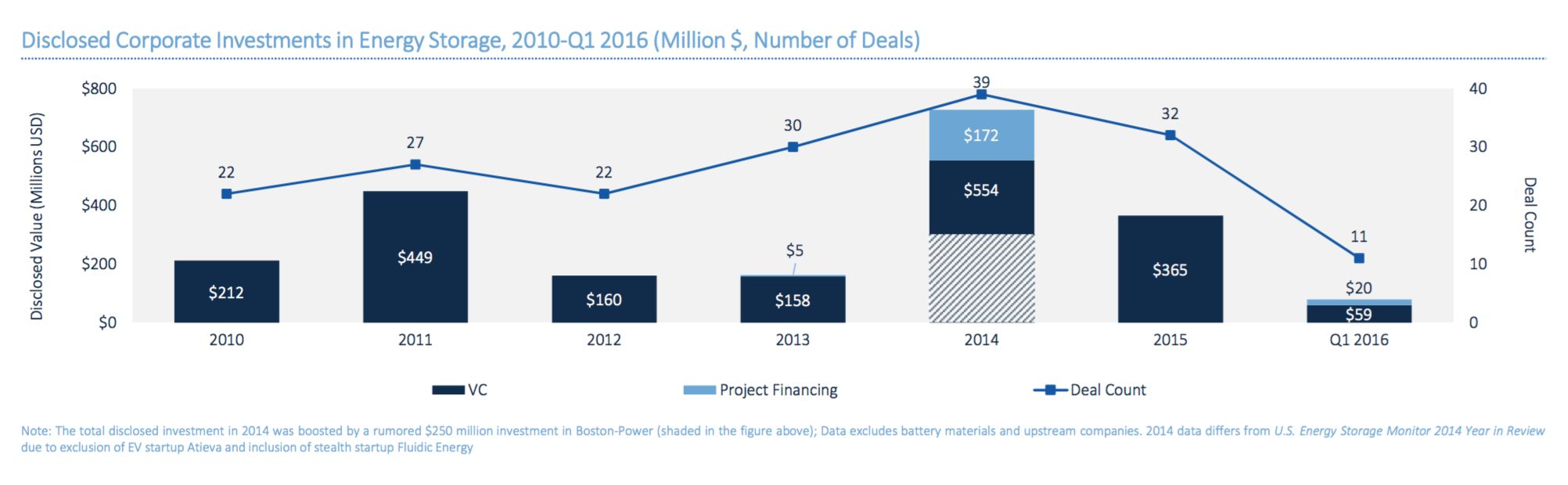

The American energy storage sector kicked off 2016 with a marked increase in corporate investments, according to GTM Research and the Energy Storage Association’s latest U.S. Energy Storage Monitor. First-quarter investments of $79 million marked an increase of more than double compared to the same period last year. Of that money, $20 million came as project financing.

It's worth noting that with a relatively small number of disclosed deals each year (39 in 2014 and 32 in 2015), a few big investments can significantly sway the quarterly tally. The largest of the 11 disclosed deals from Q1 2016, the Series C investment in Sunverge by Australian energy retailer AGL Energy and Japanese trading house Mitsui, totaled $36.5 million. That's almost half of all corporate investments for the quarter. Still, the numbers indicate there is more growth to come, said Ravi Manghani, GTM Research’s director of energy storage and lead author of the report.

"Any time you see a doubling of investment, it indicates there is more interest in the market," he said. "Although you’re starting from a very small base, it indicates it’s an industry on an upward trajectory."

If investments continue at this pace through 2016, Manghani said, we can expect the total financing to achieve a similar scale as the last two years, which both exceeded $350 million.

The makeup of the investors is changing as well. There were 24 deals from 2015 and Q1 2016 that disclosed the investors, and traditional energy and utility companies were involved in eight of them. That cohort includes heavy-hitters like NRG Energy, Statoil, RWE and E.On.

"More and more, we are starting to shift away from purely strategic investors being interested in storage to utilities or venture arms of utilities starting to look at storage in a serious way," Manghani said.

