The following is a modified excerpt from GTM Research's recently published report, The Japan PV Market, 2012-2016. For more information on the report, click here.

The Japanese solar PV market is in a state of flux; since the market's inception, the ‘Big Four’ module suppliers -- Kyocera, Sharp, Sanyo (now owned by Panasonic), and Mitsubishi -- shaped PV in Japan while serving their primary suppliers. Now, foreign entrants such as Suntech, Canadian Solar, Yingli, Trina, and JA Solar, as well as Japanese newcomers such as Solar Frontier, threaten to dethrone the incumbents. While the country's new feed-in tariff (FIT), intended to develop the large-scale solar market, has positioned Japan as a center of global PV demand, the market's main driver is and will continue to be the residential sector.

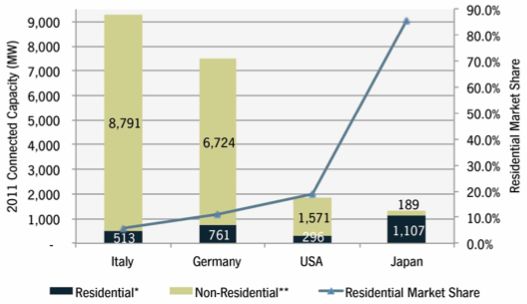

The figure below demonstrates just how powerful the residential market sector is in Japan (note that this figure defines the residential market as systems below 10 kilowatts-DC). Over 96 percent of the cumulative PV capacity in Japan is distributed, with the remainder being centralized PV plants. This merits the question, what supply chains have helped Japan become the largest residential market?

FIGURE: Residential Market Share for Major Markets in 2011

Source: The Japan PV Market, 2012-2016: A New Era of Solar or the Beginning of a Boom-Bust Cycle?

One of the primary inhibitors for the Japanese market has been its high system prices relative to other markets. Residential systems in FY2011 averaged ¥543 per watt (US$6.93 per watt) for retrofits and ¥472 per watt ($6.02 per watt) for new homes. Some of the major factors contributing to these high prices include:

-

Significant subsidy programs in combination with a lack of downstream competition allowing installers to charge high prices – in other words, padded downstream margins

-

Use of higher-cost, domestically produced panels and BOS materials

-

Preferential use of expensive products such as high-efficiency panels, panels with black or alternative backsheets, or triangular panels

-

High cost of acquisition of customers

- Expensive marketing schemes including television commercials

- Door-to-door sales

- Complicated distribution networks

- Relatively small system sizes (average of 4.34 kilowatts per home in FY2011)

-

Sales of products almost exclusively in kits

- Generally include monitoring and other high-cost items such as LCD screens for the monitoring systems

-

The Japanese yen is valued at a near all-time high compared to the euro or USD at August 2012 foreign exchange rates. This was true throughout 2011, as well.

- High labor costs relative to other countries

It is worth noting that black backsheets and triangular panels are often used as differentiators.

The sales and distribution channels in Japan are unique and relatively complicated and inefficient compared to European or American markets. Until very recently, there have been very few solar specialists in Japan, and one of the main sales channels has been through home builders. Compare this to the United States or Germany, where the vast majority of residential systems are installed by companies that specialize in solar installations.

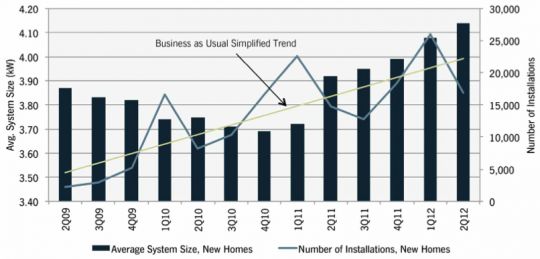

Many home builders integrate solar systems into the home during construction. In these cases, PV system costs are wrapped into the home mortgage. ‘Eco’ homes are now very popular, especially since the Fukushima disaster and resulting electricity shortages. Sales of home energy management systems (HEMS) and battery storage systems alongside solar systems are becoming popular as well. The percentage of new homes with solar in Japan is rising. The figure below demonstrates the growth of the new home starts solar market in Japan.

FIGURE: New Home Solar Integration Trends

Source: The Japan PV Market, 2012-2016: A New Era of Solar or the Beginning of a Boom-Bust Cycle?

This sales channel is very seasonal, and is dependent on the housing market as a whole. However, the figure above shows that the number of solar installations on new homes has been increasing by more than 55 percent per year since 2009. Housing data from the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) shows that the percentage of all new housing starts (including apartments, etc.) with solar was roughly 8 percent in 2011. We estimate that this number will increase to over 10 percent in 2012 and to nearly 15 percent in 2013.

It is important to note that the housing start data reported by the MLIT includes apartments in high-rise residential developments and other locations where solar is not feasible. The percent of detached houses with solar is therefore higher than we report. All of the top home builders now offer eco-homes equipped with solar and often HEMS and batteries, as well. GTM Research recently published a report titled The Smart Grid in Asia, 2012-2016: Markets, Technologies and Strategies which discusses EMS in Japan and forecasts that the HEMS market will reach $2.3 billion by 2015. Some of the largest homebuilders involved in solar include:

-

Sekisui Home

- 77.9 percent of its detached homes in FY2011 were built with PV or fuel cells

-

Sekisui Chemical

-

Daiwa House Co.

- Recently launched Endless Green Program

-

PanaHome (subsidiary of Panasonic)

-

Misawa Home

- 30.7 percent of homes in FY2011 were built with PV

-

Mitsui Home

- Mitsubishi Estate

Home builders such as Mitsubishi Estate or PanaHome naturally offer their own panels (Mitsubishi Electric and Panasonic, respectively); however, the others offer a range of products. We discuss the opportunities for entrance into this market in the full report. Home builders and remodelers also offer solar systems during remodeling and re-roofing and for pure retrofitting of existing homes.

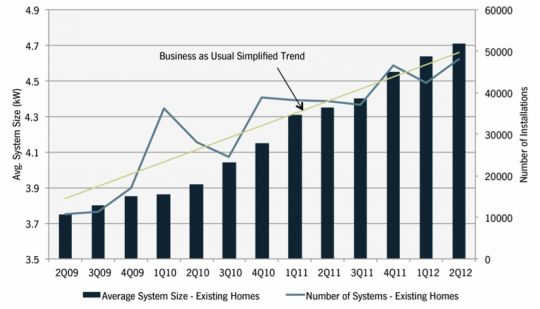

FIGURE: Existing Home Solar Integration Trends

Source: The Japan PV Market, 2012-2016: A New Era of Solar or the Beginning of a Boom-Bust Cycle?

As the figure above demonstrates, retrofitting existing homes is less seasonal and is very dependent on the availability of local incentives. This market segment has grown at roughly 90 percent per year since 2009. A home remodeler and trading company, West Holdings, is the country’s largest residential solar installer. These trading companies have shown a greater willingness to use foreign equipment than some of the other residential channels (discussed in detail in the report). In fact, West Holdings sells panels produced by domestic and foreign manufacturers (including JA Solar, Yingli and Suntech) as well as its own brand, E-Solar (using Eversol cells).

To learn more about GTM Research's The Japan PV Market, 2012-2016 report and to purchase a copy today, visit www.greentechmedia.com/research/report/japan-pv-market-2012.