In January, First Solar made headlines when it acquired a small developer in Chile with a 1.5-gigawatt pipeline of solar projects. The goal, said First Solar, was to tap into markets where solar is competitive without subsidies.

With an energy-intensive mining sector accounting for one-third of the world's copper and a massive dependence on imported fossil fuels, Chile's electricity prices are very high. In 2012, some consumers were paying an average of $0.25 per kilowatt-hour on the spot market. Solar companies recognizing the need for cheaper, domestic generation in Chile have planned for more than 6 gigawatts of projects -- some of which could cost less than $2 per watt to develop.

But there's a big difference between planned projects and executed projects.

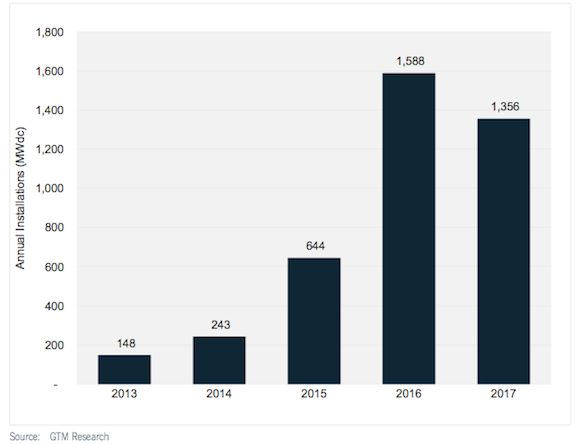

The actual number of installations over the next few years will be smaller than initial project pipelines suggest. Last month, GTM Research released an analysis of the Latin American solar market. Below are some of the major takeaways on the prospects for Chile, which is by far the biggest growth market for the industry in the region. (And for a much more detailed explanation of the market dynamics in the region, you can get the full report here.)

1. Installations will grow strongly in Chile, but it will take many years for the 6 GW of project announcements to materialize.

So far, only 3.9 megawatts of PV projects have been installed in Chile. There are another 30 megawatts currently under construction and 127 megawatts with agreements to sell electricity directly to offtakers. But as GTM solar analyst Andrew Krulewitz explains, that still leaves a lot of gigawatts undeveloped.

"Most of these projects are nothing more than a tentative land-use agreement and a project prospectus that has been submitted to Chile’s environmental permitting agency. Developers are jockeying for land closer to transmission lines in the hope that interest from offtakers increases," says Krulewitz. Even so, Chile could see between 1.3 gigawatts and 1.5 gigawatts developed after 2015.

Although the economic case for solar in Chile is compelling, there are numerous reasons for the modest growth: an extraordinarily complicated electricity market; a pipeline of coal plants that is making offtakers hesitant about signing long-term agreements for solar; and a lack of financing.

For the time being, a lot of the early activity is all about grabbing land.

