European officials have decided to impose provisional anti-dumping tariffs on solar modules, wafers and cells imported into Europe from China.

A European Commission (EC) investigation into Chinese solar manufacturers’ practices drew four conclusions:

- Chinese solar panels are sold “far below their normal market value…[and] the fair value of a Chinese solar panel sold to Europe should actually be 88 percent higher" than the price at which it is sold. "In some cases, dumping margins of up to 112.6 percent were found.”

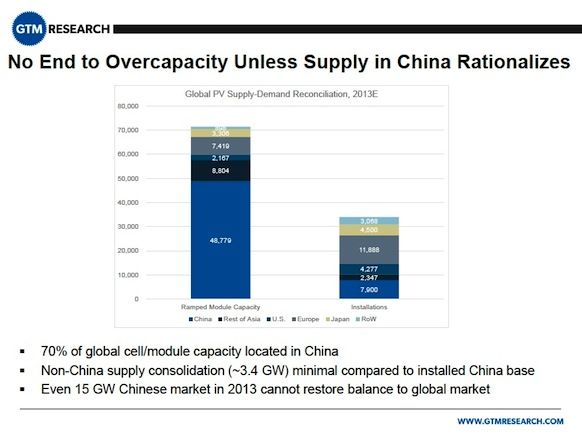

- Chinese exporters’ production capacity was 150 percent of global consumption in 2012 and its excess capacity was twice the European Union (EU) demand. The resulting “unfair competition” allowed Chinese companies to capture “more than 80 percent” of the EU solar market, causing “material injury” in Europe.

- There is “a causal link” between the Chinese dumping and EU harms that caused 40 EU solar producer insolvencies, six EU producers to partially halt production, two EU producers to leave the solar business, and the absorption of four EU producers by Chinese companies.

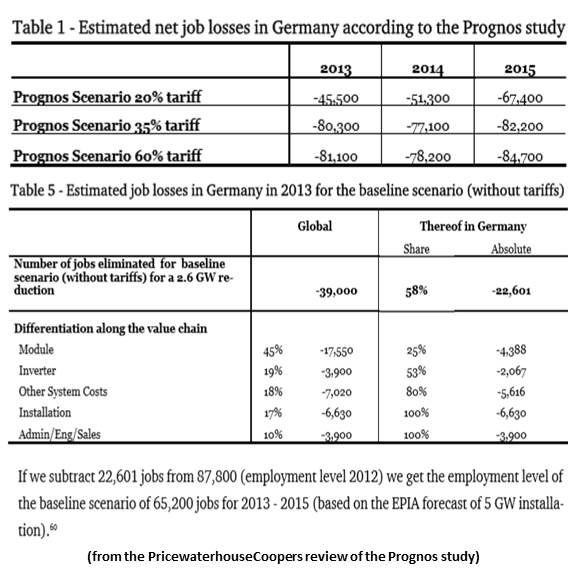

- The methodology of German research consultancy Prognos was flawed, according to a PricewaterhouseCoopers study, and tariffs will therefore not compromise Europe’s economy, but will instead secure 25,000 EU solar jobs and will create new jobs.

The EC will place an 11.8 percent charge on Chinese solar products imported into the 27 EU member states from June 6 to August 6, 2013. After August 6, the average import duty will be 47.6 percent on 100-plus Chinese manufacturers found by the investigation to have been involved in dumping solar products in the EU.

Suntech Power Holdings (STP) and subsidiaries will be charged tariffs of 48.6 percent, LDK Solar (LDK) will pay 55.9 percent, Trina Solar (TSL) will pay 51.5 percent, and JinkoSolar (JKS) will pay tariffs of 58.7 percent, according to the Wall Street Journal. Companies that did not cooperate with the investigation will pay a tariff of 67.9 percent.

The EC investigation will culminate, in December, in a final decision about tariffs and duties. If the charges are made permanent, it is likely to produce a backlash by China in the form of duties on raw polysilicon sent to China by U.S. and EU producers.

Such a trade war has loomed over the solar industry since a coalition of Western solar manufacturers led by Germany’s SolarWorld (OTCMKTS:SRWRY) convinced the Department of Commerce to impose tariffs on Chinese solar modules imported into the U.S. in November 2012.

Like the Solar Energy Industries Association during the U.S. tariff fight, the European Photovoltaic Industry Association (EPIA) is remaining neutral and pushing for negotiations. A rapidly changing marketplace burdened by overcapacity has produced a price crash, negative margins, and “severe financial difficulties,” EPIA noted. For the sake of the global solar industry, the group has called on the involved governments and industry players to negotiate, avoid a trade war “and collaborate on a global scale.”

The EC action is seen by many observers as a bargaining chip. “Given the opposition within the EU member countries to impose stiff tariffs, we expect a negotiated settlement,” financial consultancy Lazard Capital noted.

“In general, the southern countries within the EU tend to vote in favor of trade protectionism, while the U.K. and Nordic countries tend to vote against,” Forbes recently reported.

If negotiations produce a reduced tariff, Lazard predicted, it could keep Chinese solar company stock prices from falling and boost EU demand above what trade war fears suggest. Global PV demand in 2013 should stay above 35 gigawatts, it concluded, and U.S. companies are unlikely to be affected.

“While we see this as a near-term positive for Chinese names,” Lazard added, and “we remain cautious on sustained profitability with few exceptions.”

The EC’s statement on the decision seemed to confirm suspicions that its action was to leverage further negotiations. “The European Commission,” it read, “remains ready to intensify talks with China to find alternative satisfactory solutions through a negotiation. On December 5 at the latest, the EU will have to decide if definitive anti-dumping duties will be imposed for a duration of five years.” But, it added, “The Commission is open to discuss alternative forms of measures.”

European solar manufacturers also brought an anti-subsidy complaint at the World Trade Organization against the Chinese government, claiming its domestic supports violate international commerce rules. A decision on that is expected in August.

The “tight linkage” between global PV players, a recent MIT study on the looming trade war concluded in the same vein, “raises the question of whether there are practical mechanisms of public support that could advance the global PV enterprise better than the separate efforts of each country.”