James Avery, senior vice president of power supply at San Diego Gas & Electric (SDG&E), is often asked if rooftop solar is ruining his business.

SDG&E currently has 45,000 customers with rooftop solar -- more than 7 percent of the roughly 600,000 solar systems installed in the United States today -- and that number is increasing by 4 percent to 5 percent each month.

“I get asked this question,” said Avery. “‘Isn’t rooftop solar destroying your business?' 'You've lost all your sales, where’s your growth?’”

Yes, solar is creating some grid issues, but the utility isn’t in any sort of decline, he said. One major reason, in California anyway, is electric vehicles (EVs).

To meet the state’s aggressive greenhouse gas objectives, virtually every vehicle in the state will have to be powered by an alternative fuel by 2050. For the vast majority of passengers cars, electricity is expected to be the fuel of choice.

For Avery, the math looks like this: there are about 30 million cars in California today, about 3 million of which are in San Diego. EV loads range from 1.5 kilowatts to 20 kilowatts, depending on vehicle type. Picking an average load of 3 kilowatts per vehicle, that amounts to an additional 9,000-megawatt load for SDG&E to serve.

“Think I’m worried about growth? I’m worried about how the hell do I serve all of that,” said Avery.

The trick, he says, is setting the right incentives. Avery argues that by giving customers the right price signals, both solar and EVs can be integrated seamlessly, and it can even benefit the grid.

How to curb peak demand costs

There are more than 10,000 EVs in SDG&E territory today -- among the highest concentrations in the country. As of December 2014, there were more than 118,000 electric cars in California overall.

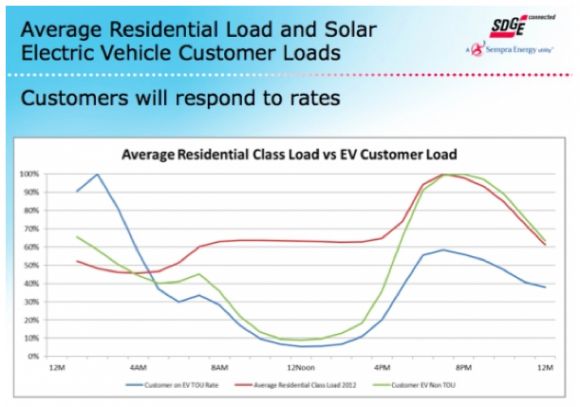

In San Diego, electricity use has peaked at 8 p.m. every day, year-round, for decades. So when EV drivers come home in the evening and plug in their cars, they exacerbate the challenge of managing peak demand, which makes up a significant chunk of SDG&E’s costs.

If the utility can’t manage load growth from EVs, particularly as more DC fast chargers come on-line, it could be devastating to the grid, said Avery. The utility will have to invest a lot of money in infrastructure, and rates will go up. But if the utility can absorb the majority of those cars in the existing grid by setting incentives to charge off-peak, it could actually put downward pressure on rates.

SDG&E is currently piloting its fourth-generation EV charging system, which incorporates a solar canopy, energy storage and dynamic pricing to allow for better grid management. Greentech Media recently toured the system at SDG&E’s Century Park campus, where the project has grown to include 36 chargers with another half-dozen under construction.

When employees plug into a station, the system looks at hourly energy market prices and loading on the distribution grid to offer a selection of charging rates via a mobile app. The driver can then select the cheapest and most convenient times for them to charge up, or let the system do it automatically, based on the availability of energy.

“This application is kind of unique in that it provides real-time pricing to the customer so we can take advantage of the solar power available on the grid to charge their cars,” said Avery.

Through the pilot, SDG&E has demonstrated that more than 90 percent of charging occurs at no impact to the grid, said Avery. Without pricing incentives, the reverse is true -- more than 90 percent of EV customers plug in at times of peak demand, when energy is most expensive.

“This program, to a very large extent, is self-funding in that the prices customers pay cover some of the infrastructure costs, but we can charge without ever effecting the grid,” said Avery. “You’re now avoiding 75 percent of the cost the utility traditionally incurs.”

SDG&E bids EV and energy storage into CAISO markets

By leveraging the gap between average load and peak load, Avery says he can integrate hundreds of thousands of EVs into the existing grid network. SDG&E has an application before the California Public Service Commission for its time-variant rate charging system, which it hopes to start installing at workplaces and multi-family dwellings by fall.

SDG&E currently offers an opt-in, time-of-use plan for EV charging, but the rate differential is so low that few customers are incentivized to take part, said Avery.

The utility recently took its EV charging program a step further by bidding a group of EV charging stations, integrated with solar and energy storage, into the California Independent System Operator’s energy markets.

The project aggregates the stationary batteries and the load from EV fleets at five locations across SDG&E’s service territory (640 kilowatts in total), and stops or starts charging based on real-time price signals from the ISO and drivers’ charging needs.

During the high price hours during which the cars are signaled not to charge, the aggregated resource is paid the marginal energy price for the period it participates, similar to a conventional generator. Drivers are compensated through variable pricing that lowers their charging costs.

The pilot, launched in partnership with Shell Oil Products U.S., is already bidding into the system on a daily basis and will run through late 2015.

“EVs will become a significant load on the electrical grid, and we’re preparing for that so we can integrate these vehicles without the need for major investments in transmission and distribution infrastructure,” said Avery. “We’re trying to fully utilize infrastructure today, and this is another tool that will help us do that.”

