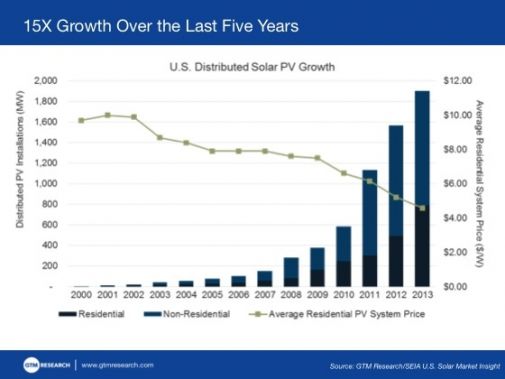

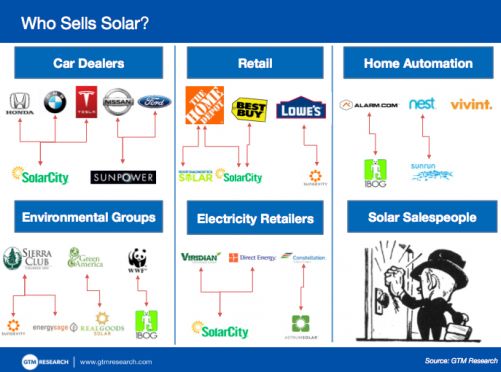

The residential solar installation and finance market is remaking itself through new alliances, vertical integration and hybrid sales channels, as well as with access to increasingly cheaper capital. We are in a post-CSI era and yet installation prices continue to fall.

The early winners in this high-growth and volatile market have emerged. But the landscape is still shifting.

Residential solar news roundup

SunEdison closed the "first $150 million of a $300 million three-year project finance revolving credit facility arranged by Deutsche Bank Securities," according to a release. The debt is intended "to support the development and acquisition of new projects in the United States and Canada." SunEdison claims to have used a total of $1.2 billion from an earlier credit facility to finance 325 megawatts of solar projects.

Sungevity raised a $70 million funding round led by Jetstream Ventures, along with investment from utility E.ON and GE Ventures. The online solar sales company has now raised more than $200 million in VC and project financing from investors including Brightpath Capital Partners, home improvement store Lowe's, Vision Ridge Partners, Oaklandimpact, Greener Capital, Firelake Capital, Craton Equity Partners and Eastern Sun Capital Partners.

Sungevity claims it can deliver a firm price quote for a residential solar rooftop immediately, without a home visit.

Joel Dobberpuhl, CEO of Jetstream Capital (the parent company of family office Jetstream Ventures), said in a company release that Sungevity’s "capital-light business model makes it an exceptional choice for our first private-market investment in downstream solar." Dobberpuhl is also a co-owner of NHL hockey team the Nashville Predators.

According to a release, Sungevity's sales in the U.S. doubled in 2013. Sungevity is looking to further fund its expansion into Europe.

Last week, we reported that Sunrun and Sungevity had formed a partnership to enroll at least 10,000 new residential solar customers. Under the non-exclusive agreement, Oakland’s Sungevity will acquire customers, while Sunrun will finance the rooftop installation and own the PV system.

Sungevity is going with a pure-play customer acquisition strategy in a market that seems to be moving toward vertical integration.

SunPower closed $42 million in non-recourse debt to finance its residential solar lease program. (Residential mortgage loans in the U.S. use this type of debt.)

Hannon Armstrong Sustainable Infrastructure Capital (HASI) furnished the debt. SunPower's residential solar lease program has won more than 20,000 lease customers in the U.S., according to the firm.

SunPower's CFO Chuck Boynton said in a release, "Among our portfolio of financing options, solar lease remains one of the more popular choices by consumers." HASI CEO Jeffrey Eckel said, "With this investment, we are further diversifying our portfolio of economic, reliable and sustainable distributed energy assets, targeting assets that can produce sustainable yield."

Hannon Armstrong is classified as a real estate investment trust (or REIT) and makes debt and equity investments in sustainable infrastructure projects.

The yield for SolarCity's recent $72 million asset-backed securitization recently priced at 4.59 percent. According to Roth Capital Partners, the "deal was oversubscribed." Roth suggested that the next deal "may be larger and include tax equity. Consequently, we view this as an incremental step toward lower-cost financing." Roth added that by continuing to adjust "important variables, such as the advance rate, maturity, and underlying asset profiles, we believe SCTY is attempting to gain an understanding of demand for its ABS product."

Deutsche Bank's Vishal Shah writes, "We believe investors are largely discounting the potential upside resulting from lower financing costs, grid parity beyond 2016, improving technology costs and potential scale benefits driving share gains over time."

Solar Universe, which focuses on franchising solar installation, announced a partnership with GHS Interactive Security, a security and home automation firm servicing California customers. Solar Universe has 37 locations in the U.S.

Verengo, the No. 3 U.S. solar installer (behind SolarCity and Vivint Solar), announced the hiring of its 1,000th employee. Founded in 2008, Verengo focuses exclusively on the residential market. “Many positive developments have contributed to Verengo’s current growth rate, including the successful expansion of our residential business into New York state and the increasing acceptance of rooftop solar leasing by home owners,” said President Ken Button.

This slide from a presentation being given by GTM Research VP Shayle Kann at next week's Solar Summit shows the decrease in installation costs, as well as the 1.9 gigawatts of distributed solar installed in 2013. (Register for the event here.)

The best place to learn about the changing landscape of residential solar is next week's Solar Summit, which will include a pre-conference seminar on "The Future of U.S. Distributed Solar Project Finance," plus panels covering "Accelerating BOS Cost Reductions in Rooftop Solar" and "Opportunities and Threats in the Residential Solar Market." Register here.