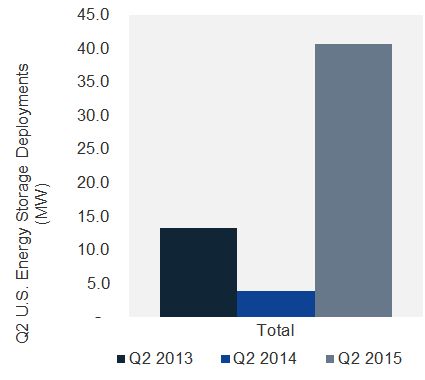

The U.S. energy storage market had its best quarter in two and a half years. According to the latest edition of GTM Research and the Energy Storage Association’s U.S. Energy Storage Monitor, 40.7 megawatts of energy storage were deployed in the second quarter of the year, a ninefold increase year-over-year.

Source: GTM Research/ESA U.S. Energy Storage Monitor

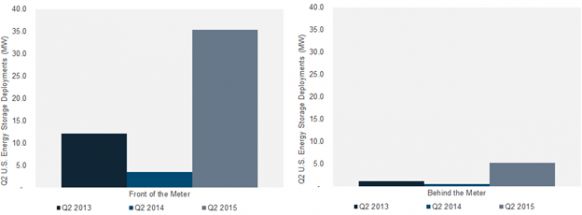

According to the report, the largest driver of the growth was the interconnection of a 31.5-megawatt project in the PJM region. It’s the single largest project to come on-line since the fourth quarter of 2012, when the 36-megawatt Notrees project was interconnected in Texas. The front-of-meter segment accounted for 87 percent of storage deployments during the second quarter of the year.

Looking behind the meter, the non-residential market had its best quarter in history, deploying 4.9 megawatts. A big share of this growth came from California, where the massive pipeline of SGIP-approved projects finally began to be interconnected. The residential market grew an impressive 61 percent over last quarter. However, it’s coming from a much smaller base than the utility and non-residential market segments and represented just 1 percent of the quarter’s deployments.

Source: GTM Research/ESA U.S. Energy Storage Monitor

The majority of storage deployed in the United States is concentrated in a few markets. The report notes that California is the largest market for both the residential and non-residential market segments. Since the first quarter of 2013, 1.3 megawatts of residential and 10.8 megawatts of non-residential storage have been deployed in California.

During the same time period, PJM (excluding New Jersey) saw the deployment of 100 megawatts of utility-scale storage. That’s more than four times what California, the second-ranked utility-scale market, has deployed since the first quarter of 2013.

According to the report, PJM and California will continue to be regional leaders for storage in the foreseeable future. However, the report is following policies across all U.S. states and highlights exciting advancements in Maryland, Oregon and Washington.

“It is promising to see that outside of PJM and California, 10 states had significant activity related to energy storage policies and programs in the last three months,” said Ravi Manghani, GTM Research senior energy storage analyst and lead author of the report. “This is a good sign for the industry, which has leaned on a handful of markets for its growth to date. We have states like Minnesota and Washington that are looking to grow their storage industries, while others like Massachusetts and New Jersey are using storage to modernize the grid and make it more resilient.”

“The number of different states that are actively engaging in energy storage shows that regulators, legislators and utilities are seeking innovative ways to deploy systems,” said Matt Roberts, executive director of the Energy Storage Association. “Advanced storage systems are being leveraged to increase reliability and resiliency in the Northeast, offset the need for ‘peaker plants’ in the Southwest, and help replace capacity and integrate renewables across the West. It’s a dynamic addition to the grid, and provides all of these benefits with each system install.”

To learn more, download the free executive summary here.

Key findings

- The U.S. deployed 40.7 megawatts of energy storage in Q2 2015

- The front-of-the-meter sector had its best quarter since Q4 2012, when the 36-megawatt Notrees project was interconnected

- Q2 2015 was the largest quarter ever for the non-residential segment

- The residential storage market grew 61 percent over last quarter, but represented only 1 percent of deployments in Q2

***

About U.S. Energy Storage Monitor

Delivered quarterly, the U.S. Energy Storage Monitor is the industry’s only comprehensive research on energy storage markets, deployments, policies and financing in the U.S. These in-depth reports provide energy industry professionals, policymakers, government agencies and financiers with consistent, actionable insight into the burgeoning U.S. energy storage market. www.energystoragemonitor.com