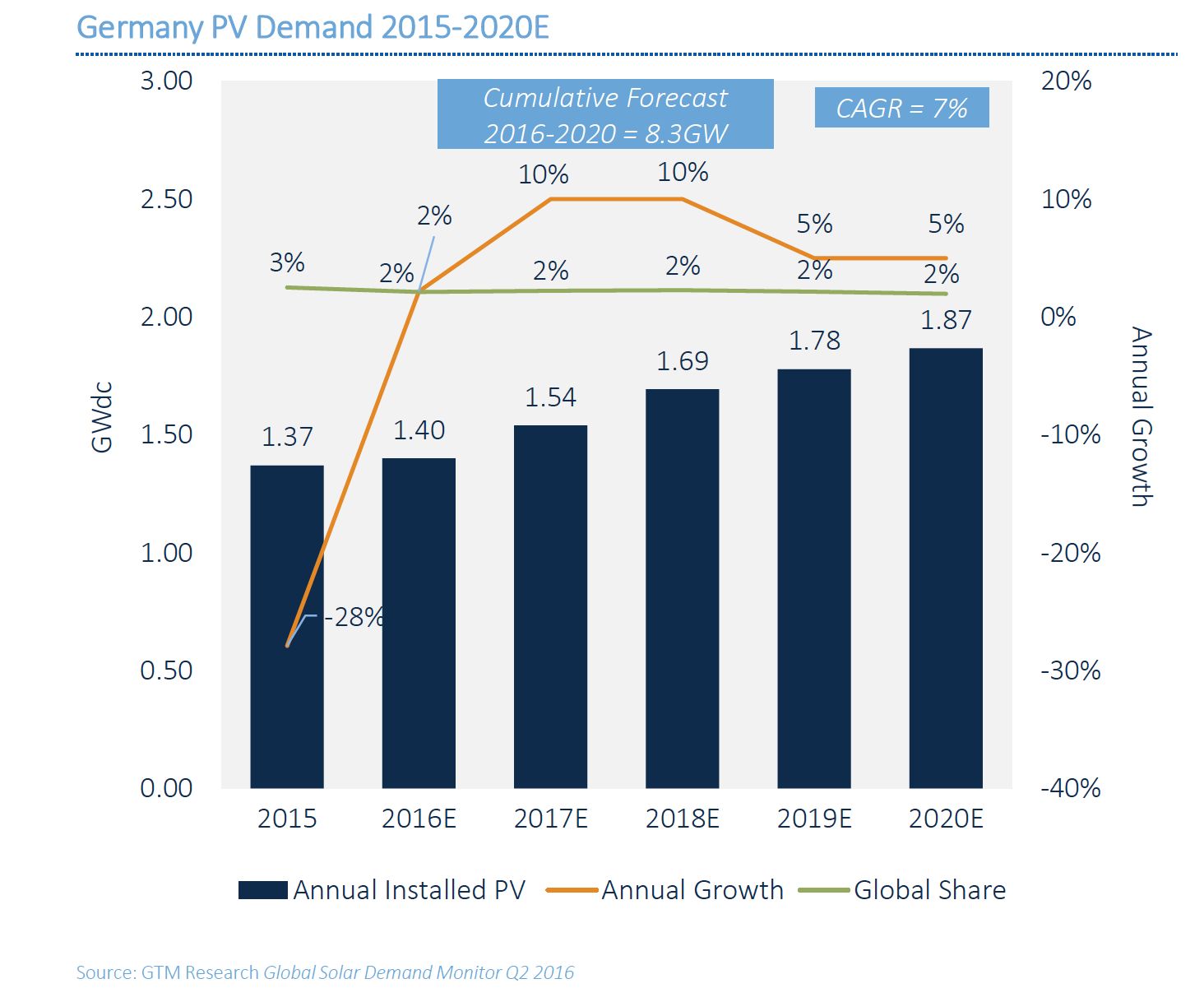

The German solar market is set for a return to growth. But the days when Germany led the development of PV worldwide are gone forever, according to GTM Research’s Q2 2016 Global Solar Demand Monitor.

