Last month, we explained how C3 Energy, the well-connected Silicon Valley startup, wants to apply its big data aggregation and analytics software to the smart grid, along with a list of its first few utility industry-focused applications. We also covered how the startup, founded by software billionaire Tom Siebel and armed with more than $100 million in investment, faces a lot of competition in the still-nascent field, from grid giants like Siemens and General Electric to IT giants like IBM and Oracle.

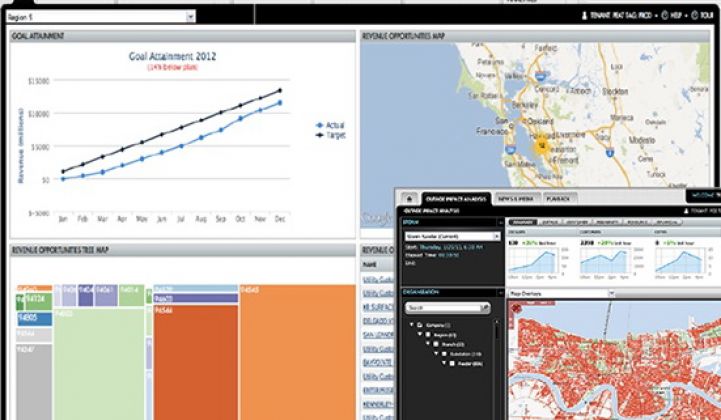

This week, the Redwood City, Calif.-based startup announced the latest four smart grid analytics applications it’s built on top of its underlying data engine, already in use by a long list of corporate and institutional customers for enterprise energy and resource planning. C3 is already supporting revenue protection, customer energy data and utility efficiency programs for utility Pacific Gas & Electric via its big data engine, but these new apps stake out new ground, both in terms of broadening the scope of its analytics capabilities and delving down into a specific set of smart grid devices -- smart meters, or AMI systems -- for improvement.

The first two apps, C3 Asset and System Risk and C3 Grid Investment Planning, are tied together by their focus on grid assets, though at different time scales. According to Monday’s announcement, the Asset and System Risk application will "track and monitor asset health in real time" to lower operating costs, help prevent outages, and minimize unexpected capital investments. The term "real time" is important here, given that the startup is pledging to perform its massive data collection, integration, sharing and updating tasks in as close to real time as the supporting data allows.

C3's Grid Investment Planning platform, on the other hand, "ranks grid investment portfolio alternatives based on a cash flow analysis and impact to system and customer reliability, and helps build informed business cases for asset replacement," according to the announcement. That's a longer-view challenge, and one that brings financial variables to the forefront. We’ve been covering the host of similar asset management and analysis tools being deployed by the likes of ABB/Ventyx, Siemens, General Electric, Alstom and others.

The third app, C3 Customer Reliability and Safety, is meant to "continuously identify grid assets at risk of failure and direct capital investments to the grid assets with the potential for the most significant customer safety and reliability impact.” Again, the word “continuously” implies a speed of data management that's not altogether common in the siloed departments that make up the utility enterprise. Linking utility call centers, outage management systems, utility field crew repair reports, and other such data could help harried operators answer customers’ questions about power outages far more accurately, for instance.

C3 Energy also announced its first grid device-specific applications, C3 AMI Operations, aimed at streamlining the workforce management process of installing, activating and maintaining smart meters or advanced metering infrastructure. The application "works with a utility's existing workforce management tools to both streamline the deployment and logistics of new AMI systems and improve the operational health of existing systems," according to the release.

In other words, it appears primarily to be a tool for improving the way utility workers handle the tasks of keeping an AMI network up and running, whether they’re field workers installing new gear, diagnosing physical breakdowns and issuing work orders, or the back-office workers trying to "light up" the network for the first time or figure out software and firmware upgrade problems. C3 Energy cites a benefit of "up to $50/meter per year in value to utility operators and their customers” from the system, though it doesn’t say just how that value is broken down between the planning, deployment, and ongoing maintenance and operations stages of the processes it promises to improve.

C3 Energy didn’t name any customers for its new applications, or say whether any of the platforms are now in use in pilot or broader scale at utilities. The startup does have a long list of utilities it’s working with on unspecified projects, either with partners like GE or on its own, including Constellation, DTE, Commonwealth Edison, Entergy, Northeast Utilities, Southern California Edison and Iberdrola.