Venture capital tends to move in waves, like sets of breakers on a beach or lemmings off a cliff.

This month, we've seen two early stage waste-heat-to-energy firms receive VC funding. They are both still in the early stage pre-product phase.

MTPV raised $6.5 million in the initial closing of its round B led by Spinnaker Capital along with Applied Ventures, Massachusetts Clean Energy Center, Ensys Capital, et al. They classify their product as a thermophotovoltaic and they use micron-gap thermal photovoltaic technology.

Alphabet Energy just raised $12 million in round A funding, led by TPG Biotech along with Claremont Creek Ventures and the CalCEF Clean Energy Angel Fund, to develop thermoelectrics. The firm had received a $1 million seed round in 2010. The firm has also received some SBIR funding. Alphabet is at the prototype stage, working with technology developed at the Lawrence Berkeley National Laboratory.

Thermoelectrics are semiconductors that when placed in a temperature gradient have the potential to turn waste heat into power. It's a brilliant pursuit, but no one has brought it home economically at scale just yet.

Traditional waste heat materials -- heat goes in, electricity comes out -- cost more than $20 per watt and are made out of bismuth telluride or other exotic materials. Alphabet's trick is in the use of silicon-based materials, silicon nanowires to be exact, with the potential to use the existing silicon ecosystem and act as a fab-less semiconductor manufacturer.

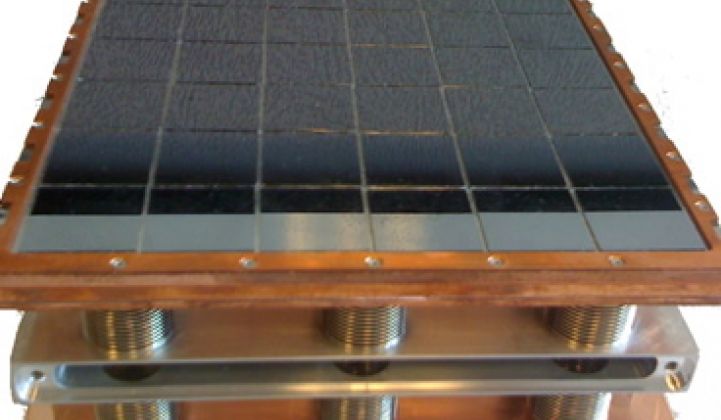

MTPV uses a silicon-based MEMS emitter which takes heat and transfers radiation to a germanium-based photovoltaic device according to an article in Semiconductor Manufacturing and Design. The CEO of MTPV suggests that the heat could come from the gas flow of an industrial plant or the methane burn-off at a coal mine. Thr firm claims that, "An industrial customer using MTPV solutions would be able to generate hundreds of kilowatt-hours of electricity from their own waste heat at a cost of $.02 to $.08 per kilowatt-hour over a 10 year lifespan. According to the firm, "Unlike other non-chip based heat recovery solutions [MTPV's products] are non-intrusive to the manufacturing environment housed inside of smoke stacks, exhaust tunnels, thermal oxidizers, open or closed flares and other waste areas without sacrificing valuable factory space, production, throughput or manufacturing quality."

Alphabet suggests enormous numbers for the potential market size -- "a $100 billion global market for products that convert medium- to high-grade waste heat into electricity, part of an existing $75 billion annual market for energy efficiency and a $6 billion annual market for industrial equipment."

In reality, these are broad, diverse, and fragmented markets that will require a variety of custom approaches.

According to Alphabet, in the near term, applications are in waste-heat-to-electricity generators that utilize hot exhaust gas from heavy industrial applications and engines.

Waste heat harvest looks to capture heat from engines and machinery in order to run things like water heaters or convert it into electricity. The U.S. consumes around 100 quads (100 quadrillion BTUs) of energy a year, and 55 to 60 quads get dissipated as waste heat, according to Arun Majumdar, the UC Berkeley professor behind much of the technology at Alphabet (he now runs ARPA-E, the advanced projects group inside the DOE).

Companies such as Recycled Energy Development (RED) and Ormat have retrofitted factories to capture waste heat, not using thermoelectrics, but using the waste heat nevertheless. GMZ Energy (with funding from KPCB, BP Alternative Energy, and Mitsui Ventures), Promethean Power, and Cypress Semiconductor are experimenting with harvesting heat. MC10 and Phononic Devices are working on similar projects with grants from ARPA-E.

Of course, reducing the amount of heat produced in industrial processes would be another way of approaching this problem. In any case, it remains an enormous, untapped market with huge potential.