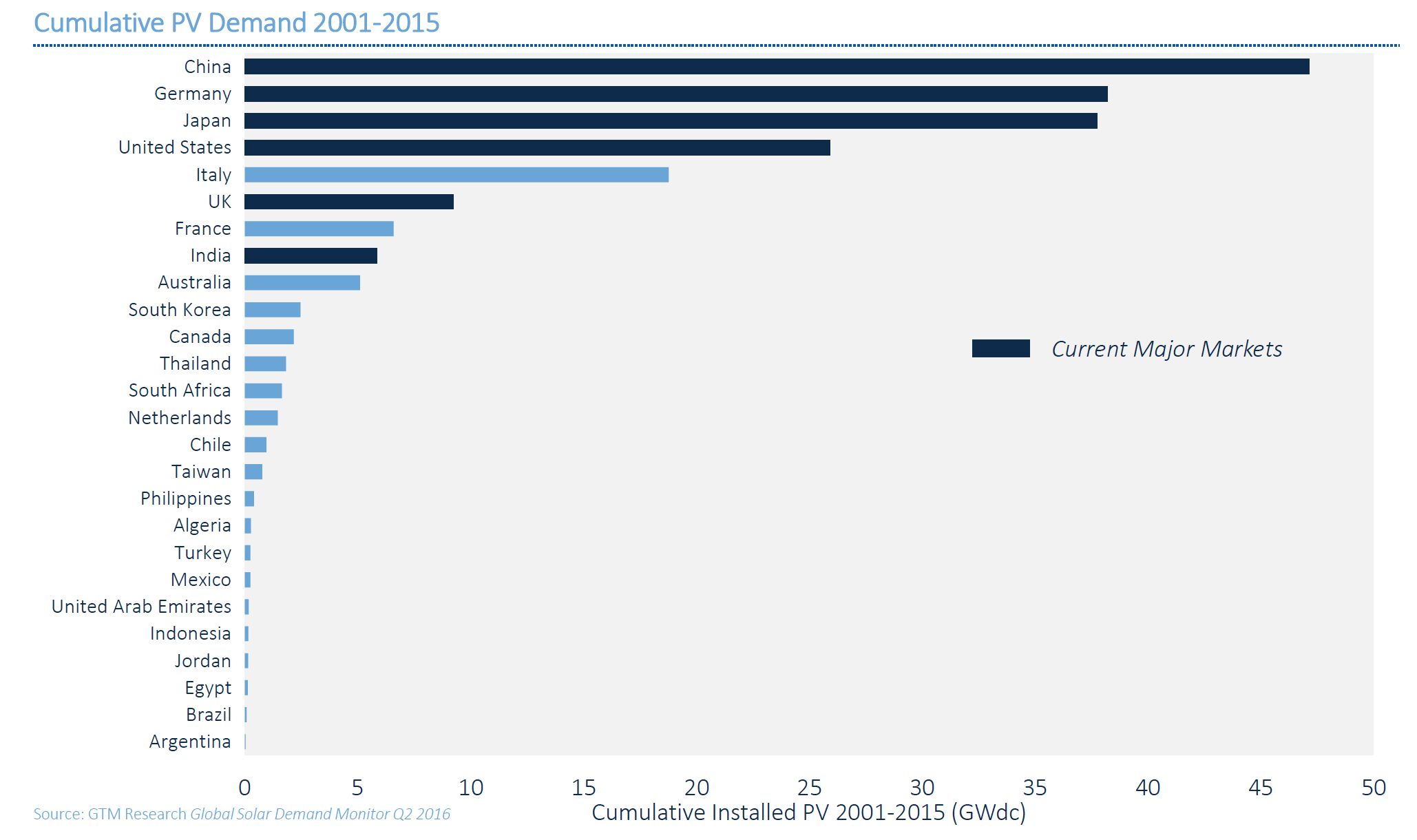

Germany is set to fall from its current position as the second-largest PV market in the world by cumulative installations -- currently behind China -- to below the top five markets between now and 2020.

