It's easy to imagine a transactive grid where distributed energy resources (DERs) are accurately valued and a fleet of distributed solar panels, fuel cells and energy storage can be dispatched by the utility (or another party) to solve some grid imbalance or to generate or store power as needed. GTM readers and stakeholders envision a grid like that every day -- one in which the full societal and system benefits of DERs are defined and captured.

But the transition to this new grid will require upending the way regulated monopoly utilities have operated for going on a century. It means changing the way the grid is formally planned, as well as the way resources are owned, incentivized and valued. It means utilities are going to have to play a different role than they do today.

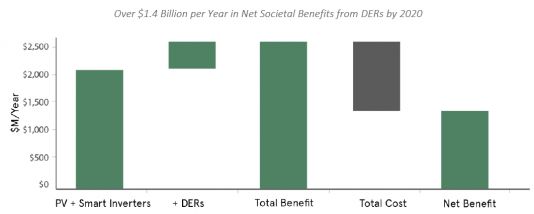

What are DERs worth to society?

SolarCity has offered up a white paper (PDF), a sort of regulatory-design framework, and provided its approach to benefits modeling as a line in the sand for this new way of thinking. The models and methodology are rooted in work already done by the Electric Power Research Institute, the California Public Utilities Commission's work with the public net energy metering tool, and filings from California utilities SCE and PG&E.

GTM Research VP Shayle Kann said, "What SolarCity is trying to do is the first comprehensive accounting of the net societal benefit of the distributed grid."

Ryan Hanley, the senior director of grid engineering solutions at SolarCity (and former smart grid manager at PG&E), asked, "If we have these intuitions that DERs are good, well, how good are they?"

He and his team have determined that if California were to fully account for the costs and benefits of DERs over the next five years, the net societal impact would amount to $1.4 billion in annual benefits.

Source: SolarCity's A Pathway to the Distributed Grid

The white paper borrowed the Electric Power Research Institute's net societal costs/benefits framework, but also looked at more difficult-to-quantify "benefit categories that are often excluded from traditional analyses."

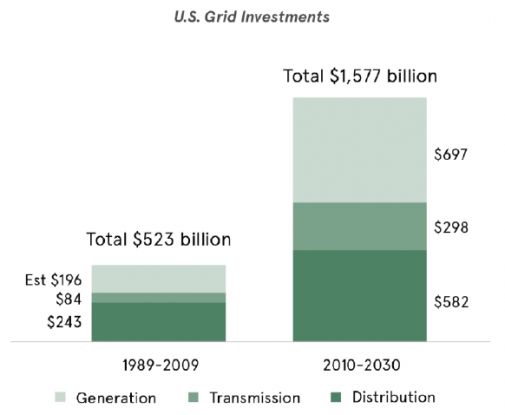

Making smart decisions on massive grid infrastructure investments

The U.S. is actually making significant investments in its grid infrastructure.

The report notes that as of 2011, "U.S. utilities had almost half a trillion dollars of un-depreciated transmission, distribution and generation assets on their balance sheets," adding that the figure is "growing at a rate of 6 percent to 8 percent per year."

The Edison Electric Institute forecasts that "another $879 billion in distribution and transmission investments" will happen between 2010 and 2030. That's $44 billion per year.

Source: SolarCity's A Pathway to the Distributed Grid

Should we spend this fortune on more of the same in order to update an aging grid? Or do we adopt a different way of planning and building the grid?

DERs can reduce "goldplated" capacity planning

SolarCity's Hanley suggests that "current grid planning encourages goldplating or overinvestment" in the design of distribution projects.

He gives an example of a substation being overbuilt to handle 20 megawatts or 30 megawatts 20 years from now, but having only a 6-megawatt deficiency today. Hanley said that today's grid tools are "more granular and can be installed with a scalpel." Building just the capacity that you need now is "cheaper for everyone," according to Hanley. It eliminates forecast error on 30-year bets and replaces that with much smaller investments.

Of course, one reason the grid might be "vastly overbuilt" is because the utility makes money on those exaggerated investments.

In addition to potential societal gains, the white paper looks at DER-based solutions for actual distribution projects in order to determine if DERs can truly replace or postpone planned utility investments. The calculation used actual distribution investment plans from California’s most recently available rate case filing: PG&E’s 2017 General Rate Case (GRC) Phase I filing.

SolarCity's conclusion? "Even using PG&E’s conservative assumptions...we quantify a net benefit for DER solutions used to replace the distribution capacity investments in PG&E’s 2017 GRC."

Infrastructure-as-a-service

Hanley asks, "How do we start to make utilities think differently about assets which they don't own?"

The white paper suggests that the concept of "infrastructure-as-a-service" will let utility shareholders derive income, or a rate of return, from "competitively sourced third-party services."

Hanley told GTM, "Walgreens doesn't need to own IT infrastructure if it can buy it from Dell or Amazon. The utilities don't have to own every piece of infrastructure that is beneficial for society."

But, Hanley said, despite the increasing penetration of DERs, they are still sitting on the sidelines. "They are not valued," and utilities are "unable to" or "choose not to capture" the value of these resources, he noted.

It's because the utilities have "no incentive to use these assets," said Hanley, adding, "The utility should be agnostic about using its own substation infrastructure or using DERs. What if they could sign a contract on third-party assets?"

In confronting grid support functions such as conservation voltage or volt/VAR support, Hanley suggests that the utility might rely on its own capacitor bank or could incorporate smart inverter intervention into that control loop and "improve the benefit they get."

The white paper calls for an integrated distribution planning approach and the creation of an independent distribution system operator.

Grid-edge modernization and renewables are changing the course of century-old power delivery industries. But regulated monopolies get disrupted through changes in regulatory policy and market design -- and this report offers a way to get there.

Hanley notes that the intended audience for this report includes regulators and PUCs, saying, "If they get the incentive right...there is a net societal benefit that we can quantify."