Trina Solar was selected to supply multicrystalline silicon modules for Sempra Energy’s 345-megawatt Copper Mountain 3 project -- and that could be a signal that PV module prices are flattening.

“The lowest prices for modules have been in the large-scale utility projects,” Trina Americas President Mark Mendenhall explained. “We didn’t participate a lot. We felt we could give up share in that segment until the market stabilized.”

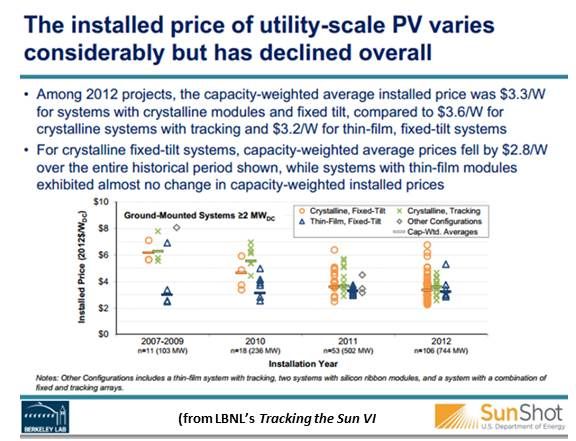

Trina has been focused on the residential and commercial segments. “There was a gap in the relative costs,” Mendenhall said, “that made thin film and other technologies more competitive in utility-scale solar.”

But today's low silicon module prices make balance-of-system costs more significant than module costs. “The value of our multicrystalline PV efficiency became more important,” Mendenhall said. “And the number of gigawatts we have installed has reduced the perceived risk and increased the financeability of a project with our technology.”

Also, he added, consolidation has left fewer manufacturers capable of providing the 1.1 million high-quality modules needed by AMEC, the Copper Mountain EPC provider. The module order must be met for the Q1 2015 construction completion target to fulfill Sempra’s contracts with the Los Angeles Department of Water and Power and the City of Burbank.

Trina’s direct competition right now in the utility-scale space is from Yingli (YGE) and Canadian Solar (CSIQ), Mendenhall said. First Solar (FSLR) (which built the 55-megawatt Copper Mountain 1 for Sempra with its thin-film modules) and SunPower (SPWR) are the leaders in the segment, he acknowledged, but they use different technologies and have different business models that include EPC operations.

Mendenhall expects module prices to be stable, he said, because “there are continuing forces at work reducing costs, but also forces at work pushing the price up.”

The first factor driving the price up, Mendenhall said, is the U.S.-imposed tariff on solar products imported from China. According to last year’s Commerce Department decision, varying tariffs are required, based on the degree of each company’s dumping history.

“Our 24 percent tariff has been in effect for over a year now, and it has prevented us from deploying the high-efficiency honey-cell technology we invested in,” he explained. ”Because the tariff is a burden the market cannot bear, we had to develop strategic relationships with Taiwan cell suppliers, and it adds cost in the supply chain. That is driving up prices in the U.S. and cutting off access to technology the rest of the world has.”

Trina has remained competitive, Mendenhall said, but “if there were no tariffs, costs would be lower and it would be easier to build and finance more solar.”

The Taiwan cells don’t have the advantages of the honey-cell technology Trina sells in Europe and the rest of the world. “For the U.S. market, we are buying high-efficiency cells from Taiwan, but the total yield and the cost are not the same.”

The EU and China just reached a settlement that prevented the imposition of tariffs there. The settlement is not perfect, Mendenhall said, “but it does reflect the desire for cooperation and allows European solar to continue to grow.” Historically, Europe has been the world’s largest solar market and has obtained 60 percent to 70 percent of its solar from China. “You can’t eliminate a big part of that and have the market continue to grow.”

The deal will, though, will have an impact on prices and some projects won’t get built, Mendenhall said.

Under price and volume limitations, Trina will be able to sell Chinese-produced cells and modules into Europe. The deal sets a per-watt price of 53 euro cents to 54 euro cents (which equates to $0.73 to $0.74 per watt), according to Mendenhall. “That is higher than the market price. If it becomes the floor of the market, the unknowns will then be how much Chinese supply gets in, how much European supply becomes available, and what the price will be.”

Prices are unlikely to drop in the next year or two, Mendenhall said, because it will take time for Europe to grow manufacturing capacity to meet existing demand. “And since Europe represents 40 percent to 60 percent of the global market, whatever happens will have more than a ripple effect on the world price.”

Though manufacturers are finding ways to work with both tariffs, Mendenhall said, everyone would prefer “a global grand deal” with an open market and fewer complications, Mendenhall said.

For now, the tariffs are pushing prices up, oversupply is keeping them down, and the result is a temporary rationalizing of price. “We have to make a reasonable sustainable margin,” Mendenhall said.

As the current consolidation resolves, competition will return. “We are coming back to a more even matching between demand and supply. We expect prices to go back down, but it is not clear when and on what slope” that will happen. And there may be a hiatus of flattened pricing before the next price drop, he added.

“Expectations of returning to the last two years of price drops are not consistent with reality. It will be slower,” Mendenhall said. “In the long term, prices will come down, but they will likely follow a more traditional technology learning curve. “