Germany’s fall in the global solar industry rankings is understandable. The country’s PV sector took off in 2003, around a decade ahead of most other markets, and between 2006 and 2015 boasted a compound annual growth rate of 23 percent.

Feed-in tariff (FIT) cuts have lowered demand since 2013, however. That year, China outpaced Germany in annual installations for the first time. It has done so ever since. But German PV demand is set to grow this year, albeit at a modest 2 percent.

Things will pick up. The next two years will each likely bring a 10 percent annual increase in demand, “largely due to auctions,” according the Monitor.

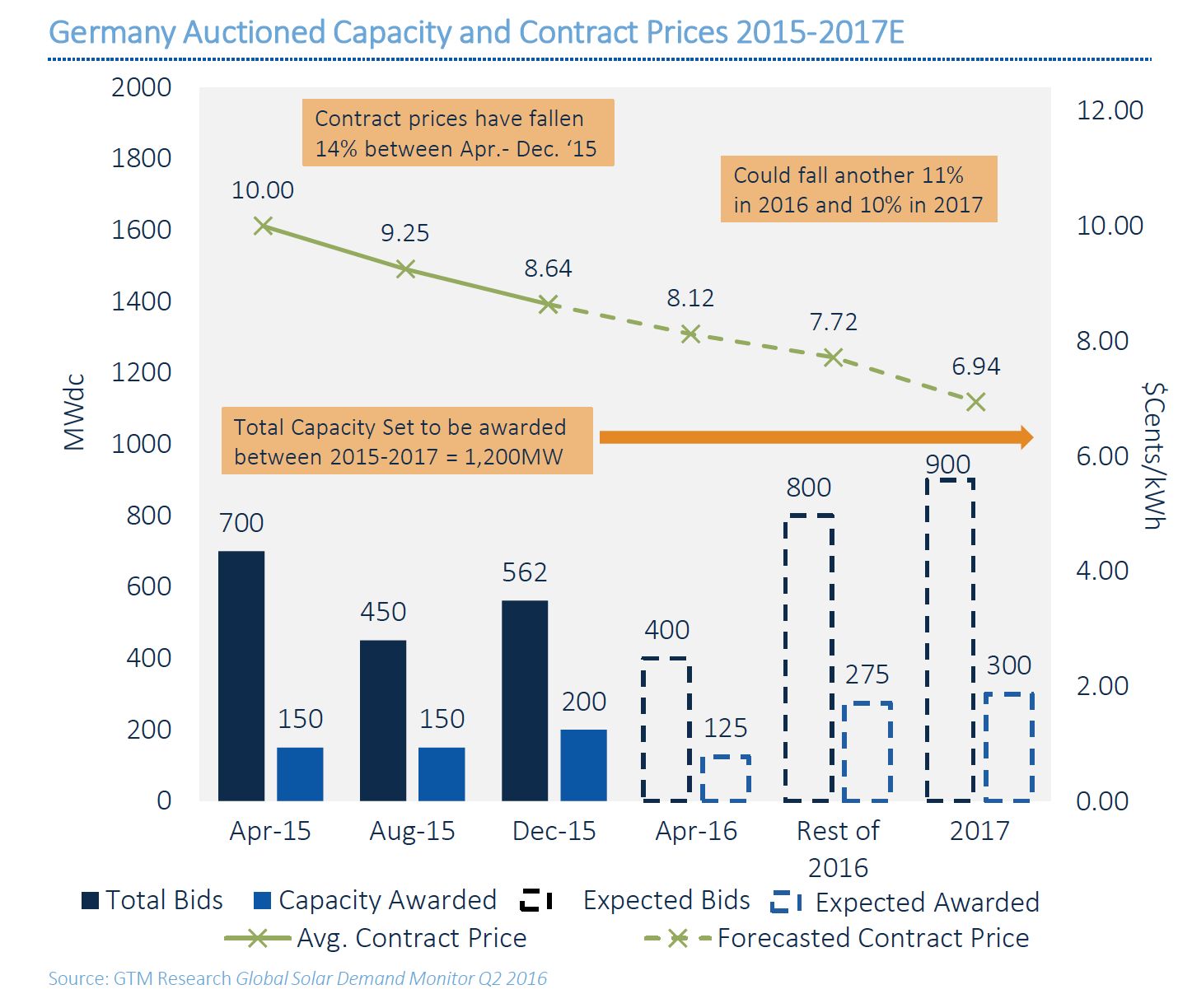

Auctions started last year for projects ranging from 500 kilowatts to 10 megawatts. This range was extended downward, to 100-kilowatt plants, in January 2016. FITs have now been removed for all solar projects over 100 kilowatts.

Instead, owners can either sell directly into energy markets or bid for capacity in tenders that saw 500 megawatts auctioned in 2015, followed by 400 megawatts this year and 300 megawatts in 2017.

Last year’s auction pushed the German PV market back into growth mode, the Solar Demand Monitor notes. The auctions are also helping to chip away further at German PV costs.

Last year tenders were up to four times oversubscribed, which resulted in a 14 percent cut in average power-purchase agreement (PPA) contract prices, from €0.0917 (US $0.010) per kilowatt-hour in April to €0.08 (US $0.0864) per kilowatt-hour in December.

GTM Research expects contract prices to fall even further, declining by 11 percent this year and 10 percent in 2017, as competition results in projects with internal rates of return as low as 4 percent on the back of additional system cost reductions and super-low interest rates on bank loans.

Installations in the distributed generation segment have fallen short of government forecasts. This has led policymakers to extend FITs for sub-100-kilowatt installations and to continue offering a rebate for residential storage.

The removal of FITs for larger plants and continued FIT support for smaller installations is expected to affect growth across distributed solar.

