The U.S. residential solar market is growing rapidly and undergoing a major transformation at the same time. A new acquisition, partnership, or project fund seems to be announced every week.

But what is the underlying trend here? For a while, many of us simply boiled it down to industry consolidation. The most recent developments, however, point to something even more specific: vertical integration.

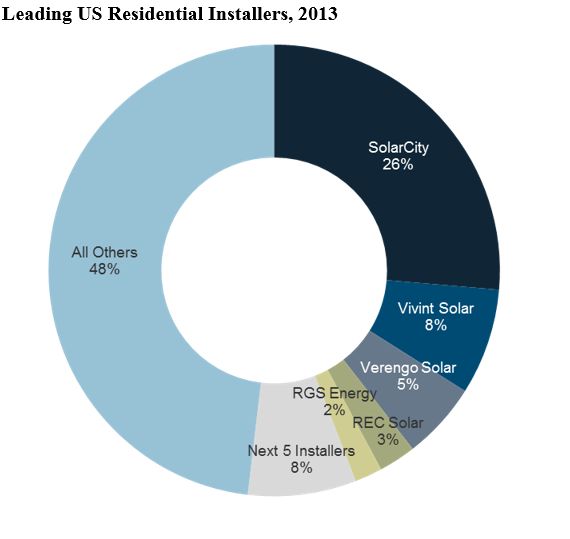

Source: GTM Research U.S. PV Leaderboard, Q1 2014

Follow the leader

SolarCity and Vivint Solar, the top two residential installers in the U.S., installed more than one-third of all residential systems in 2013 and raised more than half of the $2.3 billion in project funds announced last year. (We’ll discuss more finance trends in an upcoming update to last year’s U.S. Residential Solar PV Financing report.) The two companies have very different strategies, especially when it comes to acquiring customers. Vivint is known for selling exclusively door-to-door, while SolarCity has a diversified approach that includes retail partnerships, cold calling, advertising, and anything else you could think of.

However, there are two key similarities between these installers: they both primarily offer third-party owned solar (leases and PPAs), and they are the only two national, completely vertically integrated residential solar companies. Across these and other finance providers, the TPO model has proven easy to scale given the large addressable market of consumers who can afford a lease but not the purchase of a system. But does having control of both the project funding and installation give SolarCity and Vivint an additional advantage over their competitors?

Recent moves from several of their competitors suggests that it does:

- Sunrun and NRG Residential Solar Solutions are -- or rather, were -- two of a number of finance and service providers which own and operate systems but work with partners for installation. Each of these companies recently acquired one of their installation partners (Sunrun bought the residential division of REC Solar and NRG picked up Roof Diagnostics Solar), and while both plan to retain their existing partner networks, this is clearly a move in the direction of the SolarCity model. Having an internal installation team not only removes the installer profit margin, but also gives the finance providers visibility into the strategies of their competitors.

- On the opposite end of the spectrum, RGS Energy (formerly Real Goods Solar) is a leading national installer that uses companies like Sunrun for financing. However, last month RGS announced that it will develop an in-house leasing program for residential solar, noting that this will help the company “accelerate growth while benefiting from the long-term ownership of the solar assets.”

These companies have effectively created a hybrid model that signals two developing trends.

The Installer Trend

REC Solar, Roof Diagnostics Solar, and RGS Energy were all top ten residential installers that were either acquired or began raising their own project funds (full installer rankings are available in the GTM Research U.S. PV Leaderboard). It seems as though there is a tipping point at which one of these two options becomes the next logical step for a large installer. We'll be watching to see if companies such as Verengo, Solar Universe, Astrum Solar, and PetersenDean follow this trend -- especially since all have been expanding their geographic footprint.

The Financier Trend

As the industry becomes increasingly consolidated (the top ten installers already account for more than half of the market), many are asking if there is still room for the hundreds of small, local installers. The answer depends on the remaining third-party finance providers. While Sunrun and NRG are moving in the direction of vertical integration, SunPower, Clean Power Finance, and others appear to be sticking with their original business model -- at least for the time being.

The Outlier

So far, the only company moving in the opposite direction is Sungevity, with a business model very similar to that of SolarCity and Vivint, except for its use of subcontractors for installation. However, Sungevity hasn’t announced a project fund since January 2013. More recently, the company “formed an alliance” with Sunrun (translation: became a Sunrun installation partner) and is rumored to be working with CPF as well. Now that Sungevity is outsourcing both financing and installation, it’s beginning to look more like a project originator than an installer.

There are endless questions regarding these evolving business models, how the reemergence of solar loans will factor in, and what will happen to the long tail end of local installers. We’ll discuss them all on the panel “Opportunities and Threats in the Residential Solar Market,” featuring speakers from SolarCity, Clean Power Finance, Solar Universe, and Soligent, at the upcoming Greentech Media Solar Summit.

***

Nicole Litvak is a Solar Analyst at GTM Research, where she covers the U.S. downstream solar market with a focus on the residential and commercial markets. For more information on the market leaders, see the GTM Research U.S. PV Leaderboard.