Pushing back against the utilities’ attack on net metering is taking up about a third of Sunrun co-founder/co-CEO Edward Fenster’s time these days.

“With today’s low interest rates, stocks that pay dividends have gone up in value, so utilities’ stocks are up,” Fenster said. “At the same time, their anticipated growth is low because solar and energy efficiency are keeping per-capita energy consumption down." To keep the stock price up, they are trying to stop solar. “Utilities are fighting at the regulator to slow a disruptive technology," he said.

But they can’t say they oppose solar because it is hurting their stock prices, he explained, so they say they love solar but are against net metering.

Net metering supports the growth of distributed generation, and especially solar, by requiring regulated utilities to reimburse home and business owners at retail rates for the electricity they send to the grid.

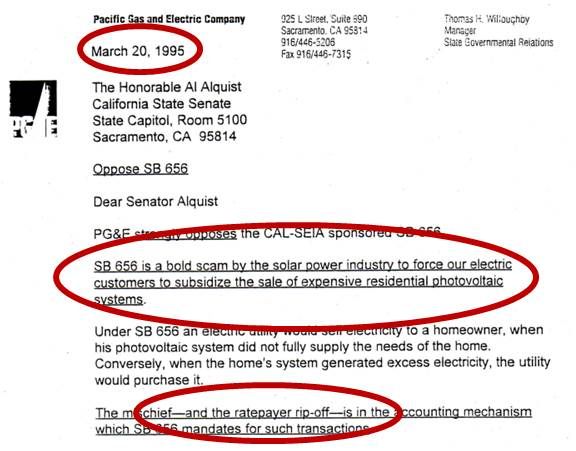

“Utilities have fought net metering from the beginning,” Fenster said, referencing a 1995 PG&E letter referring to it as a “bold scam” and a “ratepayer ripoff.”

The two arguments utilities use today are that net metering shifts costs for solar to non-solar ratepayers, and that it compromises utility financials.

It is hyperbole to say solar affects a utility’s credit-worthiness, Fenster said. And recent studies from Crossborder Energy on net metering in California and Arizona show net metering provides more benefits than costs to ratepayers.

“Utilities say they are concerned about net metering,” Fenster said. “They just don’t want their customers to own solar. They have a profit opportunity when they own solar, but not with net-metered solar.”

Regulators allow utilities to “rate-base” assets they purchase. That means they can charge ratepayers their costs and a 10 percent return. When customers put solar systems on their homes, it reduces a utility’s revenues.

Fenster cited recent contradictory executive comments as evidence of utility duplicity. Southern California Edison’s Gary Stern said distributed solar means less need for new transmission, while PG&E’s David Rubin said solar users work the grid more intensively than non-solar customers.

Another example of the attack, Fenster said, was Arizona Public Service (APS) Communications VP John Hatfield’s claim that net metering is not a revenue issue or a profitability issue but a cost-shift issue.

At the same time, Fenster said, APS is advocating for a policy change allowing it to pay for lines to new homes, a cost historically covered by housing developers.

“APS wants to pay $10,000 per home for 700,000 homes over the next couple of decades,” Fenster said, “because they can rate-base the lines. It is literally getting the existing customers to pay for the new customers. That is a massive cost-shift worth billions of dollars, but they call it cost-sharing where they can profit from it.”

APS is in especially serious financial trouble right now, Fenster said. “Only one in four analysts has a buy on the stock.” But solar should not have to carry that burden.

According to Fenster, the APS head of renewable policy has acknowledged that distributed solar reduces the utility's need to build transmission and distribution infrastructure and therefore slows the utility's growth. “Every time solar puts a system on the grid, it basically privatizes the investment APS would have to incur on behalf of all ratepayers and have everybody pay for.”

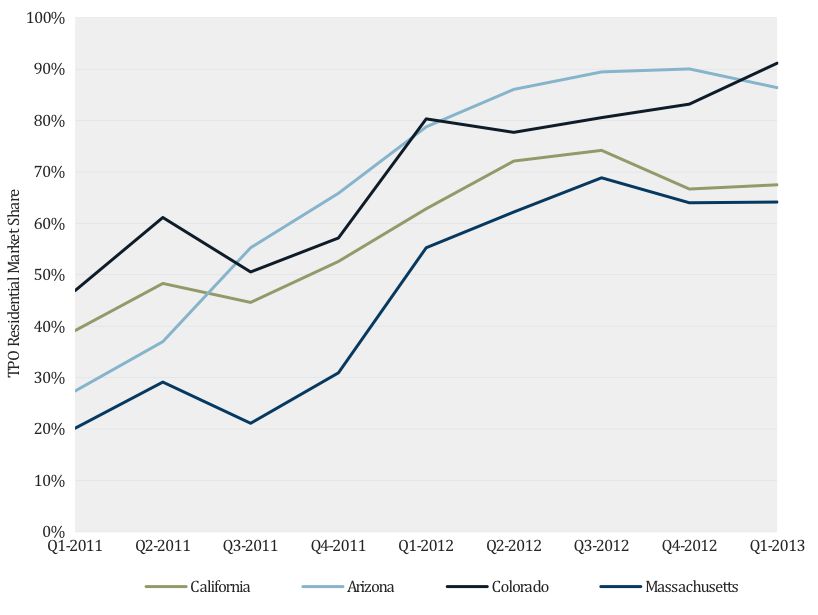

Net metering is a key factor in Sunrun’s third-party ownership (TPO) business model. With TPO, a home or business owner can sign an agreement to host a solar system owned by Sunrun and its investors. In this "disownership" model, Sunrun takes full responsibility for the system and the host gets a 20 percent discounted utility bill for the agreement’s twenty-year term.

Source: U.S. Solar Market Insight

Net metering is a key component of the value proposition through which Sunrun, its investors and the system host benefit, a value proposition that has dramatically driven the growth of solar.

Sunrun and SolarCity (NASDAQ:SCTY) lead the TPO field, Fenster said. Vivint and Clean Power Finance are on a second level, and NRG (NYSE:NRG), Sungevity, SunEdison (NYSE:SUNE), and SunPower (NASDAQ:SPWR) follow.

The transition utilities face is real, but going into the TPO business is not a solution for them, Fenster explained. Because they have always had the rate base and a guaranteed 10 percent return, they don’t have competence in selling or cost discipline.

A recent Edison Electric Institute paper about the dilemma proposed two solutions, Fenster said. In the bleaker one, utilities are like the U.S. Postal Service and solar is like UPS.

But utilities could also be like the previous generation of phone companies. “Land-line phone companies make significantly less money, but none have gone bankrupt and service is still reliable. It has just been a change in market size, and they have weathered it,” Fenster said. “It could be the same for utilities. They would be less profitable but still reliable, and could survive as credit-worthy entities."

Or, he said, some might follow the lead of a recent PG&E management team that began investing in distributed solar. “They saw the future and wanted to be a part of it.”

Hear Ed Fenster's remarks on a post-subsidy solar market at Solar Summit 2013: