The starting gun has gone off in the grid-scale energy storage market.

As GTM reported in February, the California Public Utilities Commission asked Southern California Edison (SCE) to source more than 50 megawatts of energy storage in the Los Angeles area over the next eight years. (There is also a 1.3-gigawatt target of energy storage installed in California by 2020.)

In September, SCE issued a request for a significant amount of new capacity, including the potential 50 megawatts (optionally up to 650 megawatts) of energy storage. It's called the Local Capacity Requirements Request for Offer, or LCR RFO. The RFO is largely in response to the anticipated loss of once-through cooling generating units.

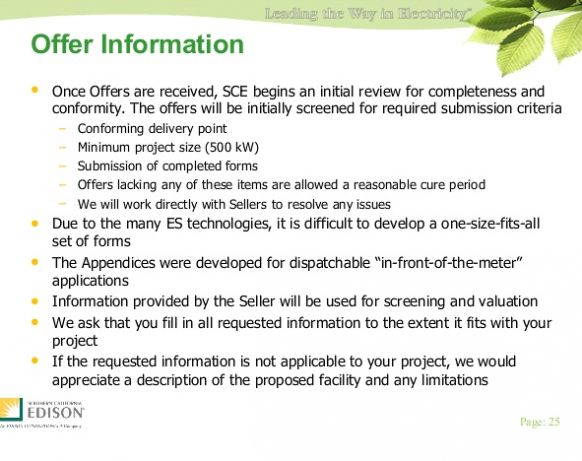

Although 50 megawatts is a small fraction of the 1,400 to 1,800 megawatts of generation that SCE will procure between now and 2021, it's one of the earliest attempts to craft an RFO aimed at large-scale energy storage. As such, the regulators, utilities, and energy storage bidders are learning as they go and creating metrics and language that suit the unique nature of energy storage.

This isn't the first energy storage on the grid. In fact, there's about 300 megawatts of operational battery storage on the grid across the globe and plenty of compressed area energy storage (CAES). But this RFO does try to account for the benefits of energy storage and assess its competitiveness against other generation sources.

Energy Storage as New Frontier

"Energy storage is new for all of us," said Rosalie Roth, Sr. Contract Originator and Energy Storage Product Lead at SCE, during a webinar last week. As to what type of technology SCE is looking for, Roth said, "Show us what you've got."

She noted, "This RFO is complex -- it's going to be a challenging solicitation." She said that all qualified resources are encouraged to participate and communicate, adding, "We are figuring it out along the way."

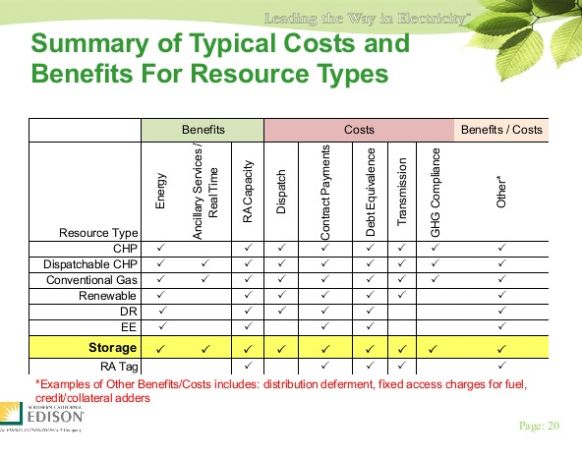

Products solicited in the RFO include demand response, energy efficiency, energy storage, renewables, distributed generation, combined heat and power, resource adequacy and gas-fired generation.

In a recent interview, John Zahurancik of AES Storage, one of the larger system suppliers, said, "The Edison RFO is the first formal recognition by a state that [energy storage] absolutely has value."

Key Points of the Energy Storage Agreement

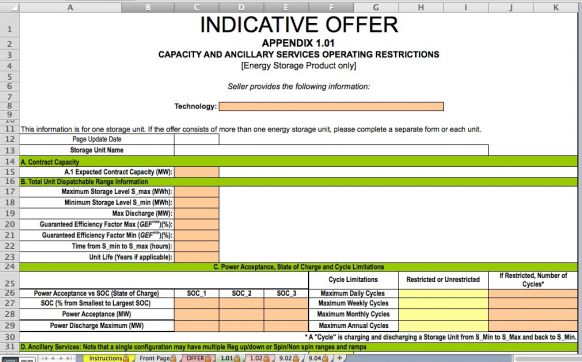

Roth said, "There are a lot of different storage technologies out there, but we have to make sure [the technologies selected] fit our definition." SCE defines an "energy storage system" as "commercially available technology that is capable of absorbing energy, storing it for a period of time, and thereafter dispatching the energy."

