We’ve been getting into the details of the distribution resource plans (DRPs) released by California’s big three utilities last week, and how they envision customer-sited, third-party-managed distributed energy resources becoming an integral part of their sprawling distribution networks.

One of the first steps in making this shared grid vision a reality is sharing data -- a lot of data, at levels of detail that utilities and third-party distributed energy providers have never shared before.

That’s made for a good deal of discussion and conflicts between California’s investor-owned utilities and companies like SolarCity, Tesla, Enphase and others over just how much sharing should happen, and how quickly.

Last week’s DRPs have opened the veil on the data-sharing plans of Pacific Gas & Electric, Southern California Edison and San Diego Gas & Electric. For the third-party distributed energy resource (DER) players in the state, it’s a mixed bag.

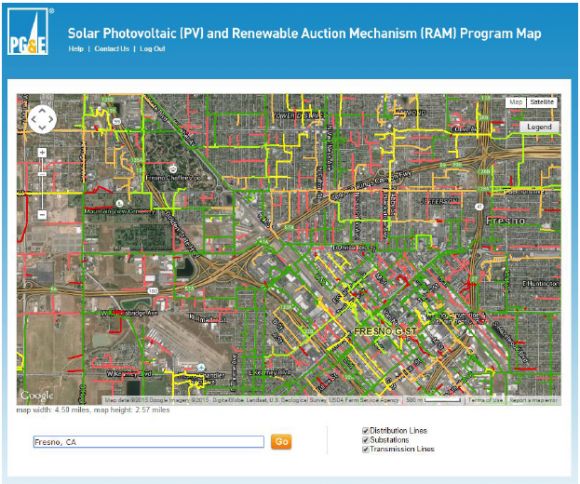

All three utilities have created circuit-level DER interconnection mapping tools, which grant third-party providers a deeper view into which spots on the grid are open to new solar systems, behind-the-meter energy storage, electric-vehicle chargers and other distributed energy systems.

But the utilities are also balking at opening up the SCADA data and power flow models, citing security reasons for withholding it. And all three say they’re not ready to provide real-time data -- something the California Public Utilities Commission has asked them to try to provide in its DRP guidance from last year (PDF).

As for customer energy usage information, long-term planning metrics and other data categories under consideration, utilities are suggesting the creation of multi-party workshops to hash out how they can reach compromises with third parties and regulators.

In the meantime, utilities are definitely asking for third-party data, which may be a sticking point for companies facing customer confidentiality or competitive constraints to turning it over.

In short, the utilities’ answer to the CPUC’s broad request for unprecedented access to their data is "yes" in some cases, "no" in others, and a definite “maybe, let’s talk about it,” for the rest. Here’s a quick breakdown of what’s on offer, and what sticking points are likely to emerge as third-party DER providers start to offer their comments and criticisms.

Yes to circuit-level DER interconnection maps

One of the most important data openings to come from the utilities lies in their new DER interconnection maps. These are built on utilities’ existing Renewable Auction Mechanism (RAM) maps, which were created to guide large-scale renewable energy project developers on which parts of the grid are open to new interconnections and which are off-limits.

As of July 1, all three IOUs have unveiled far more detailed maps, with individual circuits broken down into sections that indicate how much new DER of different types can be connected without causing grid stability concerns. And while not all circuits have been subjected to this analysis, each utility has plans to expand it system-wide over the coming years.

Southern California Edison, for example, is “making a significant amount of useful data available immediately” through its Distributed Energy Resource Interconnection Maps (DERiM), and “plans to conduct a dynamic analysis using CYME, at the line segment level, for all distribution circuits by July 1, 2017.”

SDG&E is also publishing maps for the distribution circuits it has analyzed so far, and expects its entire system to be available by the end of this year. And PG&E’s map is providing analysis of more than 3,000 distribution feeders for optimal DER interconnection.

These maps include a lot of data that CPUC has asked for, according to SCE, including non-coincident peak load forecast information at the circuit and substation level, circuit-level capacity, and where existing distributed generation is located. It will also provide current ratios of generating resources to peak load, projected load, and the results of SCE’s Integration Capacity Analysis (ICA) -- the process that all three utilities are putting together to determine how DERs help or hurt distribution grid conditions.

These maps don't go as far as the “click-and-claim” concept that GTM contributor Tam Hunt laid out in an article last year, however. Each utility will still subject new interconnection requests to their standard procedures before they allow them to go forward.

No to real-time and deep system data

Nor do these maps provide the in-depth data that SolarCity and other DER providers were asking for. That’s part of a broad range of data types that the DRPs generally put out of reach for third parties, citing concerns about confidentiality, security, and the cost of making it available compared to the value it could provide.

“SDG&E believes that the proposed data sharing of ‘GIS maps and power flow models of the entire distribution system to the substation level’ raises high concern in regards to maintaining a necessary level of physical security,” according to the utility’s DRP. “Making this information available to a third party, even under a non-disclosure agreement, could be problematic in terms of the physical security of the electric transmission and distribution system because this information could allow identification of critical infrastructure assets.”

SDG&E added that “no data will be transmitted near real-time, in real-time, nor directly from an SDG&E-owned, operated, or controlled asset.”

