SunPower, SolarCity and some of the biggest new home builders in the U.S. are marking major achievements for solar.

- By the end of 2013, one in five new homes built in the state of California will have solar.

- SunPower (NASDAQ:SPWR) is now completing its 10,000th new home solar installation.

- The SunPower partnership with new home builder KB Home (NYSE:KBH) has now accounted for more than 1,500 new solar homes.

- SolarCity (NASDAQ:SCTY) launched a zero-down financing option for new home builders to expand the reach of the third party ownership finance model.

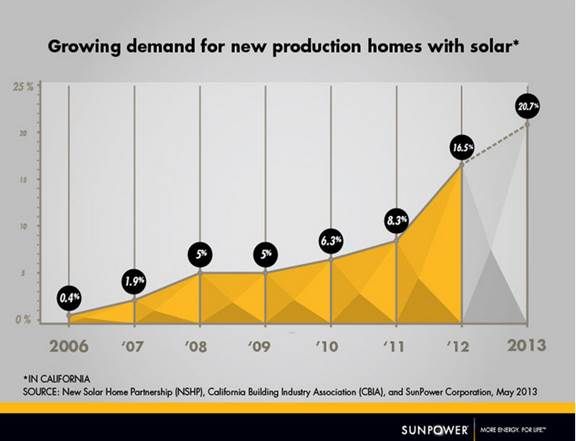

The percent of new homes built with solar doubled in 2012, growing from 8.3 percent at the end of 2011 to 16.5 percent at the end of last year, and is expected to top 20 percent by the end of 2013, according to a SunPower analysis drawn from California Building Industry Association (CBIA) and California Solar Initiative (CSI) data.

SunPower’s internal data shows that of all the new solar homes that have been built in California, SunPower has built 80 percent, according to National Sales Director for Homes Matt Brost.

The state also had two cities, Lancaster and Sebastopol, pass zoning laws this year requiring solar on all new homes.

SolarCity, which has already bumped its kilowatts installed in new homes 300 percent this year compared to the same period in 2012, is now moving more aggressively. By taking the upfront expense onto its own balance sheet with a zero-down financing program, it allows builders to offer homebuyers the SolarCity lease/PPA option without pre-payment.

The CSI New Solar Homes Partnership, launched in 2007, played a big role in the growth, according to Brost. Like the CSI rebates for residential solar retrofits, the New Solar Homes program offers a rebate that diminishes as targeted megawatts of installed capacity are reached.

But the key to its success, Brost said, is that it allows home builders to reserve their rebates for up to three years. “It takes a home builder a couple of years to sell solar to a whole new community. To take on the task, they need to know that if they put solar on the first ten houses, they can put it on the last ten houses. The ability to reserve rebates for up to three years gives them the window of time they need to design, open and sell out the community.”

Unlike the CSI rebates, the New Solar Homes program is only about half used up. “That’s because we went from 100,000 units per year in 2005-06 to less than 20,000 a few years later. There has never been a contraction like that in the housing market,” Brost explained. With recovery, I suspect we will start moving through the funds much more rapidly.”

“There is an increasing rate of new solar homes being built in states outside of California, too,” Brost said, "and a lot of what is driving it, besides mandates or regulations, is that national home builders like SunPower partners KB Home, Richmond American Homes, Lennar (LEN), Standard Pacific, and Pulte have seen success with their programs in California." That makes those companies’ divisions in other solar-friendly states like Arizona, Colorado, Texas, and Florida aware of the potential.

“In California, we worked at this for a couple of years making very slow progress,” Brost said. "But then, all of a sudden, we saw this hockey-stick effect when we reached a certain level of success. And all these other states seem to be where California was a couple of years ago.”

SolarCity’s new financing program will be available in California, Arizona, Colorado, Maryland, New Jersey and Oregon through already in place partnerships with 30-plus home builders such as Brookfield Homes (TSE:BRP), De Young Properties, Del Webb, Elliott Homes, McMillin Homes, Taylor Morrison (NYSE:TMHC), Toll Brothers (NYSE:TOL), SheaXero from Shea Homes and Woodside Homes.

SunPower had to back away from the New Jersey market because of SREC price volatility, Brost said. “Builders have to communicate this system in the sales office, and it makes that discussion really challenging,” he explained. “We need the market to level out before we can have a consistent message to the home builder and the home buyer about the solar value proposition.”

But in many states across the country, the price of solar has dropped so rapidly that the new home calculation makes sense even without incentive programs, Brost said. “If you roll that cost into a 30-year mortgage at a 5 percent interest rate, the cost to finance the electricity can be less than buying it from the utility.”

“We see a 30 percent higher demand from buyers for new homes with solar,” said KB Home Southern California President Steve Ruffner. “They want solar because they are aware it cuts their electricity bills and increases the house’s resale value."

In each state where SunPower has entered the market, there has been “an educational process getting home builders and home buyers to understand,” Brost said. Eventually, one or two get the idea and the others follow. “That’s what we’re seeing in California now. Builders definitely believe solar is part of the future of home construction.”