British Gas has chosen Canadian startup Pulse Energy to provide energy efficiency reports to its 900,000 commercial customers in a three-year, multi-million-dollar deal.

Pulse Energy is similar to Opower in that it provides energy reports to utility customers based on analytics and behavioral psychology. Unlike Opower, it does not come from the residential market, but has always been squarely focused on the commercial sector. Its platform has tailored products for larger commercial clients, as well as small and medium-sized businesses.

The privately funded energy intelligence company has been around since 2007, but has mostly flown under the radar. Its North American clients include BC Hydro and Pacific Gas & Electric, as well as an unnamed client in Australia. (Pulse would not disclose its total number of utility clients.)

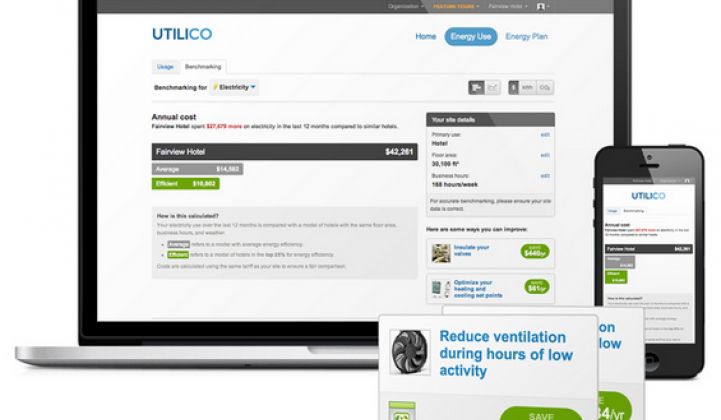

Pulse also develops dashboards for commercial clients, as well as a remote auditing product similar to those offered by Retroficiency, FirstFuel and WegoWise. But the firm has found momentum with its behavioral analytics product among utility customers.

“Our partnership with Pulse Energy will allow customers to see in real time where they are using the most energy and how they can increase their efficiency to save...money,” Stephen Beynon, managing director of British Gas Business, said in a statement. “Working with the Pulse Platform, we are able to identify the specific actions suited for each customer to help them to improve their energy productivity with minimal effort.”

The Pulse platform for large commercial clients is geared more toward the energy manager in the facility. It also comes with an interface for high-level insights that can be used for applications such as presentations in the C-suite or to show students in a school district how their energy efficiency projects are paying off.

BC Hydro offers Pulse analytics to its larger clients as part of its Continuous Optimization Program, which covers buildings of more than 50,000 square feet in size. The Canadian utility has a mandated demand-side efficiency target of 5,100 gigawatt-hours for 2014, according to Pulse Energy.

The software is also designed to notify building managers of the best approaches to plan, optimize and verify energy efficiency savings. “We don’t just train users on how to use the software; we train users on how to carry out energy management,” said Steve Jones, VP of product management at Pulse Energy.

For small commercial customers like the ones Pulse Energy works with through Pacific Gas & Electric, the approach is different. Those customers also receive reports on their energy use, but the interfaces are simpler and the messaging is tailored for their specific business. Pulse Energy supports more than 100 different verticals, differentiating between businesses such as dry cleaners and laundromats.

The competition for Pulse Energy is everywhere: remote auditing software companies, residential companies like Opower that want a slice of the small commercial pie, direct-to-business competitors like Noesis or EnerNOC, and big data analytics firms like C3.

Although the competition is stiff for Pulse Energy, utilities are increasingly looking for low-cost ways to engage commercial customers on efficiency. Pulse has products that touch the different areas where utilities are interested, from behavioral reports to deeper building analytics.

Pacific Gas & Electric is using Pulse Energy to specifically target small and medium-sized businesses. Because British Gas operates in a competitive environment, offering added value to small businesses is critical to attracting new customers.

British Gas is also one of the retailers on the forefront of installing mandated smart meters in the U.K., and some commercial customers will be looking for energy retailers who offer another layer of energy services that leverage smart meter data. “Having a mandated savings target is very powerful,” said Jones, “but so is customer need.”