The problems with setting up real-time data links include the risk of “SDG&E’s safe, reliable, and customer-focused operations to be compromised.” What’s more, “the infrastructure is not in place to deliver real-time or near-real-time data, and SDG&E questions the full benefits of expending the extensive time and resources to create the needed infrastructure.”

We'll have to wait and see how DER providers react to these proposals to deny them access to more real-time and granular grid data. SolarCity certainly hasn't taken kindly to utility claims of security risks in making grid operations data available to qualified third parties, noting that it would add little in the way of useful information to terrorists or hackers seeking to do harm to the grid.

SCE’s DRP agreed that “[s]haring other data types, in particular data from sensor systems, supervisory control and data acquisition (SCADA) systems, and substation automation systems, raises customer confidentiality and physical security concerns.” However, there could be away to aggregate this data on a time-delayed basis, which “may provide a valuable proxy for real-time operational data."

Working out the sharing rules for useful, yet sensitive, data

SCE also extended the idea of aggregating and anonymizing a long list of other data types that aren’t easily available to third parties today. “For example, SCE currently provides its distributed generation (DG) adoption forecasts for the CEC’s Integrated Energy Policy Report (IEPR). This forecast could be provided publicly on SCE.com,” it wrote.

But it also warned that “other data types, such as coincident peak, backup generator population, and generation production characteristics for intermittent resources, may, depending on the level of granularity, contain customer-confidential information or may be 'reverse-engineered' to identify individual customers.” That's a commonly recognized danger in anonymized customer data -- it can be correlated with other data sets, stripping it of the anonymity it was supposed to provide.

PG&E suggested that pilots should be used to test how to share useful, yet problematic, data sets, like smart meter readings and grid conditions. Those real-world tests will give utilities a chance to figure out what kinds of data are important for getting third-party DER providers and customers involved in sharing the costs and benefits of grid support. They’ll also help determine how much funding utilities may need to scale up data-sharing capabilities.

To come up with the proper way to share these types of data, SCE proposed a stakeholder workshop process, one that would lead to a joint proposal for CPUC approval. This is also the route it suggested for determining how the value of DERs for grid capacity, stability and efficiency should be calculated, under the definition of a Locational Net Benefits Methodology (LNBM) shared by the three utilities.

There’s an interesting catch in this value-sharing process, however, as SCE noted in its DRP. Each utility is supposed to measure a wide variety of grid-supporting investments to find the lowest-cost option. But “releasing market-sensitive information to DER developers could severely harm SCE’s ability to acquire DERs performing grid functions at the lowest possible cost to its customers,” it wrote.

It’s likely that non-utility parties will protest that utilities already have an overwhelming advantage when it comes to possessing market-sensitive information, since they have exclusive access to the grid data that would go into determining that value. SCE notes that “non-market participant parties have a legitimate interest in reviewing this information to ensure that SCE is appropriately applying the Commission-approved deferral framework” -- something that SolarCity has pointed out in its CPUC filings on this issue.

DER providers need to share data, too

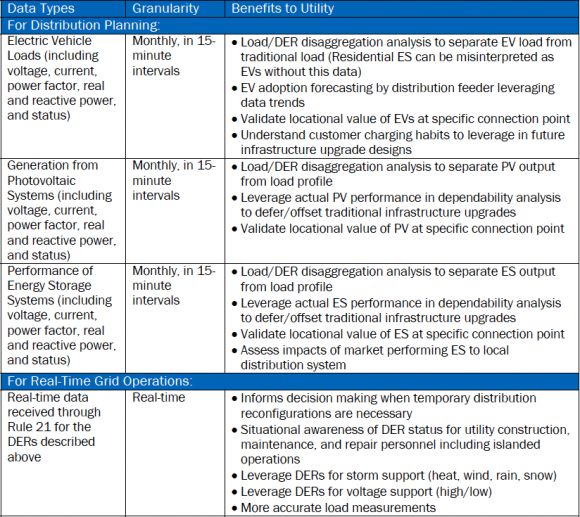

This leads to a final wrinkle in the data-sharing challenge: deciding what data third parties have to share with utilities. SCE lays out a long list of data types, including voltage, current, power factor, real and reactive power, and device status for various DERs, that “would provide benefits for SCE’s distribution planning and real-time operations.”

This data is important both for informing real-time grid operations like switching and voltage regulation, and in long-range planning for capacity deferral at the circuit and substation level. It could also play a key role in helping utilities figure out what effects DER will have on system-wide capacity and transmission reliability.

Some of that third-party data is likely to be market-sensitive itself, SDG&E noted. But without it, the utility may not be able to make long-range plans with any accuracy.

“Projections based on past DER growth in an area can be misleading as DER installers may have left the neighborhood due to saturation, resulting in little or no future growth,” SDG&E noted. “Conversely, DER installers may be targeting a low-penetration area, which would result in larger than average near-term growth in DER resources for that area. SDG&E could then incorporate these growth plans into its demand forecast, which could affect the analysis of the distribution system."

“In order for DER developers to share this type of data, SDG&E believes that a process similar to that required for transfer of utility data is appropriate. Data exchange would be limited in scope and subject to confidentiality rules.”

We’ll have to wait and see what companies like SolarCity make of this request.