In a major opportunity for large-scale energy storage, California last year announced a 3.3-gigawatt “all-source” procurement aimed at securing enough carbon-free grid capacity to allow the state to close coastal natural-gas power plants without threatening grid reliability.

This procurement represents a big expansion of the state’s clean energy resource mix, but it comes with some hard deadlines. Most notably, half of the total, or 1.65 gigawatts, must be brought online by August 2021. That gives the utilities, community-choice aggregators (CCAs) and third-party energy providers tasked with securing them less than a year and a half to pick winning projects, and even less time for those winners to build the projects they’ve promised.

To make it more complicated for the utilities responsible for much of the procurement, the California Public Utilities Commission (CPUC) intends to put the projects it picks through a lengthy approval process, including the opportunity for stakeholders to examine them and protest their environmental impacts or costs to ratepayers. This process, known as a “Tier 3 advice letter,” can take up to 6 months, and until it’s done, project developers can’t promise their financial backers or equipment suppliers that they’ll actually happen.

Last month, the California Energy Storage Alliance (CESA) trade group proposed a solution: shorten the timeline for approval by streamlining the process. Failing to do so, it warned, could “significantly endanger the ability of projects to achieve financing, permitting, procurement and construction milestones,” possibly leading to projects being canceled.

CESA proposed two options to the CPUC, which could take up the proposal within the next month. The first would be using a “Tier 2 advice letter,” which allows utilities to submit and get approval for less complex matters within 30 days, without a lengthy stakeholder review.

The second would be an “expedited” process for its Tier 3 advice letters, similar to the CPUC’s 2016 order to fast-track energy storage projects in response to the closure of the Aliso Canyon natural-gas storage facility, which allowed about 70 megawatts of energy storage systems to move from proposal to completion in less than six months.

CESA noted that the state’s three investor-owned utilities are on different schedules for picking winning bids. Southern California Edison, which the CPUC initially indicated would be the only utility required to secure resources, launched its request for offers in the fall, received offers in November, and on May 1 announced seven energy storage projects, totaling 770 megawatts of capacity, that it's asking the CPUC to approve.

But bankrupt utility Pacific Gas & Electric only opened its solicitation in February, giving it a very tight timeline to pick winners and announce them in May. And San Diego Gas & Electric has scheduled to file its Tier 3 advice letter by the end of August, leaving only 11 months from then to the 2021 deadline.

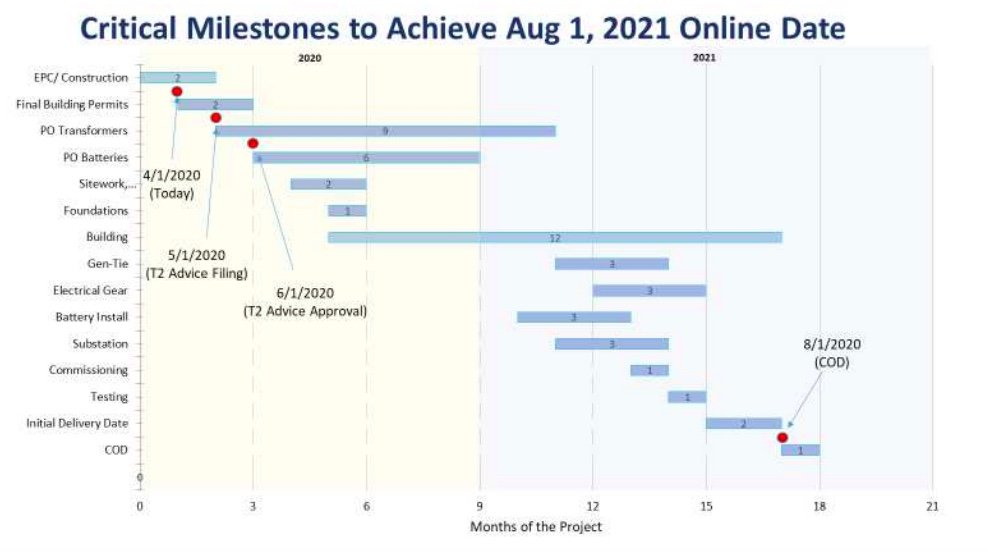

That’s barely enough time for a project that’s already secured financing, environmental and construction permits, and a generator interconnection agreement to move through key steps toward completion, as CESA laid out in the chart shown below.

CESA’s proposal has won the support of energy storage and renewable energy developers including Fluence, LS Power, LG Chem, NextEra Energy Resources, sPower, Recurrent Energy and RWE Renewables, providing a glimpse of the companies that may be vying for contracts to meet the CPUC’s mandate.

