With the U.S. storage market estimated to be valued at $3.3 billion per year by 2022, and deployments forecasted to hit 7.3 gigawatts annually, we're mining the U.S. Department of Energy's storage project database to see how owners are developing portfolios to capitalize on the growing number of revenue streams enabled by storage assets.

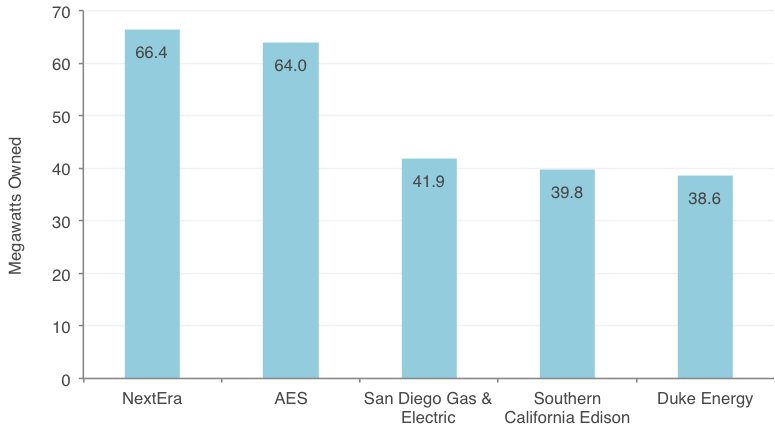

Today, the top five storage owners in the U.S. are a mix of investor-owned utilities and diversified energy companies: NextEra, AES, San Diego Gas & Electric, Southern California Edison and Duke Energy.

Installations from the top-five players range in size from double-digit-kilowatt projects up to utility-scale deployments such as Duke Energy’s 36-megawatt Notrees project and AES Energy’s 32-megawatt Laurel Mountain facility.

FIGURE: Top 5 Energy Storage Asset Owners in the U.S., 2017 (to date)

Source: U.S. Department of Energy

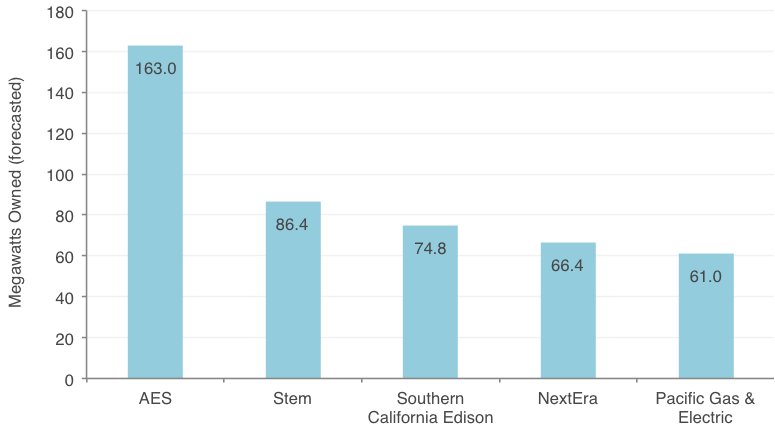

By 2021, the build-out of storage pipelines will dramatically reshape this ranking. Large projects in the works by Stem and Pacific Gas & Electric will move these companies into the top five, and only three of the current top five owners will retain their positions.

The scale of pipeline projects in relation to operating projects is hard to understate: AES’ 100-megawatt Alamitos Energy Storage Array and Stem's 85 megawatts of behind-the-meter assets are each individually larger than NextEra's current operational portfolio. Stem's rise to the No. 2 spot is especially notable considering that the company currently manages a portfolio of just over 1.3 megawatts.

