of a home energy management SaaS platform that facilitates interaction within the energy ecosystem and provides utility solutions

-- Transphorm: Developer of technology to eliminate the electric conversion losses when converting power from one form to another, AC/DC, AC/AC, DC/AC and DC/DC

-- va-Q-tec: Provider of customized vacuum insulation panels (VIPs) and heating & cooling storage elements containing phase-change materials (PCMs)