Forget about the iCar. Or, at least, don't expect to hear much about it from Apple.

During an interview with Bloomberg at Apple’s developer conference earlier this month, CEO Tim Cook confirmed that the consumer electronics giant is working on autonomous car technology, but declined to confirm the existence of an Apple-designed vehicle.

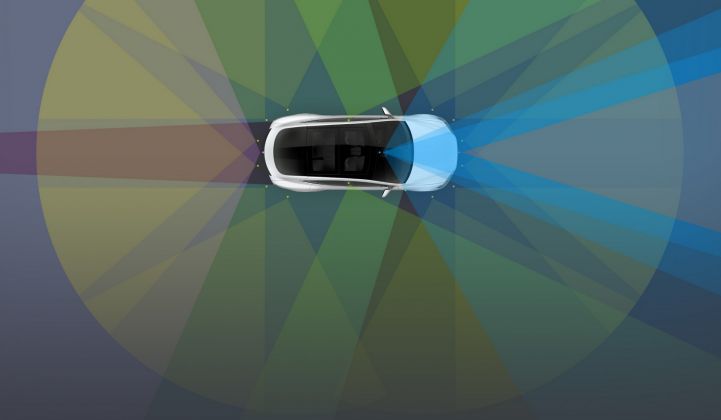

Cook called self-driving cars “the mother of all AI projects,” and also “one of the most difficult projects to work on.” The confirmation, Apple’s first on the subject, follows news in April that Apple had obtained state permits to test self-driving cars on California roads, using three Lexus SUVs.

Notably, Apple’s first public discussions of its self-driving car plans didn’t mention the much-rumored Project Titan (Apple’s internal name for the self-driving car division), or an Apple-designed or manufactured car, which many have dubbed the iCar. Still, Cook didn’t specifically rule out an Apple car in the brief interview.

But Apple’s confirmation shows how major tech companies in Silicon Valley -- from Google to Uber to Tesla -- are investing heavily in autonomous technology, fiercely recruiting engineers with autonomous tech backgrounds, and figuring out how to navigate this new ecosystem with varying levels of success so far. And it’s not just Silicon Valley -- the auto industry, naturally, is hyper-focused on moving faster and beating out the Valley in this new autonomous world.

Apple has had some struggles even getting to the point where it’s started to talk publicly about autonomy. A variety of outlets reported that in late 2016, Apple began to rethink its self-driving car strategy -- moving away from designing a car to creating a tech platform -- and had to lay off dozens of employees and close down parts of its project.

The stakes in this emerging field are just too high to get it wrong, particularly in the early phases. You can see how aggressive companies are getting with autonomy just by how many public fights and lawsuits there have been so far.

Tesla and Mobileye, an Israeli image-sensing startup, were previously working together on autonomous tech until an ugly public breakup. Mobileye expressed concerns about the safety of Tesla’s Autopilot hands-free system, while Tesla accused Mobileye of trying to block Tesla’s efforts to develop its own vision capability for its Autopilot system.

Tesla also earlier this year sued the former head of its Autopilot group, Sterling Anderson, alleging that Anderson breached his contract and poached Tesla’s engineering talent to create a new startup called Aurora Innovation, which he founded with the former head of Google’s self-driving car unit. Tesla settled the lawsuit in April.

While Tesla is an unusually litigious company, it’s not the only one that has turned to the courts to try to protect its autonomous car tech and talent. Google’s self-driving car subsidiary, Waymo, sued Uber last year after accusing one of its former engineers, Anthony Levandowski, of stealing confidential documents from the Google company.

Levandowski left Waymo to create the self-driving tech startup Otto, which Uber acquired last year (Uber subsequently fired Levandowski after he refused to cooperate with the discovery process of the lawsuit). Uber paid $680 million (mostly in company equity) for Otto’s tech and a team of self-driving car engineers.

Leading self-driving car talent is being valued at $10 million or even “tens of millions” per employee. Startups working on self-driving car tech are scoring sky-high valuations and being acquired for major sums. GM bought self-driving car tech startup Cruise Automation for $1 billion last year (that group had its own founders' lawsuit, which was ultimately settled).

For venture capitalists, investing in the right autonomous car company and team can have massive payoffs. Cruise had raised a modest amount of funding (about $19 million) from Spark Capital, Maven Ventures, Founder Collective and Y Combinator. That’s a return that would make any cleantech investor jealous.

Car companies have been major acquirers of self-driving car tech. A report from Navigant research earlier this year put GM, Ford, Daimler, Renault-Nissan and BMW ahead of tech companies like Waymo, Tesla and Uber when it comes to the race for autonomous car tech. A lot of that has to do with their acquisitions and willingness to pay high valuations for the Valley’s self-driving car talent.

When you look at the flurry of activity happening in Silicon Valley around self-driving cars, Apple’s efforts actually appear among the slowest and most cautious.

Apple just got its self-driving car test permits, while Google has had those for years (and was testing for years before it needed permits). Tesla has its autonomous car tech already enabled on its cars on the roads (albeit in a limited fashion), and has been getting real-world data and feedback for months.

It’s unclear exactly how aggressive Apple plans to be when it comes to building self-driving car tech. But as Apple’s other core products age, and some, like the Apple Watch, have received mixed reviews, the company will no doubt need a toehold into the next big thing. And autonomous car technology is definitely that.