Electricity generation from coal-fired power plants in China dropped by an estimated 4 percent in 2015, according to new government data reported by the Institute for Energy Economics and Financial Analysis.

More significantly, year-over-year thermal power capacity utilization fell from about 54 percent in 2014 to 49.4 percent in 2015, the first time thermal power capacity was not the majority of electricity generation.

The new data comes after questions last year as to whether coal consumption was falling as fast as some thought in China, given conflicting data.

One of the major reasons for the slump in coal consumption was the sluggish Chinese economy, which had its slowest growth rate in overall electricity demand since 1998. The Chinese government also reported this week the slowest economic growth rate in 25 years, a trend that is expected to continue.

Cuts to coal imports in China were even more severe than the consumption rate, according to IEEFA, down more than 30 percent from 2014.

“This telling import data confirms the last flicker of hope has been snuffed out, not least for Australia’s Galilee Basin,” Tim Buckley, director of energy finance studies for Australasia at IEEFA, wrote in his analysis. “It also carries massive negative implications for Indonesia’s coal export market, given the concurrent collapse in Indian demand,” he said.

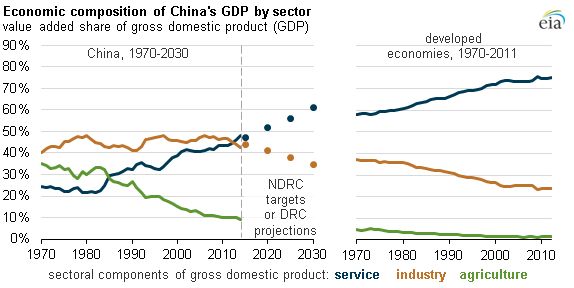

Besides the slow economy, another key to China’s energy mix is the contraction of its heavy industry, which burns nearly one-quarter of all coal used in the country. IEEFA reported electricity use by heavy industry fell nearly 2 percent during 2015, while the service sector's electricity consumption grew by more than 7 percent. In 2013, the service sector in China overtook the industrial sector for the first time, according to the U.S. Energy Information Administration.

China is moving away from using its thermal generation capacity, but that doesn’t mean the country isn’t adding more. IEEFA reported 64 gigawatts of new thermal power capacity that is essentially idle, “an addition that makes no sense,” Buckley said.

While there are still investments in thermal generation in China, renewables and nuclear are making up an increasing portion of power investment.

Clean-energy investment in China was $110 billion in 2015, about equal to the investment of the U.S. and Europe combined last year, according to the latest figures from Bloomberg New Energy Finance.

IEEFA forecasts a record 18 gigawatts of solar in China in 2016, along with 24 gigawatts of wind and 16 gigawatts of new hydro. At the same time, China’s National Energy Agency announced it will not approve any new coal mines for three years and will close approximately 1,000 small mines.

Although data from China’s National Energy Agency will continue to be scrutinized, “the implications of these changes are huge,” Buckley said of the country’s slow push away from coal, adding that China’s total emissions could peak a decade earlier than the country's official target of 2030.