Rising electricity demand, growing energy security concerns, the impact of climate change, and the improving competitiveness of clean technologies have combined to see clean energy make a remarkable return to favor with public market investors in 2013, according to a new report by HSBC.

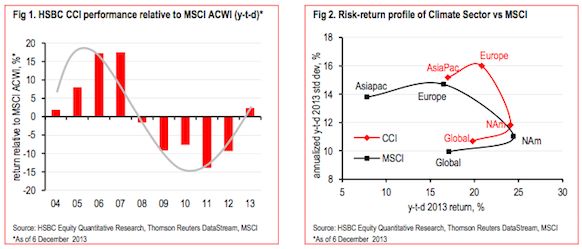

In its latest Quarterly Index Review, HSBC says its Global Climate Change Benchmark Index (CCI) has delivered a 19.8 percent return year to date, outperforming the MSCI All Countries World Index (ACWI) by 2.7 percent and marking the first year since 2007 in which the climate sector has outperformed global equities.

The report notes that 2013 has also seen a resurgence in public market deals in the sector and investment flows, in particular, secondary-offering and IPOs -- a trend HSBC connects with growing confidence in the climate sector.

“On a risk-reward basis, the Climate Change theme has outperformed global equities across all regions except North America in the year to date,” says the report. “The excess returns in Asia Pacific, Europe and globally have more than compensated investors for the additional risks they have endured.”

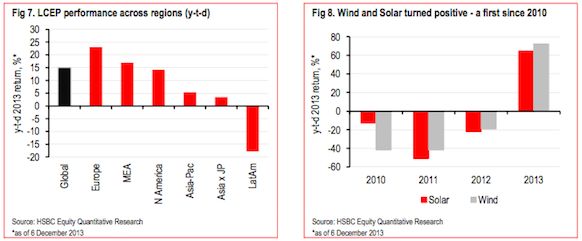

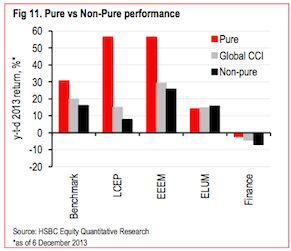

The report’s authors, HSBC analysts Joachim de Lima and Vijay Sumon, noted that Energy Efficiency & Energy Management (EEEM) shone through as the strongest-performing sector for the year to date, posting a 29.3 percent return. This was followed by Low Carbon Energy Production (LCEP) and Environment and Land Use Management (ELUM), which returned 15 percent and 14.8 percent, respectively. The only sector to have posted a negative return is Climate Finance, down 4.3 percent.

In the LCEP, wind and solar are highlighted as two of the strongest-performing themes, up 72 percent and 65 percent, respectively (see graph below). 2013 is also the first year since 2010 that both wind and solar have registered positive returns.

Interestingly, the report also notes that “pure-play” companies (those with more than 50 percent of their revenues from climate-relevant activities) have been the strongest performers in the HSBC Global CCI, up 30.7 percent for the year to date, compared with 16.1 percent returned by non-pure-play companies (see Fig. 11 below).

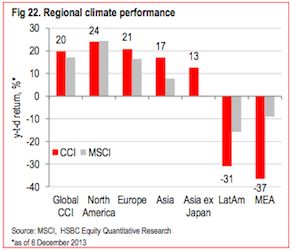

Around the world, Europe was noted as among the strongest performing regions in 2013, with its CCI rising by 21 percent. The report notes that this is “despite the fact that most countries are in the throes of revising their energy strategies, with many having already cut support and in some cases subsidies having been eliminated altogether.”

After underperforming in the first half of the year, Europe bounced back strongly in the second half and now ranks second only to North America, which has returned 24 percent, says the report. Europe has also outperformed the HSBC Global Climate Change Index by 1 percent, the MSCI ACWI by 3.7 percent and MSCI Europe by 4.3 percent for the year to date (see Fig. 22 below).

***

Editor's note: This article is reposted from RenewEconomy. Author credit goes to Sophie Vorrath.