It took First Solar and SunPower more than a decade to get their module capacity up to hundreds of megawatts. As testament to China's drive to grow a renewable energy industry, Taiwan's Neo Solar Power builds crystalline solar cells and has managed to go from zero to 240 megawatts in four years. By the end of this year, the company will have installed capacity of 600 megawatts. In the month of February of this year, the firm had sales of $28 million.

I spoke with the Dr. Quincy Lin (林坤禧), the Chairman and founder of Neo Solar Power, on Saturday at the Monte Jade event in Santa Clara, Ca. Dr. Lin co-founded Neo Solar Power Corp. (NSP) in 2005. Before founding NSP, Dr. Lin spent 15 years in senior positions at TSMC.

Three years after its founding, NSP's revenue reached $300 million. Despite 2009's crushing downturn, NSP actually grew its business that year and Lin remains extremely bullish on the global solar market -- the company forecasts a global demand of 8.3 megawatts in 2010 and 12.3 megawatts in 2011.

Lin's company sees pricing of polysilicon in this oversupplied market at $45 to $50 per kilogram on the spot market by the end of this year.

NSP was profitable in 2008 albeit on narrow margins. The first half of 2009 was a challenge with negative 19 percent gross margins but business metrics returned to positive in the second half of the year.

NSP distinguishes itself from the many commoditized cell manufacturers with its relatively high efficiency.

The firm targets the following average conversion efficiencies in 2010:

* Multi-crystalline: 17.2%

* Mono-crystalline: 18.5%

China's Domestic Solar Market: Wind Market as Template

When it comes to renewables, there's no denying that China is thinking big and moving fast.

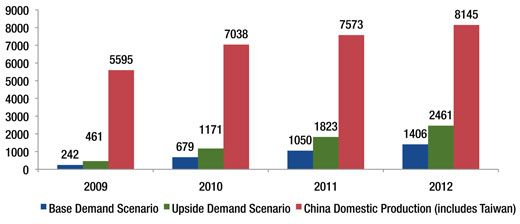

But despite the enormous potential, there is very little action in China's domestic PV market. A fraction of China's PV capacity is deployed domestically according to the demand data from GTM Research's PV in China report. Note that the units are "MW."

So what will it take to rev up the Chinese domestic solar market?

Perhaps we can look at the rapidly growing Chinese wind market as a model for setting the Chinese domestic market in motion.

The development of the wind industry in China was the country’s first real foray into scaling a renewable, non-dispatchable generation technology. The government’s approach to building this industry -- establishing a subsidy program with grid interconnection and independent power production are good indicators of the way it might approach scaling its domestic solar industry.

China’s wind market was virtually nonexistent 20 years ago, and has grown to be the fourth-largest market in the world, behind the U.S., Germany and Spain. Over the past five years, installed capacity has grown at an annual rate of 52 percent (!). Cumulative installed capacity through 2008 was over 12 GW, with 6.2 GW installed in 2008 alone. China will likely overtake Germany and Spain to reach second place in terms of cumulative installed wind capacity in 2010.

Some optimistic industry pundits have predicted that new subsidies will make China the world’s largest solar market in 2015.

In the words of Andrew Beebe, Vice President, Global Product Strategy at Suntech, "The PV markets of China and the U.S. actually have a great deal in common. They're both currently benefiting from a great deal of regional and national government support and focus; they are both complex with regulatory and bureaucratic challenges; and they both promise to be absolutely massive."

For a deep dive into the Chinese photovolataic market, check out the China PV Market Development report.