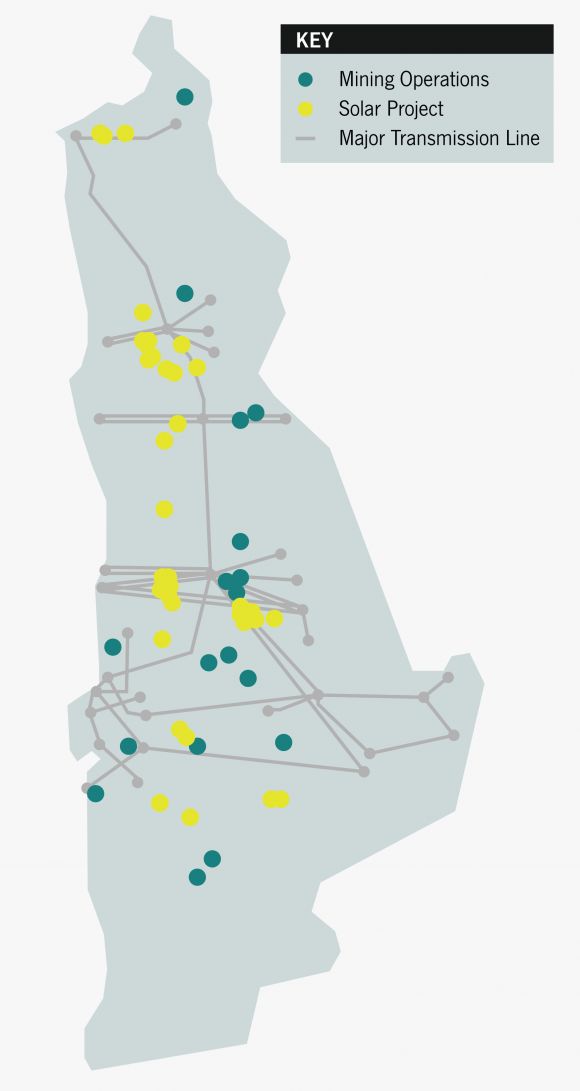

2. Initial development will focus on the mining sector, but larger projects will sell into the spot market.

Mining companies in Chile, which are the country's biggest consumers of energy, are showing interest in buying solar electricity that is cheaper than conventional sources on the spot market. SunEdison recently signed an agreement with the Chilean mining company CAP to supply electricity from a 100-megawatt plant -- the largest so far in Latin America. These offtake agreements are essential to the financing and eventual construction of a project; despite high spot prices, there is uncertainly surrounding long-term pricing and financiers are unwilling to participate in such a volatile market.

Similarly, many mining companies are still wary of signing agreements for variable power from larger projects projects out of fear that they'll have to go back to the spot market if the system does not produce an adequate amount of electricity. This may present new opportunities for Concentrating Solar Power plants with storage, even though they are more expensive to build than a PV plant.

"Many of the small projects that have come online in Chile are co-located with the offtaker or are in close proximity," says GTM's Krulewitz. "This allows them to bypass the complicated electricity market, which is highly competitive yet also heavily regulated, including the pricing of electricity. As evidenced by the map, many of the larger projects are not adjacent to offtakers, implying that they will sell electricity into the volatile spot market. In this case, knowledge of Chile’s electricity market will prove essential to signing an offtake agreement and arranging for financing."

Which brings us to the third point.

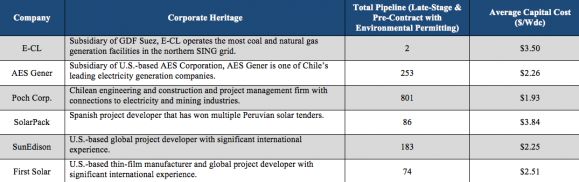

3. Only the most sophisticated companies will be able to navigate Chile's complicated electricity market.

Seeing the potential in Chile, a variety of companies from the U.S., Asia and Europe that are opening operations in the country. But only those with significant international experience and good partnerships with companies that already understand Chile's electricity market will win out. In the chart above, GTM Research outlines five companies that are likely to succeed: E-CL, AES Gener, Poch Corp., SolarPack, SunEdison, and First Solar.

"The companies that GTM predicts will be likely winners in Chile are those with significant experience interacting with the Chilean electricity market or experienced international solar developers," says GTM's Krulewitz. "In many cases, as evidenced by SunEdison performing EPC duties for E-CL’s 2-megawatt project in Arica, coordination between an experienced solar developer and a knowledgeable local partner will be key in finding success the early stages of this developing national market."

E-CL, AES Gener, and Poch Corp. are large-scale conventional power plant developers with a deep understanding of Chile's market (and in the cases of E-CL and AES, owners and operators); Solarpack has been a major presence in the Peruvian solar industry and was one of the first companies to get a bilateral power purchase agreement for a 1-megawatt plant in Chile; and both SunEdison and First Solar have significant experience working with local companies in emerging markets around the world.

The opportunity is clear and companies are moving to take advantage. But for now, expect Chile to realize steady growth -- not the explosive growth that early project pipeline announcements would suggest.

To learn the ins and outs of the Latin American solar market, make sure to check out GTM Research's report, Solar in Latin America & The Caribbean 2013: Markets, Outlook & Competitive Positioning.