The compressed timeline could force financial backers of some of the lowest-cost projects to abandon them, James Mashal, market applications analyst at Fluence, said in an interview this week.

Fluence, a joint venture of Siemens and AES, is working with developers on competing projects, although Mashal declined to comment on them. Fluence has built or contracted for more than 500 megawatts of storage in California, including the 100-megawatt Alamitos battery project tied to an AES natural-gas plant in Southern California.

Those previous projects had far longer timelines, he said. Under the new, tighter deadlines, “my concern is, you could have a great project that says, ‘If you approve this in June, I’m good to go, [but] if you’re not approving until August or September, I’m walking away.’”

The coronavirus pandemic has added uncertainty to the process. LS Power, the developer of the 40-megawatt Vista battery project in Southern California, noted in its CPUC filing that the economic disruption from the pandemic has led investors to be “far more risk-averse."

Fluence’s filing stated it was “aware of at least two developers negotiating with an [investor-owned utility] that plan to walk away from their contract negotiation unless the approval timeline is shortened.”

The argument against expediting: Blocking loopholes

CESA’s push for speedy deployment of energy storage systems meant to replace four “once-through cooling” (OTC) natural gas plants on California’s coast has split opinions among the environmental groups involved in the proceeding. Some, including the Environmental Defense Fund, support the proposal. That group noted in its filing that failing to secure energy storage replacements could lead to the plants staying open for years to come, increasing carbon emissions and local pollution.

The California State Water Resources Control Board has already reluctantly extended its Dec. 31, 2020 deadline for closing the plants, which use seawater as coolant and expel it into the ocean at high temperatures that can kill fish and other marine life, in response to the CPUC’s request. Southern California Edison and state grid operator CAISO fear that shutting them down before finding effective replacements could leave the grid more vulnerable to blackouts or other disruptions.

But the Sierra Club and California Environmental Justice Alliance, which represent low-income communities subject to the pollution put out by the OTC plants and have fought to close them for years, have nevertheless asked the CPUC to reject CESA’s proposal in their filing.

At the core of Sierra Club and CEJA’s argument is the fear that Fluence joint venture partner AES, which owns three of the four OTC plants, may seek to extend their life by exploiting what the Sierra Club has described as a “loophole” in the rules for what’s allowed to replace them.

In March, the CPUC approved a major decision in its integrated resource plan — the same proceeding that created the 3.3-gigawatt procurement — that deals with setting the state’s long-term greenhouse gas reduction plans. As part of that decision, the CPUC removed a rule that would have allowed power plants to add new natural-gas-fired turbines at sites that also include energy storage, a move demanded by CEJA and the Sierra Club.

But the decision would still allow expanding natural-gas capacity at existing sites if they can reduce the rate of emissions by adding storage and using biomethane generated by rotting organic material and captured at landfills, dairy farms and other sites. That represents a possible loophole for projects being proposed for the August 2021 deadline, Luis Amezcua, senior representative for the Sierra Club Beyond Coal campaign, said.

And if the CPUC approves a blanket application of CESA’s expedited process to all projects, such a proposal could be approved with little opportunity for the public to examine its emissions-reduction claims or oppose it.

Instead, Sierra Club and CEJA are asking the CPUC to consider an alternative approach of looking at each proposed project on a case-by-case basis “to ensure that those projects which require more careful consideration (such as fossil fuel or biomethane projects that claim to be reducing GHGs and air emissions) are not expedited.” That could allow the majority of energy storage projects to move quickly and unimpeded, while focusing scrutiny on those that involve burning fuels, Amezcua said.

“There are a lot of creative things that the gas industry is trying to come up with to push back on the idea that their infrastructure is going to be a stranded asset,” Amezcua said, a nod to California’s 100 percent carbon-free energy by 2045 goals, which would appear to leave no room for gas-fired generation in its future.

Meanwhile, there’s another group that wants to retain scrutiny over projects that may be fast-tracked: California’s three investor-owned utilities.

In their jointly filed comments, they agreed that it will be “extremely challenging” for projects to meet the August 2021 deadline without changes to expedite the process. But they said that a Tier 3 advice letter process was still needed so that the CPUC could review and issue resolutions on key matters — specifically, “procurement and cost allocation for load-serving entities that opted-out of self-providing their procurement.”

That statement refers to the fact that the state’s CCAs, which are responsible for a growing share of the state’s future energy and capacity requirements, have the option of handing over their share of the 3.3-gigawatt procurement to utilities. While many of the state’s larger CCAs such as East Bay Community Energy and Los Angeles area’s Clean Power Alliance have sought out their own resources, smaller and more recently formed CCAs may not be positioned to take on the task.