Demand for commercial-scale plants, from 20 kilowatts to 1 megawatt, is expected to fall, while residential-scale installations below 20 kilowatts will rise slightly.

GTM Research believes that a higher-than-expected rate of installations this year could trigger a downward FIT review and that commercial projects no longer eligible for FITs might not be able to win auctions because of their lower efficiency compared to utility-scale solar.

In the long term, according to the report, “There is no clarity on auctions for large-scale projects beyond 2017 and little indication that corporate PPA or merchant sales business models will work by then.”

German solar insiders have also voiced concerns about the long-term outlook, even though “we believe GTM's forecast is in line with the market potential,” said Rasmus Friis, Conergy's regional head for Europe, Middle East, Africa and India.

“Germany will not meet its targets with this pace of new installations,” he said. “In the German Renewable Energy Act of 2014, the federal government set down an annual target of 2.5 gigawatts. In order to meet most or all of our energy demand with renewables, then a total of approximately 200 gigawatts of PV capacity must be installed by 2050. To reach this amount by 2050, an average of 4 gigawatts to 5 gigawatts of PV must be installed annually.”

Falling solar-plus-storage costs may help plug that gap, at least in the residential and small commercial segments, the Solar Demand Monitor notes. In addition, “Banks might start financing corporate PPAs as such projects become more common,” it states.

Even as Germany’s solar market approaches saturation level, there will be a continued need for new installations. “With time, older PV systems must increasingly be replaced,” Friis said.

“As yet, replacements have not played a large role. When the targeted capacity of 200 gigawatts of PV has finally been reached, estimates show that 6 gigawatts or 7 gigawatts of PV will have to be replaced per year. Therefore, repowering is one of the trends for the future,” he added.