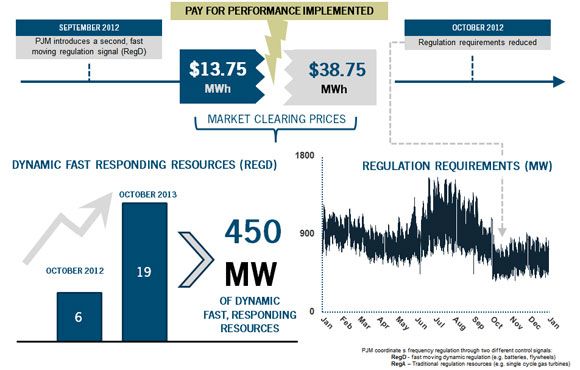

Fast-moving resources for frequency regulation tripled in the past year in PJM Interconnection territory. The clearing price for the resources nearly tripled as well, according to a new report from PJM.

The changes are due to FERC Order 755, enacted in 2011, a ruling from the Federal Energy Regulatory Commission that increased the pay for “fast” responding frequency regulation sources, such as batteries, flywheels and demand response. The resources can respond faster to grid signals than traditional centralized generators, but cannot last as long.

Frequency regulation has always been needed on the grid to provide balancing, but in areas with high penetration of intermittent renewables, faster grid balancing resources are particularly needed.

Because the faster resources, known as RegD in PJM terminology, could follow the signal more quickly and more accurately, PJM has been able to lower its regulation requirements.

PJM made four changes to the regulation market:

- Two-part offer. The market was adjusted to allow for a two-part offer, one for capability of how many megawatts it can offer and for performance of those megawatts.

- Effective Megawatts. Resources are evaluated against traditional assets, known as RegA based on a concept of effective megawatts. “Effective MW are essentially the offered regulation capability scaled by the historic performance of the resource and any incremental benefits the resource would provide if it was a fast resource as opposed to a slow one,” the report explains.

- Intra-Hour Lost Opportunity Cost. PJM started incorporating the lost opportunity cost in five-minute intervals, whereas previous market clearing price was calculated on an hourly basis. The hour-ahead prices were often not in line with the actual lost opportunity cost, so the new five-minute intervals allow for more accurate compensation.

- Actual Mileage. The fast-moving signal travels more miles than the traditional signal. The mileage ratio is the hourly miles of regulation signal the resource is following divided by the hourly miles of a traditional signal. “On average, for every 5.7 MW we request a slow regulation resource to move, we request a fast-regulating resource to move 16.2 MW for a ratio of roughly 3:1 when comparing the RegD signal to the RegA signal,” wrote PJM. The more miles traveled, the greater the compensation.

Other FERC orders, primarily Order 745, have also increased payments for alternative resources in PJM. Earlier this year, PJM reported economic demand response payments increased because of the ruling. PJM will not be the only independent system operator to be impacted by the two rulings; it is just the first to make the market changes.

***

Network with leaders from GE, SDG&E, IBM, AT&T, Intel, PG&E, and more. Learn more about our new Grid Edge Executive Council.