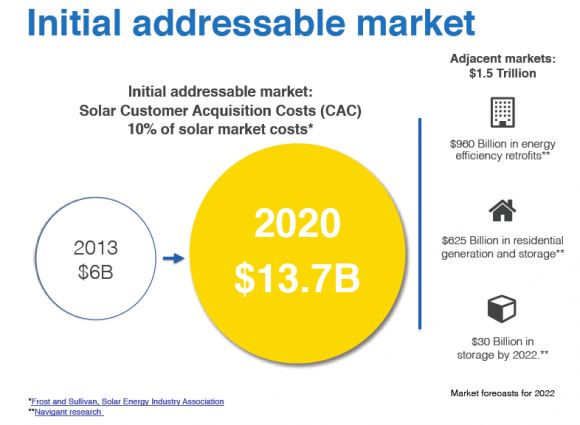

Customer acquisition can make up roughly 10 percent of a residential solar system’s total cost, according to GTM Research, making it a big target for solar companies trying to squeeze every penny out of their costs of doing business. Approaches range from more sophisticated marketing and lead generation models to software that can serve up instant solar quotes via online platforms and retail-store kiosks.

UtilityAPI is taking on another choke point in the solar customer acquisition process -- the cumbersome and time-consuming process of getting utilities to cough up their customers’ energy usage and billing data. Today, that involves phone calls, authorization forms and long waiting periods, a gauntlet that can turn some customers away and add significant costs to serving those that do stick with it.

UtilityAPI’s software can automate that process, allowing would-be customers to authorize the release of their data simply by filling in a few boxes on an online portal, CEO Elena Lucas said at Tuesday’s Cleantech Forum in San Francisco. From there, its application programming interfaces (APIs) can pull data from utility smart meter databases and back-office billing systems, and translate it into formats that solar companies need to determine which customers are a right fit for solar and which aren’t.

“Solar companies currently have to do, literally, a three-way phone call” with the would-be residential customer, solar rep and utility call center operator, to get permission to get the data in the installer’s hands, she said. Commercial customers have their own process, involving authorization forms to allow the installer to pull the data. Either way, getting the data back usually takes at least two to three weeks, and sometimes much longer, she said.

“It really mucks up the sales process, the relationship you have with the customer,” she said. “We try and take care of that beforehand.”

UtilityAPI’s blog lays out the step-by-step process its solar partners are using to simplify the process. First, they contact the prospective customer via email or text message, directing them to the startup’s web or mobile portal. From there, customers can log into their utility online portal or, if they haven't set up an account, input their name and address as it appears on their bill.

Once that’s done, the account will appear in the solar company’s UtilityAPI dashboard, allowing them to collect and present the customer's data with a mouse click. Importantly, that data has been converted from the often-unique formats that utilities use into formats that solar companies need, she said. That includes simple kilowatt-hour interval data from smart meters, as well as breakdowns of the tiered rates that California residential customers pay, and the demand charges and time-of-use rates that make up a significant part of a commercial customer’s bill, according to Lucas.

To date, the Oakland, Calif.-based startup has integrated with California’s big three investor-owned utilities -- Pacific Gas & Electric, Southern California Edison and San Diego Gas & Electric -- and plans to have seven more integrated by year’s end, she said. It raised $125,000 from Better Ventures in December, and has recently secured a commitment for $200,000 of a planned $500,000 funding round -- enough to hire one software engineer and one business development employee.

Since its September launch, UtilityAPI has connected 357 registered users, and is tracking more than 1,600 residential and commercial smart meters, working with an unspecified list of “some of the largest solar companies out there,” Lucas said. UtilityAPI charges $10 per meter to pull the 12-month historical data needed to determine whether a customer is a good fit for solar, as well as “derisking” the financing of a PV system, she said.

Ongoing monitoring costs $1 per meter per month, and can be used for a variety of purposes, she said. Those can range from helping resolve customer questions about why their bills don’t match their expectations, to delivering insight into whether they might be amenable to energy-efficiency services, energy storage systems, or other add-ons being built into solar companies' future business models.

Just how UtilityAPI's costs per meter compare to what solar companies have to spend to get the equivalent data today is hard to calculate, but it should be a lot less, according to Lucas. UtilityAPI is working with the Department of Energy’s SunShot Catalyst program, which has set a goal of driving down the “soft costs” of solar systems, to help measure those improvements. "Our goal, which is what we’re telling the DOE, is that we can reduce customer acquisition costs by a third,” she said.

UtilityAPI is also working with companies outside the solar space, including behind-the-meter energy storage providers and providers of technology to help agricultural operations monitor water and energy use, she said. “Really, all of the energy companies out there need this data,” she said.

For years, utilities have been working on delivering smart meter data to their customers and approved third parties through the Green Button Initiative. But progress has been slow, and hasn’t yet incorporated all the complex forms of data that go into calculating final bills, allowing third parties to use the data to collect revenue, and other key factors. That is opening space for companies like UtilityAPI to push the envelope on bringing their own versions of utility data to a broader audience -- and, perhaps, putting utilities at risk of being outpaced by companies that are populating homes and businesses with their own energy-aware technology.