EnviroMission (ASX: EVM; Pink Sheets: EVOMY), a firm we've covered recently, has secured $29.8 million in debt and equity from AGS Capital Group.

According to a press release, the debt/equity agreement "will provide EnviroMission with the ability to place EnviroMission securities with AGS Capital Group on an as-required basis or at intervals when market conditions support a debt/equity transaction."

The funds are for working capital for "site-specific front-end engineering and design currently being undertaken by Arup for Solar Tower development in the United States."

"This funding will allow EnviroMission to complete the next critical stages of development with confidence that there will be adequate financial means to deliver Solar Tower development through to ultimate project financing," according to the firm's CEO, Roger Davey.

See below our article from November of last year.

***

Southern California Public Power Authority (SCPPA) has approved a Power Purchase Agreement (PPA) with EnviroMission Limited to purchase power from EnviroMission's Solar Tower power station development planned for Arizona.

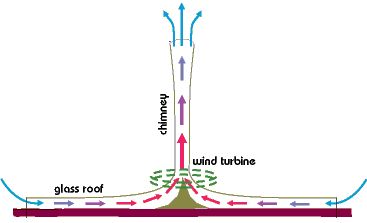

The "solar tower" is a straightforward idea. A massive tower funnels hot air driven upwards by a temperature differential and spins turbines at the base of the tower to create electricity. It's been demonstrated at a small 50-kilowatt scale in Manzaneres, Spain. But to make it a reality at utility scale, the tower needs to be 800 meters to 1,000 meters high (as a reference point, the Empire State Building is 373 meters high) and constructed of reinforced concrete or some other durable material. The collector base -- in effect, the real estate around the tower -- needs to be miles in diameter. Enviromission itself described a proposed project in Australia stretching 1,000 meters high, 130 meters in diameter and with a 5-kilometer diameter collection area. As with all projects of this size, there is a considerable amount of embedded energy in the infrastructure itself.

David Gelbaum's Quercus Trust was an investor in 2007 as per this SEC document.

After years of attempting to get this eighth wonder of the world financed and built in Australia, EnviroMission shifted its attention to the American Southwest and established a U.S. entity in 2009.

I spoke with Kim Forte, General Manager, Communications of EnviroMission Limited and she attributed the firm's difficulties in Australia to less-than-helpful government policy and the sway of vested coal interests.

In June 2009, EnviroMission filed two land applications in the U.S. for two prospective 200-megawatt solar tower developments in Arizona. EnviroMission's Chief Executive, Roger Davey, claims that the 200-megawatt unit can be built for $700 million. Mr. Davey's annual compensation at this non-revenue generating company is $336,104, and Ms. Forte's is $209,161, according to this Reuters data.

The company is now celebrating a milestone: convincing SCPPA to agree to approve a PPA for power from the EnvironMission project. SCPPA is a California joint power authority made up of eleven municipal utilities and one irrigation district. Its members deliver electricity to approximately two million metered accounts over 7,000 square miles to a population of nearly five million people. EnviroMission is working with engineering firms to do the front-end engineering work.

This kind of PPA makes for exciting press releases, provides hope and maybe a stock bump for the company and some green PR for the utility. But the utility has little risk. EnvironMission did not provide the terms of the PPA but we can assume that EnviroMission must provide X megawatts at a specific kilowatt-hour price, and if the company doesn't build it or meet the price -- the utility doesn't buy it. An example would be PG&E's PPA with space-based solarnaut Solaren or even the three-megawatt PG&E PPA with CPV aspirant GreenVolts. PG&E had even larger PPAs with Optisolar and Ausra with more conventional solar technologies, but when circumstances changed, First Solar came in, and swapped out the original technology for proven photovoltaic technology.

The project would face significant challenges in the permitting process in California because of the environmental impact of the canopy's expanse and a number of other factors such as visual impact. The Air Force and the FAA might have issues with the height of the structure, as well.

Forte wrote in an email, "Whilst details of the PPA are at this moment in confidence, it is fair to assume that the basis of the PPA provides an arrangement for the purchase of economic stable green electricity from EnviroMission that will also meet commercial criteria for EnviroMission; anything less would not justify either party entering into an agreement."

The scale and simplicity of this design are inspiring. But, how does a project developer deliver a project book for a kilometer-high solar tower or an orbiting space-based solar station to a financier? What bank or financier takes on this type of project when earth-based (and reality-based) solar projects are available and already challenging enough?