Earlier this month, the Florida Supreme Court issued a ruling that will allow property-assessed clean energy financing programs to expand across the state.

PACE programs make it possible for investments in water- and energy-efficiency retrofits and distributed renewable generation to be paid back through property taxes, which lowers the risk for both lenders and owners and can potentially open up a far larger swath of the energy-efficiency market.

PACE financing has come under fire from federal housing regulators worried about how programs would impact mortgages. That was the situation in Florida, where the Florida Bankers Association contested the validation of bonds that back PACE loans. The bankers didn’t want PACE loans to be paid back before mortgages if there were outstanding property obligations.

The Florida Supreme Court ruled that the group did not have the standing to fight the program (it did not offer a judgment on the issue). The legal hurdle had been holding up the expansion of PACE in Broward County and some other regions of the state.

Even so, PACE had moved ahead in other Florida counties, such as Miami-Dade. Florida’s PACE Funding Agency has the ability to issue up to $2 billion in bonds as needed. More than a dozen counties have signed on to offer PACE loans. The state Supreme Court decision was the outcome of an appeal in Leon County, where the district was looking to issue $200 million in bonds for PACE.

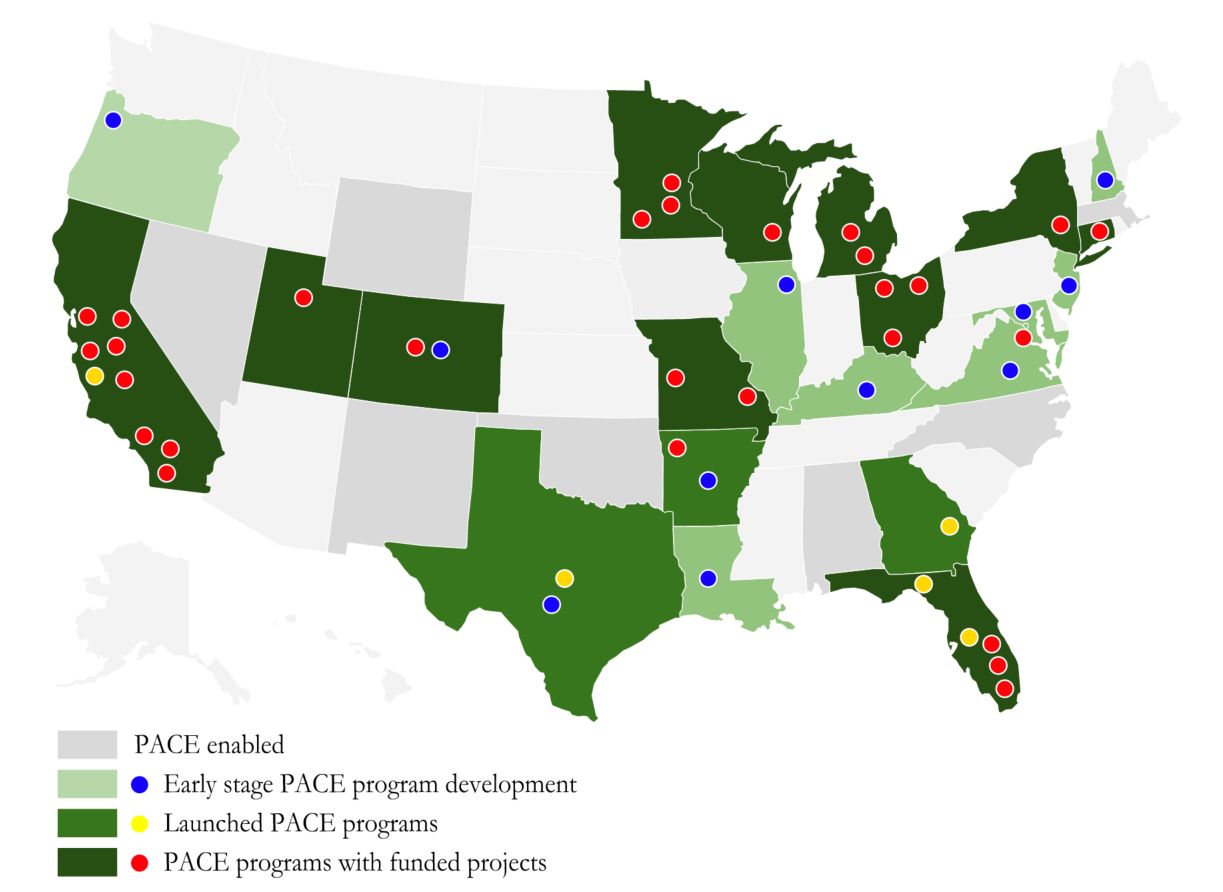

Florida could become the second-largest residential market behind California, where the bulk of residential PACE loans are originated. Earlier this year, the White House established new PACE guidelines through the Federal Housing Administration that should also help other states scale up residential PACE. With increasing guidance from the federal level, the Florida banker’s legal challenge to PACE could be an isolated incident.

Although additional guidance on residential PACE has been issued recently, commercial PACE remains the first move for most states. The upper Midwest, especially Michigan and Missouri, are scaling up commercial PACE financing across the state, according to Kristina Klimovich, communications director at PACENow.

More than 15 counties in Michigan are taking part in PACE, with state agencies such as the Public Service Commission also taking advantage of the financing mechanism. Missouri counts dozens of counties and cities that are leveraging commercial PACE.

In the Northeast, the Rhode Island Infrastructure Bank recently issued an RFP for a PACE administrator after legislation was signed into law in June. Alabama and Kentucky also approved PACE financing earlier this year. Pennsylvania and South Carolina have pending PACE bills in the state legislatures, while Virginia amended a PACE bill to better enable commercial deals.

Credit: PACENow

Despite the action across the U.S., California has a significant lead in PACE financing. Last week, ReNewAll, a California financing company, announced $300 million for clean-energy projects for members of the National Electrical Contractors Association, including those financed through PACE, as well as leases and power-purchase agreements.

There has been about $150 million worth of PACE projects completed since 2009, nearly half of which have been energy-efficiency projects. But that is a fraction of the more than $1 billion in residential PACE financing that is being deployed, primarily in California.