What's the easiest way to avoid purchasing costly catastrophe insurance for your renewable energy project? Answer: Don't site your project in an area with a high probability of natural disasters.

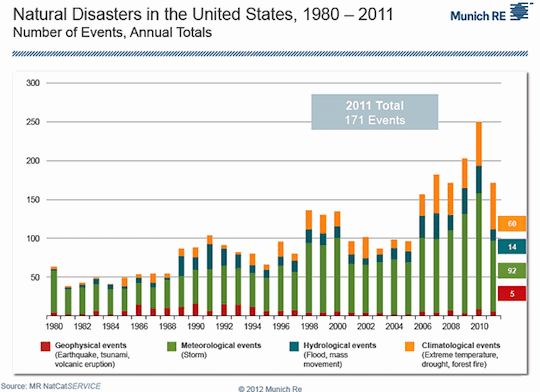

But this is easier said than done. Given the worrisome increase in the frequency of these disasters (see Figure 1), combined with a growing demand for renewable energy in places where various natural disasters are frequent, avoiding these high costs is becoming more difficult.

James Green from JLT Group claimed in a 2011 report titled "Managing Risk in Renewable Energy" that in order to combat these high costs, more developers are looking at alternative risk transfer products like catastrophe bonds to cover losses from large catastrophic events such as hurricanes [1]. Having never heard of these financial instruments before, I set out to find how catastrophe bonds work and determine their potential role in managing risk for the renewable energy industry. To help me understand the mechanics of these bonds, I contacted Mr. Barney Schauble of Nephila Capital, who proved to be a crucial resource during this process.

Image via Munich Re

How Does a Catastrophe Bond Work?

Catastrophe bonds came to prominence in the early 1990s after insurance claims from natural disasters like the Northridge earthquake in California and Hurricane Andrew in Florida wiped nearly $30 billion off the balances sheets of insurers and reinsurers. This severely stressed the ability of firms within the insurance industry to meet their financial obligations [2]. Up until this time, the existing insurance and reinsurance markets had been fairly comfortable with natural catastrophe risks, but the staggering amount of insured losses from these catastrophes led protection buyers to explore alternative sources of risk capacity. These buyers soon realized that the only entity large enough to assume the risk of these considerable catastrophes was the capital markets, so with the help of some creative financial engineering, they began to sponsor catastrophe bonds.

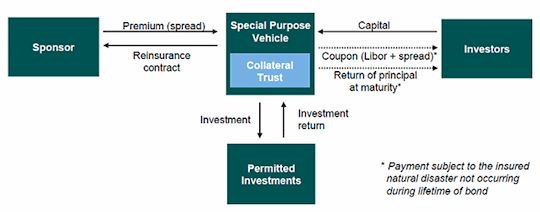

A catastrophe bond is a form of insurance-linked security (ILS) that is sold in the capital markets. To issue a catastrophe bond, the sponsor, typically a reinsurance company, creates a special purpose vehicle (SPV) that issues the individual bond notes to capital markets investors (shown in Figure 2 [2]). Unlike a corporate bond, the money contributed by investors is held by the SPV in low-risk securities, such as U.S. treasuries, and not on the sponsor's balance sheet. The coupon that is paid to investors is made up of the return on these low-risk investments and the premiums paid to the SPV by the sponsor.

Image via GAM

Catastrophe bonds usually mature in two to three years and issue quarterly interest payments (coupons) with typical yields ranging from 500 bps to 1,500 bps above benchmark interest rates [3]. Traditional ratings agencies have rated these bonds anywhere from A to B [2]. Because they derive their value from the frequency of natural phenomena, they are relatively uncorrelated with fluctuations in the financial markets, making them attractive fixed income investments for institutional investors looking to diversify their portfolios and insulate themselves from market volatility.

On the flip side, the estimated high returns reflect the relatively high-risk nature of catastrophe bonds. Catastrophe bonds are structured around the likelihood of "super" catastrophes, which are defined as having around a 1 percent annual probability [2]. Damage from hurricanes and earthquakes are the most common types of losses against which sponsors protect themselves, but bonds protecting against damage from other events such as tornadoes and large hailstorms are also created. In the event that the specific natural catastrophe mentioned in the bond causes a specified amount of damage, the bond is "triggered" and all or a portion of the original principal can be used to pay those obligations.