FIGURE: Forecasted Top 5 Energy Storage Asset Owners in the U.S., 2021

Source: U.S. Department of Energy

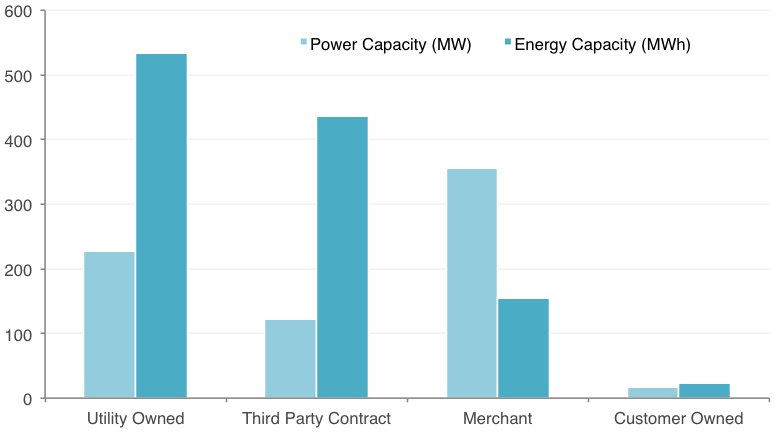

Ownership trends over the next five years also herald a shift toward third-party ownership models. This marks a departure from the status quo, where utility ownership makes up the largest share of the energy storage market in terms of total operational energy capacity.

While utilities were early adopters of storage, they were mainly involved in developing first-generation pilot projects and other emerging applications. Even though these early projects were mostly smaller installations designed for niche applications, they were sufficient to solidify utilities as the leading owners by energy capacity in the nascent market.

FIGURE: Operational Capacity by Ownership Model (MW and MWh)

Source: GTM Research Energy Storage Data Hub

The main drivers of this business model evolution are the storage goals and legislative deadlines for procurement laid out under California’s AB 2514. The state's mandate, which requires California's three investor-owned utilities to add 1.3 gigawatts of grid storage by 2021, has fostered a divergence in ownership models based on an individual utility's need. After two procurement rounds, a pattern is becoming clear: PG&E is pursuing utility-owned storage bundled with generation and substation upgrades, while SCE and SDG&E are contracting storage from third-party owners to meet resource adequacy and local capacity requirements.

Despite their early-adopter status, utilities generally lack institutional experience in dealing with energy storage projects, said GTM Research Director of Energy Storage Ravi Manghani. This, coupled with the small scale of battery projects relative to a utility’s more traditional gigawatt-scale generation assets, makes outsourcing to third parties more attractive, he added.

Even in situations where utilities are able and willing to own storage, as is the case with PG&E, they often turn to third parties to develop turnkey projects that are kept off their books until the utility takes possession at completion.

“Until we get to where storage becomes an asset that utilities are more comfortable with, third-party ownership is a safer approach to procuring a huge amount of storage,” said Manghani.

Utilities benefit from third-party ownership, as it allows them to meet their storage goals with reduced risk. In the wake of the Aliso Canyon gas storage shutdown last year, for example, Southern California Edison was able to procure hundreds of megawatts of local capacity through third-party projects while avoiding many of the uncertainties involved in both project finance and the Southern California real estate market.

“At the end of the day, utilities are looking for specific services that storage is going to provide,” said Manghani. “The best model that we know of today to procure a service is through third-party contracts.”

In a typical third-party contract, a utility pays a fee to the asset owner to bring their system on-line during specified periods of supply shortfall. The owners are otherwise free to further monetize the asset by providing services to other customers. This represents one of the main drawbacks of third-party models for utilities: When they do not own their storage assets, they miss out on these potential revenue streams.

