Here’s our latest tally of investments in clean technology startups, ranging from new battery technologies for power tools and solar-roofed homes, to providers of software for the smart building space.

Building Robotics has taken a different tack than most of its contenders in building energy optimization. Instead of installing sensors and networks to give facility managers more control over their space, it’s using the people who work in buildings as its sensors, and their smartphones as its network nodes.

On Wednesday, the Oakland, Calif.-based startup announced a $12 million investment round led by Emergence Capital, and featuring two new investors, CBRE and Microsoft, with potential strategic applications for its software. Previous investors Claremont Creek Ventures and The Westly Group also joined the round, which brings its total funding to just under $20 million.

Building Robotics has renamed itself after Comfy, its core software product, which is now installed in about 3.5 million square feet of office buildings with customers including Johnson Controls and Infosys. It allows building occupants to log into its app to request changes to their indoor environment, primarily turning the temperature up or down, and uses the aggregate of the data it collects to directly control building automation systems through a server installed at each site.

The primary goal is to increase people’s comfort and productivity at work, Jake Saper, senior associate at Emergence Capital, noted in an interview -- a premise backed up by number of studies that tie building temperature and lighting to employee satisfaction. But it’s also a source of data on which parts of the building are being heated or cooled too much, or during parts of the day when they’re not being used, which has allowed Comfy users to achieve an average 20 percent reduction in energy costs related to HVAC and lighting, he said -- all without installing any sensors.

In other building energy management news, Blue Pillar has raised $3 million from investors, according to a recent filing with the U.S. Securities and Exchange Commission. The Indianapolis-based startup raised about $14 million in 2015, and had previously raised about $10 million from investors including Claremont Creek Ventures, Arsenal Venture Partners, Allos Ventures and OnPoint Technologies, the U.S. Army's venture capital fund.

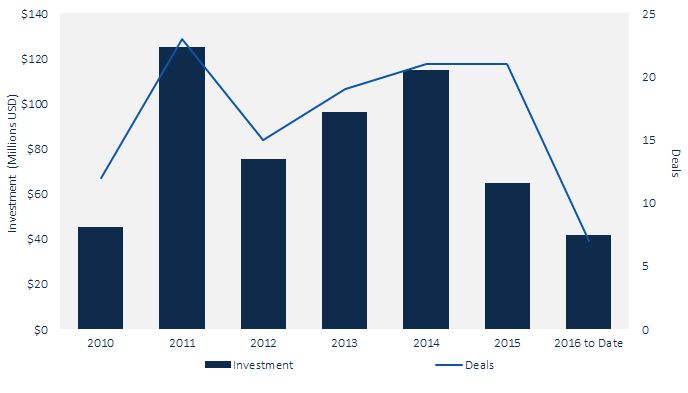

Here’s a chart from GTM Research tracking the year-by-year investment and deal count in the building energy management space:

Moving to energy storage, German startup Sonnen announced Monday that GE Ventures has taken a “mid-double-digit million-euro” stake in the company, which provides behind-the-meter batteries for solar PV-equipped homes. Previous investors in Sonnen include Germany’s E-Capital and Czech firm Inven Capital.

Sonnen announced in February that it had shipped its 10,000th battery system, putting it in a leading position in its home market. Germany’s solar incentive structure has made self-storage of rooftop solar energy an increasingly economically attractive proposition. It’s also targeting U.S. markets including Hawaii and California, where Tesla and sister company SolarCity lead the still tiny, but potentially rapid-growing, market for behind-the-meter residential energy storage systems.

Sonnen has also built a platform, dubbed SonnenCommunity, to aggregate its customers’ batteries for use as a flexible energy resource, whether to allow customers to share energy and reduce their dependence on grid power, or to bid into grid-balancing markets. This is a common promise from providers of behind-the-meter batteries, and it could fit into GE’s broader energy management strategy. Last month, global energy services company Engie bought a controlling stake in Green Charge Networks, another behind-the-meter startup, indicating the appetite from corporate investors in this space.

Almost all the behind-the-meter batteries being deployed today are based on lithium-ion technologies, a field that’s undergoing constant cost and performance improvements, as well as its fair share of would-be “game-changing” technology breakthroughs.

Prieto Battery, a startup developing a three-dimensional lithium-ion structure to increase energy density and cycle life, announced last month that it has raised an undisclosed investment from Stanley Ventures, the new venture arm of tool-making giant Stanley Black & Decker. The Fort Collins, Colo.-based startup has previously raised money from investors including Intel.

Power tools are an important market for new battery technologies, and the goal of this new strategic investment is to “bring their innovative technology to market through our world-class brands and industry-leading products,” Larry Harper, vice president of Stanley Ventures, said in a statement. Last year, another lithium-ion startup, Sakti3, was acquired for $90 million by Dyson, the maker of high-end vacuum cleaners and other appliances.

Mobile devices are another obvious market for advanced batteries. Qnovo, which makes software to improve the performance of batteries for smartphones and other mobile devices, announced this week that it has landed an undisclosed amount from Constellation Energy Ventures, the venture arm of utility Exelon. Last year, the Newark, Calif.-based firm raised $8.6 million.