CAT Bonds and Renewable Energy Finance

On the subject of renewable energy stakeholders utilizing catastrophe bonds to secure lower-cost coverage from the capital markets, Barney Schauble of Nephila Advisors mentioned a precedent: catastrophe bonds had been used by a utility in the past to secure coverage for their generating assets and transmission infrastructure. In 2011, French utility Electricite De France (EDF) sponsored its Pylon II Capital catastrophe bond to secure €150 million of European windstorm damage to its electricity transmission and generation infrastructure in mainland France [4].

So could a similar bond structure be applied to renewable energy projects? Like so many questions in business, the answer appears to be that it depends. Schauble articulated that one of the most important factors for potential bond sponsors to consider, beside the degree of exposure to natural disasters, is the amount of coverage desired. In the catastrophe bond market, a general rule of thumb is that the size of any bond issued should be at least $100 million [5]. Below that amount, the transaction costs of sponsoring the bond, modeling risks, and finding investors for the bond would surpass the cost of traditional insurance, making the process unattractive for sponsors. However, for developers or owners of large projects or pools of projects with more than $100 million in assets that also have an inherently high degree of risk of damage from natural disasters, sponsoring a catastrophe bond could lower the cost of this type of protection. This would also lower the project's levelized cost of energy (LCOE), making the project more attractive to potential financiers.

In addition, Schauble noted that potential bond sponsors are also examining the use of catastrophe bonds to address the issue of credit risk aggregating in a single geographic area. If, for instance, a regional utility purchased traditional catastrophe insurance for all of its renewable energy projects from a single insurer, a single catastrophic event could compromise the ability of that insurer to fulfill the payment obligations. To address this problem, the utility could secure the same coverage from the capital markets in the form of a catastrophe bond, similar to EDF's actions in 2011. While it is possible that sponsoring the catastrophe bond would be more expensive than traditional insurance, the bond may be the more attractive option for the utility, as it would eliminate the elevated credit risk of the traditional insurer.

As the number of natural disasters increases worldwide and as large-scale renewable energy development expands into new geographic areas (offshore wind in the U.S. and U.K.), more large-scale developers and utilities may look to catastrophe bonds to address large risk concentrations. Additional studies are underway at NREL that will examine how this topic fits into the larger realm of the cost of insurance in renewable energy development, so stay tuned to the FinanceRE website for upcoming reports on the topic.

[1] The Economist. (2011). Economist Intelligence Unit, "Managing the Risk in Renewable Energy," http://media.swissre.com/documents/EIU-SwissRe-Managing-Risk-Renewable-Energy.pdf. Accessed June 15, 2012.

[2] GAM. (2012). "Catastrophe Bonds — The Birth of a New Asset Class," http://www.britishchambershanghai.org/sites/default/files/catastrophe_bond_-_the_birth_of_a_new_asset_class_june_2012.pdf. Accessed July 10, 2012.

[3] Risk Management Solutions. (2012). "CAT Bonds Demystified," www.rms.com/Publications/Cat_Bonds_Demystified.pdf. Accessed July 19, 2012.

[4] www.artemis.bm. (2011). Pylon II Capital Ltd. http://www.artemis.bm/deal_directory/pylon-ii-capital-ltd/. Accessed July 19, 2012.

[5] Wiedmeyer, J. (7 August 2012). Personal communication with Barney Schauble of Nephila Capital. [Phone interview conducted at the National Renewable Energy Laboratory in Golden, CO.

[6] Munich Re. (2012). "Catastrophe Trends and Pools, " presented at the National League of Cities Risk Information Sharing Consortium Conference in St. Louis, MO. May 11, 2012. http://www.nlc.org/File%20Library/Utility%20Navigation/About%20NLC/SML/NLC-RISC/Resources/Conference%20Materials/2012%20Trustees/RISCTrustees-2012-HazardsUpdate-MunichReFinal.pdf. Accessed on October 30, 2012.

***

Editor's note: This article is reposted in its original form from the National Renewable Energy Laboratory. Author credit goes to Jared Wiedmayer.