Strategic coupling

The year has been fruitful for storage companies in search of significant others. The partnerships, consummated in the form of contracts or memoranda of understanding, fall into two major categories: hardware vendors linking up with companies that operate upstream or downstream in the supply chain, or vendors joining with installers. The goal is to shore up the supply chain that runs from raw ingredients to storage systems and from storage systems to customers.

In the former category, for instance, South African mining company Bushveld Minerals Limited signed an MOI in April with UniEnergy Technologies to connect its vanadium, titanium and iron ore resources with the energy storage market.

There were numerous examples of storage producers teaming up with installers. In February, Adara Power (formerly known as JuiceBox Energy), the maker of an 8.6-kilowatt-hour lithium-ion storage system, partnered with solar installer Simmitri. The following month, Adara partnered with Bombard Electric's renewable energy installation division to supply storage in Las Vegas and southern Nevada.

Simmitri also partnered with Sunverge in March to provide the latter's Solar Integration System for residential and commercial customers. The offerings include 7.6-kilowatt-hour and 11.2-kilowatt-hour energy storage systems. That same month, Enphase inked a deal to become residential solar financier Spruce's inverter supplier of choice for home solar systems. That opens the door to Spruce using Enphase storage down the road.

In April, Verengo Solar became home battery dealer Swell Energy's installer of choice for residential energy storage. Flow battery producer Primus Power announced it was partnering with power management company Eaton to bring its product to non-residential and utility customers.

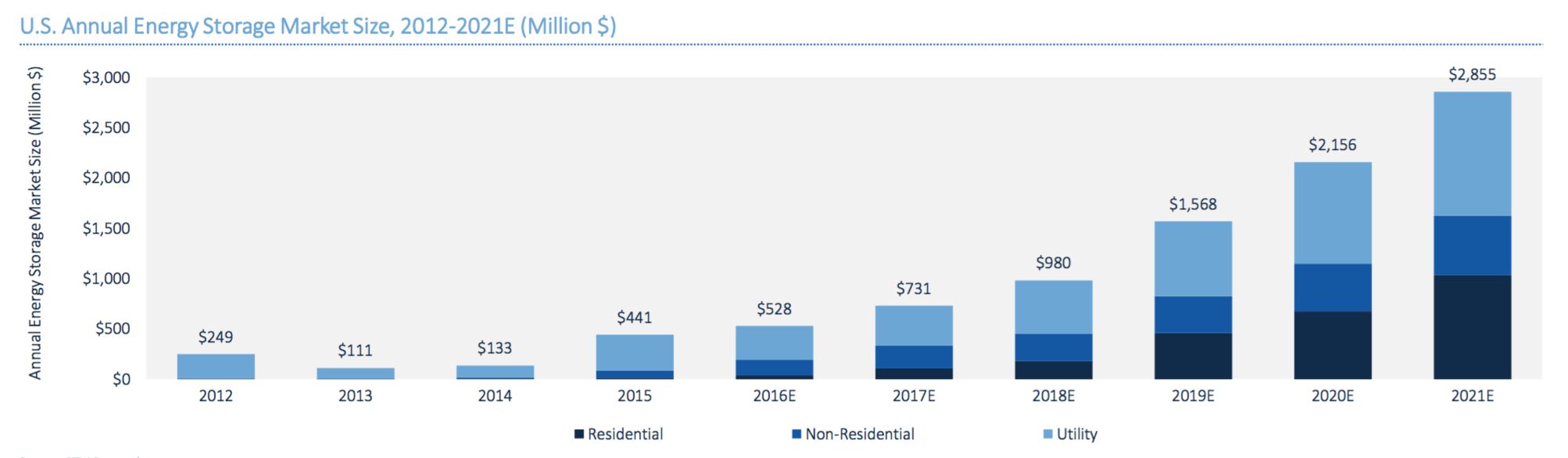

These new corporate relationships are a sign of the industry maturing and becoming more efficient, Manghani said. They will continue to play a role as the U.S. energy storage industry grows from $441 million in 2015 to a projected value of $2.9 billion in 2021.