On the southern shores of the Georgian Bay, Owen Sound is providing a glimpse into the future of electricity production and distribution in Ontario.

The town, northwest of Toronto, is the first phase of Hydro One’s upgrade to its distribution system, including an advanced distribution management system.

The living lab, as Hydro One calls it, has a 14-megawatt wind farm that can provide one-third of the area’s peak electricity demand. But if the wind kicks up during off-peak hours, it can wreak havoc on the distribution lines.

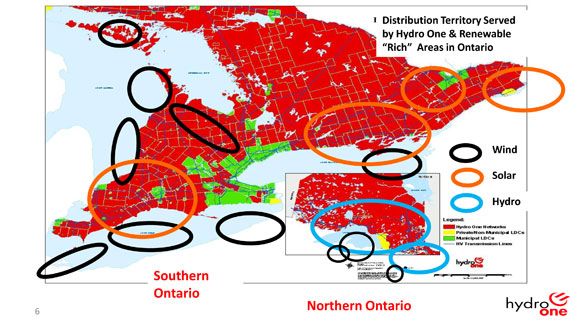

Owen Sound is hardly alone. Ontario’s Green Energy Act of 2009 calls for the end of coal-fired generation by 2014 and offers support for wind, solar and bio-energy projects. The result is that Hydro One is seeing increasing levels of renewables, primarily wind and rooftop solar, on its system.

Hydro One has more than 76,000 miles of distribution lines, many of which were built in the 1950s. About 20 percent of the distribution assets will reach the end of their expected life within a decade. Not only are many components reaching the end of their service life, but they also are not equipped for increasing levels of renewables on the grid edge that require a more dynamic distribution system.

Hydro One owns 97 percent of transmission in Ontario, where there is plenty of telemetry. “But down in the dirty world of distribution, it’s a whole other paradigm,” said Del Wilson, smart grid program manager at Schneider Electric. “It’s a new set of challenges.”

Schneider Electric, which purchased Telvent in 2011, is providing the advanced distribution management system (ADMS). General Electric is the power systems solution provider, and IBM is the overall system integrator. The utility has two layers of distribution, a 44-kilovolt system and a 12-kilovolt system. There is some telemetry at the substations between the transmission and 44-kilovolt line, but “absolutely nothing” down at the 12-kilovolt level, according to Wilson.

The ADMS will increase visibility at the substation level for both distribution layers, such as more telemetry on voltage regulators and feeder breakers. The system will also allow for simulation to fill in the gaps in the data, since automating every inch on the distribution line is not financially feasible.

One of the challenges for Hydro One was the switch order management. “Evaluating the switching order is very different than it was five years ago,” said Wilson. The ADMS allows the utility to model the switching to see if the end result is what operators expect. Schneider Electric also had to extend the system protection capabilities of the ADMS for Hydro One given its large territories.

The first phase in Owen Sound is going as planned, and Hydro One is evaluating the second phase. But the overall question of how much distributed generation merits telemetry is still an open question. “We are still struggling with the volatility of some of these distributed generation plants,” said Wilson.

Utilities have different drivers for installing an ADMS, but some of the pain points are shared amongst utilities -- or they will be. Hydro One’s increasing levels of renewables is something California utilities are also experiencing. As Schneider Electric gains customers across the globe, it is developing applications for its ADMS that will be able to help other clients.

An advanced distribution management system is just one part of Hydro One’s upgrade. Earlier this year the utility contracted Space-Time Insight for predicative analytics for asset maintenance. It is also piloting flywheel technology for frequency regulation on a feeder that serves two wind farms.

Hydro One will deploy its ADMS across the entire territory, but there is no firm timeline as to when the entire project will be complete.

For much more on grid-edge opportunities and challenges, download GTM's free report The Grid Edge: Utility Modernization in the Age of Distributed Generation.