SunPower had "another strong quarter" in the words of Tom Werner, CEO of the vertically integrated solar company. This quarter's positive news comes after very recent funding announcements: a $250 million Google tax equity partnership and a $42 million non-recourse debt structure with Hannon Armstrong.

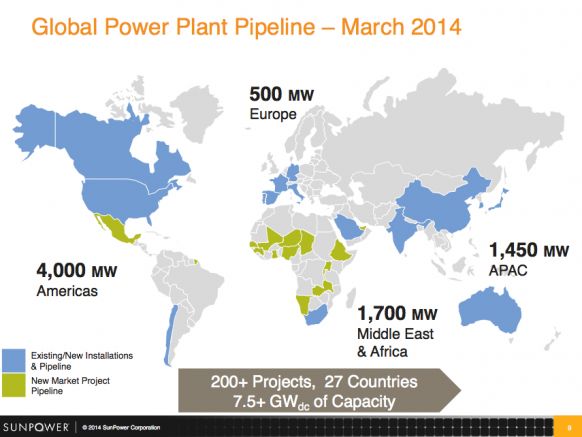

The company claimed strength in all regions and markets and described a pipeline of more than 7.5 gigawatts. Werner cited 300 megawatts of projects won because of stakeholder Total's involvement. The company noted, "We also expanded our footprint in France, where 44 megawatts of recently awarded French tender projects specified SunPower's technology." Werner also spoke of growth in the low-concentration C7 business in China.

The new 350-megawatt Fab 4 cell facility is "on track" to produce 50 megawatts to 100 megawatts in 2015 and more than 200 megawatts in 2016, according to the CEO. Werner spoke of a high-growth market with stable prices that urged rapid completion of the plant -- even as the firm is already evaluating locations for its next capacity expansion. A "pre-production" cell "incorporating Fab 4 technology" hit more than 25 percent efficiency, as measured by NREL.

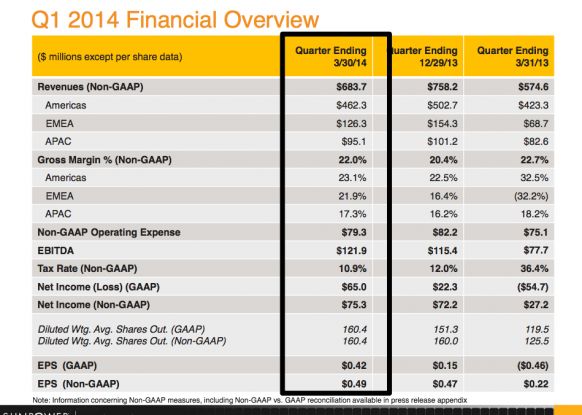

SunPower's CFO Chuck Boynton said that the firm "beat plan" in all regions and markets, that the factories are running at full utilization and that inventory is at a two-year low.

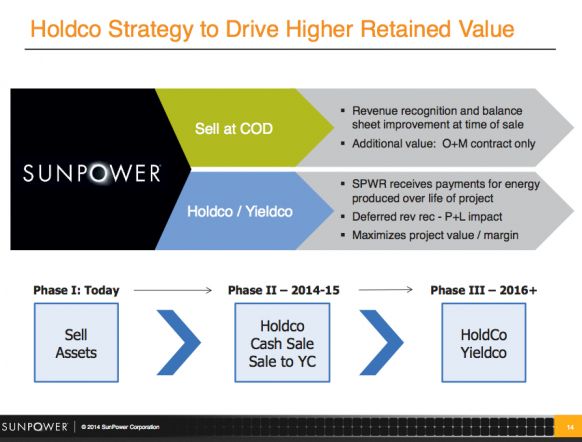

SunPower's CFO Chuck Boynton, explained that the company's new holdco strategy drives NPV and retained value and allows SunPower to capture the increased power-producing performance of its panels. With more than 500 megawatts under contract, "We can hold assets and sell strategically." The CEO said that asset-backed securities are under consideration "as we expand our portfolio."

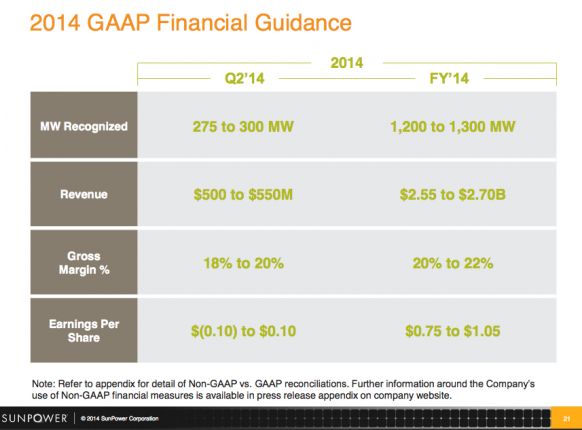

Second Quarter and Fiscal Year 2014 Guidance

SunPower's second-quarter 2014 consolidated GAAP guidance expects revenue of $500 million to $550 million and gross margin of 18 percent to 20 percent. For fiscal year 2014, the company expects, on a GAAP basis, revenue of $2.55 billion to $2.70 billion, gross margin of 20 percent to 22 percent, and net income per diluted share of $0.75 to $1.05.