Location, Location, Location: Capacity must be located in the West Los Angeles Basin and Moorpark sub-areas. Roth noted that there are high-value areas (green) and medium-value areas (blue). She said it was "very locational." As Roth mentioned, all technologies are welcome: "As long as [they] are feeding into an A-bank substation, it would count."

Timing: Delivery for certain substations can start in 2015. All projects must deliver by 2021.

More Timing: The document reads, "Gas-fired, demand response and energy storage projects must be capable of providing full capacity for at least two hours, though bidders are encouraged to submit offers that provide full capacity for at least four hours as well." Resource adequacy is defined as a minimum of four hours over three consecutive days. The SCE team noted that "the CAISO market will dictate how we discharge this battery." Energy storage projects must have an expected capacity of at least 0.5 megawatts.

Energy Storage Agreement: Projects are to be interconnected similarly to generation resources. The agreement does not address behind-the-meter deployments which might be better addressed by using a demand response application. Bill Walsh, the SCE attorney assigned to this RFO, said that the LCR is intended to cover different flavors, but "we only made seven contracts." He added, "It's supposed to look like generation," with SCE "in control of charge and discharge." Unlike the PJM Interconnect, which requires fast storage for frequency regulation, this LCR is about repowering and peaking and calls for a "four-hour capacity requirement." An interconnection request is not required in order to submit an offer.

Energy Storage Repowers: SCE will consider an offer to repower an existing energy storage facility so long as the repower yields better efficiency, lower emission rates and better reliability for current generating facilities with ten years or less operating years remaining.

Compensation and Performance: There is a monthly capacity payment and a variable O&M charge. The monthly capacity payment can be reduced for availability and efficiency shortcomings.

Dispatch and Energy Management: SCE is responsible for managing, purchasing, scheduling, and transporting all of the storage unit's charging requirements. SCE will provide dispatch and charging notices. Energy for station use is the responsibility of the seller and must be separately metered.

Credit and Collateral: Includes delivery date security, daily delay damages, and performance assurance.

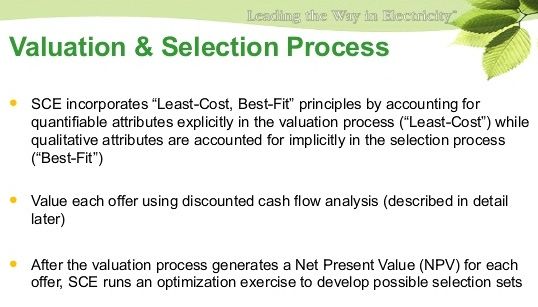

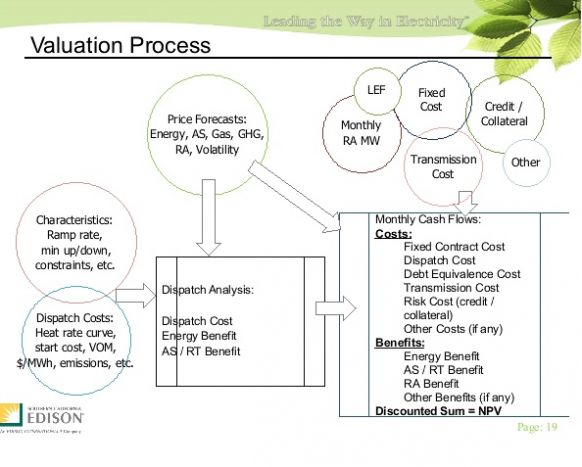

Valuation and Selection Process: The easy-to-understand valuation process is explained on the following pages.

The utility notes that energy storage can be considered as a storage resource, as a preferred resource, or both.

Southern California Edison serves about 13 million people in California and has taken a leading role in the smart grid, and now in energy storage.

Janice Lin of Strategen has said that energy storage is cost-effective but needs a market signal. Well, here are some clear market signals from California.

Not everyone believes in energy storage's ability to function as a panacea for the grid. The grid storage brought on-line (or not brought on-line) via this RFO will reveal the strengths and weaknesses of today's energy storage systems.

December 2 is the last day to submit a non-binding intent to offer.

***

GTM Research just published a new report that pinpoints the most promising energy storage applications, geographic markets and market segments, and discusses the best business models and competitive strategies. The report also profiles over 150 companies that are active in the North American storage industry, including 25 that are particularly well positioned to succeed.