A new survey report from GTM Squared shines light on utility investment trends and sales cycles for solar, energy storage, and grid edge products. For vendors sitting across the table from utility buyers, the Mastering the Utility Sales Cycle report presents answers to questions about technology strategies, regulatory hurdles and competitive positioning.

The report reflects the perspective of more than 300 industry professionals, with roughly one-third from utilities, and two-thirds from vendors, consultants, regulators and researchers.

Below is a preview of the survey and some key takeaways. The complete report is now available to GTM Squared members here.

Preparing for the challenges of power market evolution

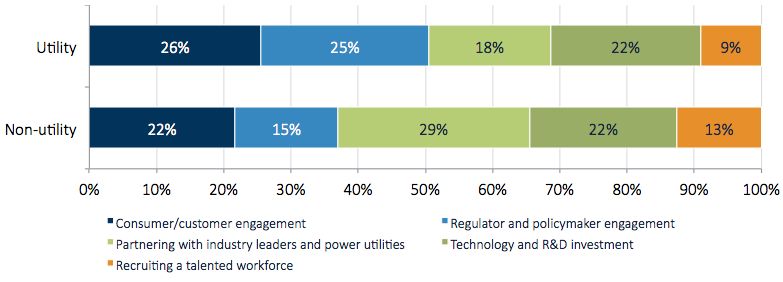

Respondents from all demographics are making investments now to prepare for the future.

Concerns about recruiting a talented workforce have declined from the 2016 GTM Squared survey report; presumably companies are getting better candidates. Utilities are showing greater interest in consumer attitudes, while non-utility people are gearing up for greater involvement in regulatory proceedings. With DER proceedings underway in most states, it is little wonder.

Q: What is your organization investing in as it prepares for changes at the grid edge?

Source: Mastering the Utility Sales Cycle

All parties see room for improvement. Management and non-utility players report a spike in concern about regulatory issues -- and the need to get on top of them. Ongoing struggles about net metering have rung alarm bells across the solar industry, and serve as a reminder to other technology sectors whose business models depend on favorable public policies.

The results reflect an industry in transition as it navigates the choppy waters of market reform.

Understanding the utility sales cycle for grid edge technologies

The survey confirms that energy policymakers and regulators are major factors in driving grid edge investment by utilities. States, especially, are encouraging demand response, net metering, and EV infrastructure, while distribution system planning policies are beginning to take shape in leading markets.

But policy is only successful if accompanied by falling technology prices and rising customer demand. It turns out that one of the biggest customers for DERs are the utilities themselves. Respondents ranked utility-facing technologies for operations and analytics as among the biggest opportunities over the next five years.

Interestingly, utilities ranked energy storage as the No. 1 investment in coming years, while non-utility people pointed to grid operations software and hardware. Advanced metering was another priority, as many utilities have yet to build out AMI.

Q: Rank the grid edge products that utilities will invest most in over the next 5 years

Source: Mastering the Utility Sales Cycle

Inside the minds of grid edge counterparties

Imagining the two dealmakers sitting across from the table from each other, we asked some questions to try to get in their minds. What do utilities want, and what should vendors offer them?

No other factor, not even price, ranked as high as seamless integration. Making the sale requires that new technologies dovetail with legacy systems.

Price, however, was much more important to utility buyers than to others. Non-utility people think having a trusted brand and innovative features are more important than do utility people. Given the novelty of many technologies, utilities may be looking at bottom-line cost and performance issues, and are less concerned about the history and reputation of vendors and their intriguing bells and whistles.

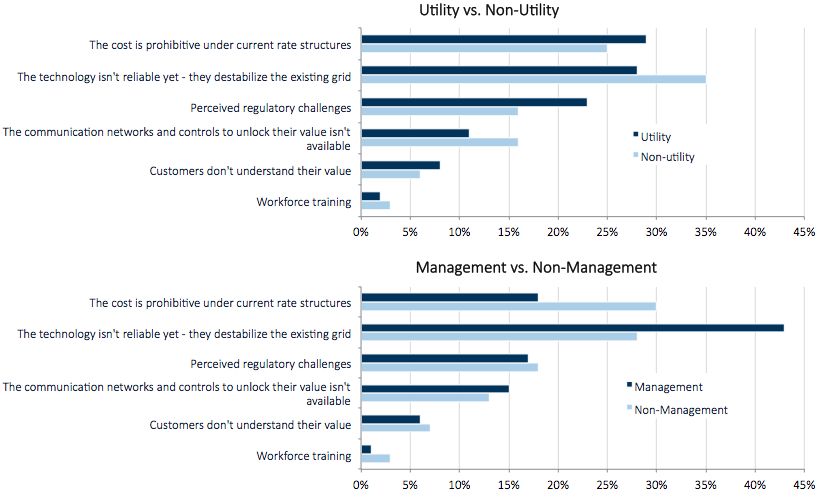

Q: What keeps utilities up at night when procuring physical DERs and grid edge assets?

Source: Mastering the Utility Sales Cycle

Whether the technologies are ready for action keeps all parties awake at night, none more than management positions (C-level, presidents and vice presidents). Utility and non-management people were equally concerned about high costs, and utilities have a bonus fear of regulatory disapproval for grid edge investments.

The vendors that fail to get traction with utilities are seen as not understanding utility operations -- especially by non-utility people. Utilities also cite sub-standard products (not “utility grade”) as a cause of failure.

Conclusion

The survey’s results show that vendors and utilities are still seeking to understand each other across the deal table. The uncertainty found in last year’s GTM Squared survey has continued, perhaps even increased.

Utilities can have different concerns and priorities than vendors might think. They clearly put performance and cost first, especially in integrating new technologies into legacy systems. With so much sunk capital and so much riding on grid reliability, performance is not negotiable.

But regulatory concerns rank high for utilities, perhaps more so than non-utility people appreciate.

And little wonder, given the heavy influence of regulations in driving grid edge deployment. We are still some ways off from a “free market” in distributed energy technologies. The Trump administration has stoked rising concerns about the future of clean technologies, rolling back the Clean Power Plan and withdrawing from the Paris climate accord. Whether their reforms will reach down into distributed energy, typically the purview of state and regional policymakers, remains to be seen.

Meanwhile, state regulatory changes continue to be volatile. Nevada recently pulled the plug on distributed solar, only to plug back in as the legislature overruled the state commission on net metering. The New York REV proceeding, after years of effort, is still grinding toward implementation, despite losing REV champion Audrey Zibelman to Australia. Battery sales are booming, but residential solar in California, the largest state market, has slipped. Hanging over the solar industry is the threat of a trade war that could drive up hardware costs and scuttle some projects.

It’s clear from the survey and from developments in the industry that mastering the sales cycle means more than offering affordable plug-and-play solutions.

Click here to become a GTM Squared member and download Mastering the Utility Sales Cycle today!