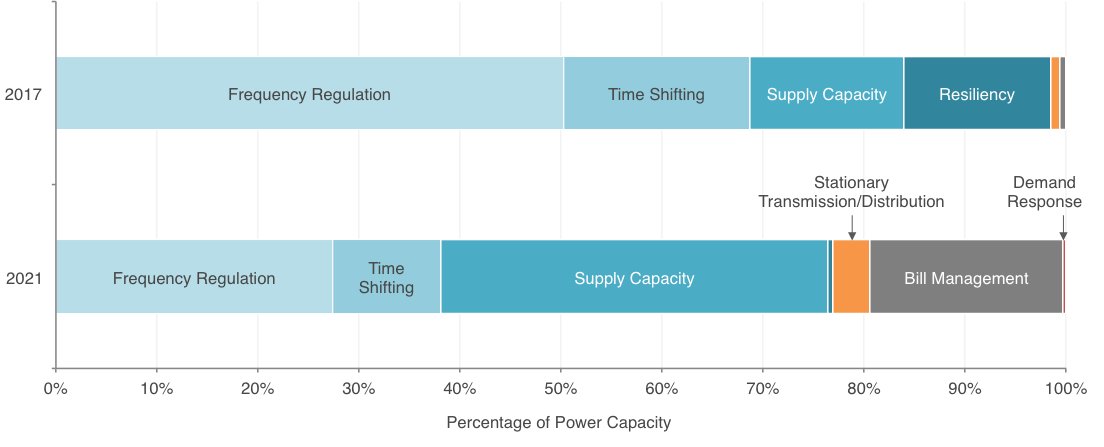

These new revenue streams are causing a shift in use cases for storage projects. In 2021, the top five portfolios are forecasted to shift away from the current emphasis on frequency regulation and resiliency toward supply capacity and bill management. This is largely a result of third-party-owned, behind-the-meter systems and changes in business models that link project finance to avoided customer costs.

FIGURE: Top 5 Storage Portfolios by Use Case, 2017 vs. 2021

Source: U.S. Department of Energy

From an industry perspective, this trend toward third-party ownership may lead to greater variation in on-the-ground deployments than one might see under a more utility-dominated market. For example, the third-party-owned pipeline projects of AES (100 megawatts) and Stem (85 megawatts) will provide SCE with identical peak demand and local capacity service on a megawatt-for-megawatt basis, but in reality these assets are very different.

The AES capacity will be deployed as a single installation, while Stem will field an array of behind-the-meter systems that may individually range in size from a few dozen kilowatts to multiple megawatts.

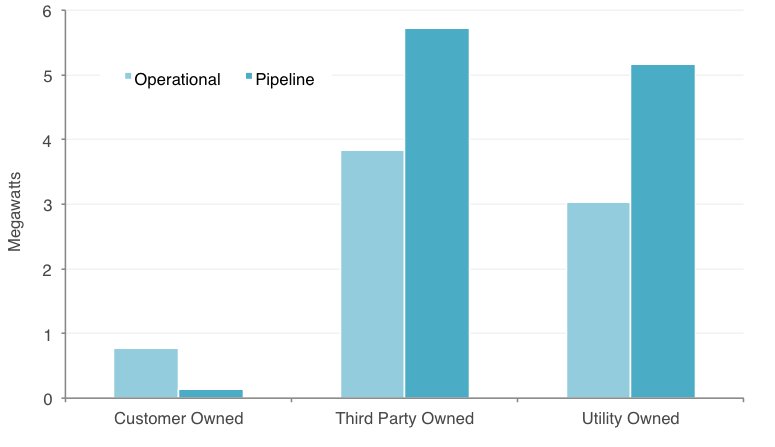

Despite this near-term trend toward third-party models, utilities may still come to play a larger role in storage markets, said Manghani. The average project size for both ownership models increases when looking at all pipeline projects in the U.S. Department of Energy's project database, but utility-owned assets are growing at a faster rate. The relative growth of utility-owned projects in the pipeline speaks to the learning curve that utilities are currently navigating, he added.

FIGURE: Average Storage Project Size by Ownership Model

Source: U.S. Department of Energy

“Looking 20, 30, 40 years ahead, there is a genuine case to be made that utility ownership will likely be the most dominant ownership model,” said Manghani. “They can leverage and optimize the [assets] to the best of their ability because they know their grid better than these third-party owners.”