“There is virtually no benefit to the distribution grid from solar”

While SDG&E is finding ways to make EVs a grid asset, Avery can’t say the same about rooftop solar. At least not yet.

Customers are often trying to do the right thing for the environment by going solar, but they aren’t being incentivized to do the right thing for the grid or for their neighbors, he said. Today, one set of customers is subsidizing another to the tune of more than $100 million per year.

According to a CPUC report, net metered accounts in the state paid slightly more than their full cost of service (103 percent) in 2011. In SDG&E territory, however, net-metered residential solar customers paid for 54 percent of their service costs that year.

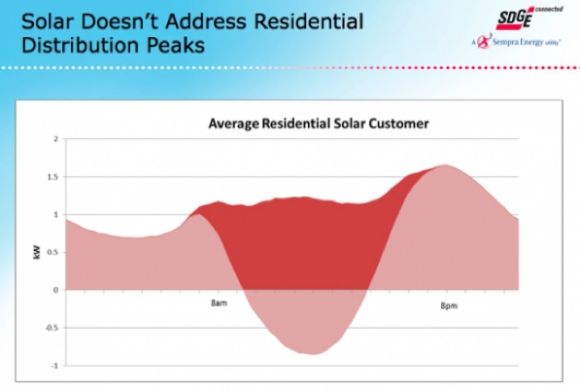

Solar peaks in the middle of the day when demand is generally low, and dies off at night when demand spikes and the utility has to ramp up energy production to meet it -- a scenario often described as the “duck curve.” If customers pay a flat rate for electricity and are getting paid for every kilowatt-hour of electricity they produce, regardless of when they produce it, there’s no motivation for them to change their behavior.

"Right now, there is virtually no benefit to the distribution grid from solar,” said Avery.

“I don’t ever see rooftop solar being a benefit until you couple it with [other] technologies,” he added. “And until you get a price incentive to do it, why would you couple it?”

For Avery, the root of the problem is the rate system. A lot of technology is being held out of the market because rates don’t reflect costs, he said. That goes for energy storage, but also for smart thermostats and programmable appliances like air conditioners and pool pumps -- all of which can reduce peak demand on the utility.

SDG&E has filed a rate proposal with the CPUC it believes will set the right incentives through demand-differentiated rates and time-of-use pricing. The filing also notes the importance of unbundled rates so that solar customers can see the free grid benefits they’re getting.

In Arizona, the Salt River Project’s elected board this week approved a new demand charge on solar customers based on their peak power demand in a given month.

Customers in SDG&E territory don't have an incentive to change their behavior today, said Avery. As he describes it, the same way SDG&E’s EV charging station with dynamic pricing encourages customers to charge off-peak, dynamic electricity rates will push customers to install solar in ways that don't impact the grid or neighboring customers.

“One of the biggest untapped things in our industry, and a lot of utilities don’t think about this, [is that] my best opportunity for controlling my cost is my customer,” said Avery. “The customer can help, and if they’re [incentivized] to help, they’re more than happy to.”

"We are the customer advocate"

Avery emphasized that while SDG&E wants to see reform, it is not anti-solar. SDG&E is decoupled and mandated by the state to pursue renewable energy and efficiency projects. If a customer uses twice as much power or half as much power, SDG&E’s earnings are the same, he said.

“We don’t build power plants; we don’t build large renewables resources. We’re the ones that are basically just delivering our services to the customer, and as such, we have a responsibility to provide the best resources at the best price for our customers,” said Avery. “And when we have basically an inequity between our customers, we try to get rid of that and keep it fair for everybody.”

“It has really evolved to a point where we are the customer advocate,” he said. “We are the ones that have the connection with the customer. Our customers tell us what they want. It really doesn’t compete with what we’re doing, so why wouldn’t we want to do this?”

There’s no doubt customers want a cleaner grid. That’s why SDG&E is divesting from its coal and nuclear assets, switching to cleaner-burning natural gas plants and rapidly adopting renewable energy.

Ten years ago, SDG&E was less than 0.5 percent renewable. By the end of this year, the utility expects to meet California’s 33 percent renewable energy target for 2020.

SDG&E is now reviewing proposals for a 500- to 800-megawatt solicitation for new, local resources to meet future demand. A minimum of 200 megawatts is to come from “preferred resources,” including energy efficiency, demand response, renewables, combined heat and power resources, and distributed generation. The utility is expected to make its selections in two to three months.

In the years ahead, SDG&E identified one of the biggest problems as a 15 percent solar penetration on the distribution grid, meaning about 15 percent of the peak capability on that load could be served by solar.

“When it gets to that stage, the intermittent issues associated with solar can create havoc on our system,” Avery warned. “Now, keep in mind, a lot of our system is antiquated analog equipment.”

SDG&E has tried to get ahead of the challenges facing its aging grid with the adoption new technologies, such as self-healing grids and smart inverters, as well as advanced EV charging systems. SDG&E is also investing millions in a distributed energy resources management system and an expansion of the Borrego Springs microgrid project.

If utilities aren't preparing for changes in the energy landscape, they're already too late, said Avery.

“You cannot forget what you are here to do, and that is to provide safe and reliable power,” he said. “At the same time, it is also to meet our customers’ needs. Sometimes, those needs are unspoken, [because] they don’t know them yet.”